The US Securities and Exchange Commission (SEC) has dropped its investigation into Paxos’ alleged securities violation for issuing the BUSD (Binance USD) token. Paxos received a Wells Notice in February 2023 from the regulator, stating its intent to investigate the stablecoin issuer’s role in offering unregistered securities to US investors. Paxos took to X to announce this development, “Paxos prevails in SEC investigation of BUSD stablecoin.” It continued to state it received an investigation termination letter from the SEC, “On Tuesday, we received a formal termination notice from the SEC stating that it will not recommend enforcement action against Paxos Trust Company in the investigation of Binance USD (BUSD).” Source: Paxos Paxos celebrated this announcement and mentioned the

Topics:

Suraj Manohar considers the following as important: News

This could be interesting, too:

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

Bilal Hassan writes Crypto Becomes a U.S. ‘Weapon,’ Says CryptoQuant CEO

Bilal Hassan writes White House Crypto Czar Sold Holdings After Trump Took Office

Bilal Hassan writes CZ Suggests Safe Token Release Based on Price Growth

The US Securities and Exchange Commission (SEC) has dropped its investigation into Paxos’ alleged securities violation for issuing the BUSD (Binance USD) token. Paxos received a Wells Notice in February 2023 from the regulator, stating its intent to investigate the stablecoin issuer’s role in offering unregistered securities to US investors.

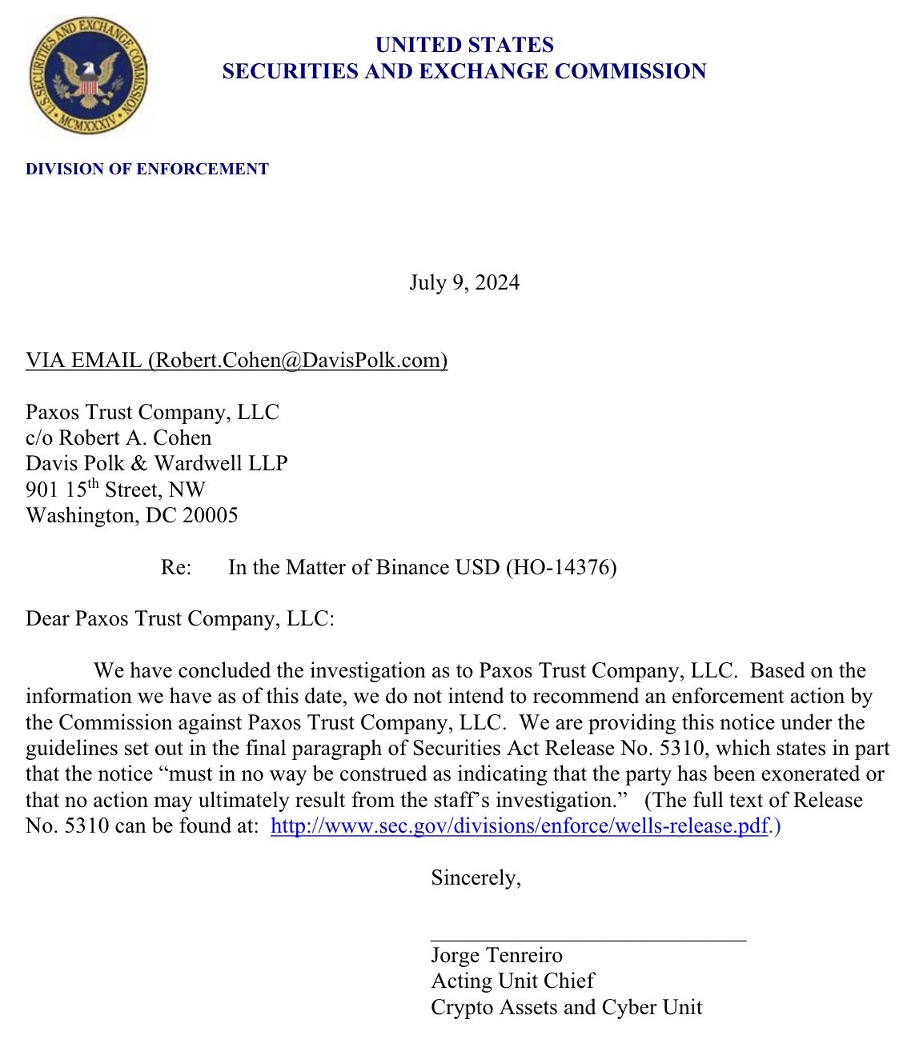

Paxos took to X to announce this development, “Paxos prevails in SEC investigation of BUSD stablecoin.” It continued to state it received an investigation termination letter from the SEC, “On Tuesday, we received a formal termination notice from the SEC stating that it will not recommend enforcement action against Paxos Trust Company in the investigation of Binance USD (BUSD).”

Source: Paxos

Paxos celebrated this announcement and mentioned the importance of stablecoins to the financial system, emphasizing its efforts to provide consumer-safe asset-referenced products. “We believe this development will unlock a new wave of stablecoin adoption by leading global enterprises. Well-designed stablecoins with strong consumer protections – like those issued by Paxos – will transform the financial system in payments, settlement and remittance use cases. This transformative technology will make the financial system more stable, accessible and transparent.”

The SEC’s reluctance to pursue this investigation comes after multiple court rulings against its assumptions of major crypto assets being securities. Most recently, a judge ruled that BUSD was not a stablecoin in another SEC-related case against Binance. That ruling referenced another one from 2023–a judge stated that XRP, Ripple’s native token, was not a security.

These developments may mark the tables turning for the SEC as numerous crypto companies complain about its actions stifling the technology’s innovation and adoption. Binance, Coinbase, Kraken, Consensys, and more are fighting cases brought by the regulator against them. As it backs away from cases, these may result in the same, as these firms and their supporters insist on the absence of wrongdoing.