A consumer watchdog has warned about the lack of transparency Tether exhibits in confirming the reserves backing its stablecoin and it ignoring the amount of crime USDT facilitates. Non-profit organization Consumers’ Research has released a warning to alert the crypto community and everyone else of Tether’s lack of transparency in revealing the reserves backing its USDT stablecoin. This report comes after S&P Global rated it 4 out of 5 after a risk assessment, with 5 being the worst score achievable. Consumer Research’s report calls Tether out through various accusations, including a lack of audit by third parties to confirm USDT tokens are backed appropriately. “Tether continually waves a bold red flag with its refusal to be independently audited, or to properly audit itself. Tether has

Topics:

Suraj Manohar considers the following as important: News, Stablecoins

This could be interesting, too:

Bitcoin Schweiz News writes Die USA werden zum Bitcoin-Land: Banken benötigen keine spezielle Lizenz mehr für Krypto-Services

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin Schweiz News writes USA-Goldreserven bald als Krypto-Token? Die Blockchain-Revolution für Staatsgold

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

A consumer watchdog has warned about the lack of transparency Tether exhibits in confirming the reserves backing its stablecoin and it ignoring the amount of crime USDT facilitates.

Non-profit organization Consumers’ Research has released a warning to alert the crypto community and everyone else of Tether’s lack of transparency in revealing the reserves backing its USDT stablecoin. This report comes after S&P Global rated it 4 out of 5 after a risk assessment, with 5 being the worst score achievable.

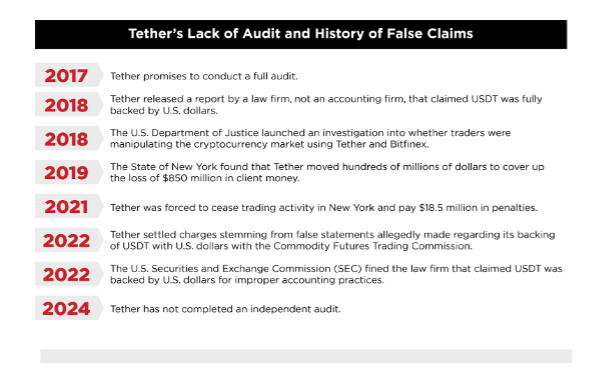

Consumer Research’s report calls Tether out through various accusations, including a lack of audit by third parties to confirm USDT tokens are backed appropriately. “Tether continually waves a bold red flag with its refusal to be independently audited, or to properly audit itself. Tether has promised that it would conduct a full audit since at least 2017, but has still failed to do so,” the report read.

Source: tetherwarning.com

The watchdog also submitted a letter regarding the concerns surrounding Tether to every state governor in the country. It also got the message out through radio campaigns and has a website created specifically for this cause, detailing Tether’s misgivings.

“As you will see outlined in the attached Consumer Warning, Tether has many of the same issues that FTX and Celsius had before their collapse – potentially costing consumers billions of dollars using deceptive and misleading marketing tactics that are inconsistent with the truth,” the letter Consumers’ Research sent to state governors read.

Beyond transparency with its reserves, the non-profit also bashed Tether for taking anti-money laundering lightly, thereby facilitating criminals to launder money using USDT.

Tether Has Worked to Reduce USDT-Related Crime Lately

As those accusations paint a grim picture for Tether and the crypto community relying on USDT, the largest stablecoin by market capitalization, Tether has made attempts to reduce risks. For instance, it works with law enforcement agencies to freeze and recover funds stolen through its stablecoin. Recently, it helped law enforcement to seize over $108 million from cybercriminals. The stablecoin issuer also formed a group with Tron and TRM Labs to create the T3 Financial Crime Unit (T3 FCU) to quash criminal activity using USDT on the Tron network.