A recent report by Binance Research shows that .4 billion worth of cryptocurrency is being staked. As staking systems have grown, more and more people have been drawn to them because of the potential rewards. However, it’s worth noting that staking has some hidden risks as well.The Proof of Stake SituationSome of the most notable cryptocurrencies are based on a Proof of Stake algorithm, and they have drawn a significant amount of cryptocurrency to be staked on their networks, according to a recent Binance report. As of the 24th of October, .4 billion was reportedly being staked out of .2 billion, which is the total cumulative staking market capitalization. That number could increase when Ethereum’s long-anticipated transition to PoS is finally executed.Some of the most popular

Topics:

Jordan Lyanchev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

A recent report by Binance Research shows that $6.4 billion worth of cryptocurrency is being staked. As staking systems have grown, more and more people have been drawn to them because of the potential rewards. However, it’s worth noting that staking has some hidden risks as well.

The Proof of Stake Situation

Some of the most notable cryptocurrencies are based on a Proof of Stake algorithm, and they have drawn a significant amount of cryptocurrency to be staked on their networks, according to a recent Binance report. As of the 24th of October, $6.4 billion was reportedly being staked out of $11.2 billion, which is the total cumulative staking market capitalization. That number could increase when Ethereum’s long-anticipated transition to PoS is finally executed.

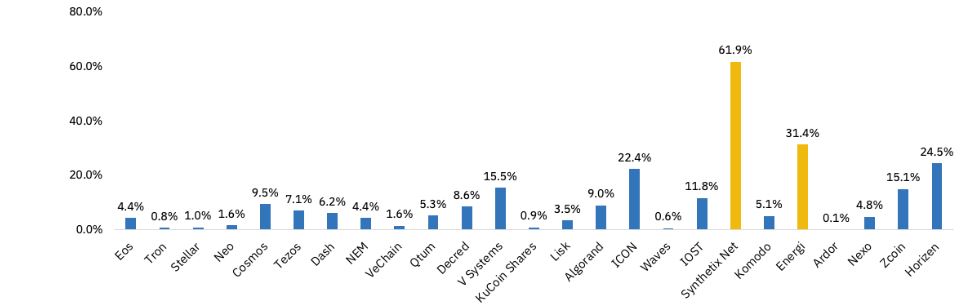

Some of the most popular cryptocurrencies that are based on PoS are EOS (market cap: $2.6B), Stellar ($1.2B), and TRON ($1.0B). Each of them requires a different amount of coins to be staked, and their yield percentages vary as well. According to the report, Synthetix Network and Energi had the highest yields, 61.9% and 31.4% respectively.

However, higher yield percentages could also mean a higher inflation rate across the network and more risks.

It’s worth noting that the report accounts for numbers up until October 24th. Since then, the cryptocurrency market has surged and the market capitalization of these currencies has increased.

Staking: How Does It Work?

The two major hashing algorithms are Proof of Work (with Bitcoin as the most notable example) and Proof of Stake. The governance of these network types are particularly different, as the latter requires users to “stake” a certain amount of crypto in order to participate in the decision-making process.

In other words, an investor “locks” a specific amount of PoS-based coins to support the operations of that blockchain network with the promise of receiving rewards. Those rewards are usually distributed proportionately among all participants who have “staked” tokens on the network. It actually resembles the traditional financial markets, as PoS relates to concepts such as interest rates and currency risks.

Some of the risks to be considered include the possibility of technical failure, restrictions, payout timings, and each network’s unique requirements.

Initially, PoS was implemented by Peercoin years ago and has since evolved into variations such as Delegated Proof of Stake. DPoS was introduced in BitShares and is currently used by projects like Atom and EOS. Other variations include the distribution model (Stellar) and dual-coin systems (NEO/GAS).