Vitalik Buterin, the co-founder of Ethereum, has recently stated that interest rates on decentralized finance protocols that are significantly higher compared to those in traditional finance come with unstated risks attached.Vitalik Buterin on High DeFi Interest RatesThe co-founder of Ethereum and one of the most prominent members of the cryptocurrency community, Vitalik Buterin, recently took it to Twitter to comment on high yields and interest rates associated with Decentralized Finance (DeFi) protocols.According to him, “decentralized finance should not be about optimizing yield. Rather, we should be solidifying and improving a few important core building blocks: synthetic tokens for fiat and a few other major assets (aka stablecoins), oracles (for prediction markets, etc.), DEXes,

Topics:

George Georgiev considers the following as important: AA News, defi, ETHBTC, ethusd, United States, Vitalik Buterin

This could be interesting, too:

Wayne Jones writes Argentina’s Mining Sector Pioneers Lithium Tokenization by Tapping Cardano

Wayne Jones writes Chinese Auto Dealer Dives Into Bitcoin Mining With 6M Investment

Wayne Jones writes Nigeria Arrests 792 in Landmark Crypto-Romance Scam Raid

CryptoVizArt writes Ethereum Price Analysis: Following a 15% Weekly Crash, What’s Next for ETH?

Vitalik Buterin, the co-founder of Ethereum, has recently stated that interest rates on decentralized finance protocols that are significantly higher compared to those in traditional finance come with unstated risks attached.

Vitalik Buterin on High DeFi Interest Rates

The co-founder of Ethereum and one of the most prominent members of the cryptocurrency community, Vitalik Buterin, recently took it to Twitter to comment on high yields and interest rates associated with Decentralized Finance (DeFi) protocols.

According to him, “decentralized finance should not be about optimizing yield. Rather, we should be solidifying and improving a few important core building blocks: synthetic tokens for fiat and a few other major assets (aka stablecoins), oracles (for prediction markets, etc.), DEXes, privacy…”

Buterin also touched on the fact that “flashy DeFi things that give you fancy high interest rates” are being overly emphasized.

“Interest rates significantly higher than what you can get in traditional finance are inherently either temporary arbitrage opportunities or come with unstated risks attached.”

Indeed, last year at Tel Aviv’s Ethereal conference, Buterin warned about the risks of DeFi, stating that protocols have a non-zero chance of failure.

Comparing Rates

Indeed, comparing interest rates on DeFi-based lending protocols, they seem higher compared to interest rates provided by traditional finance institutions.

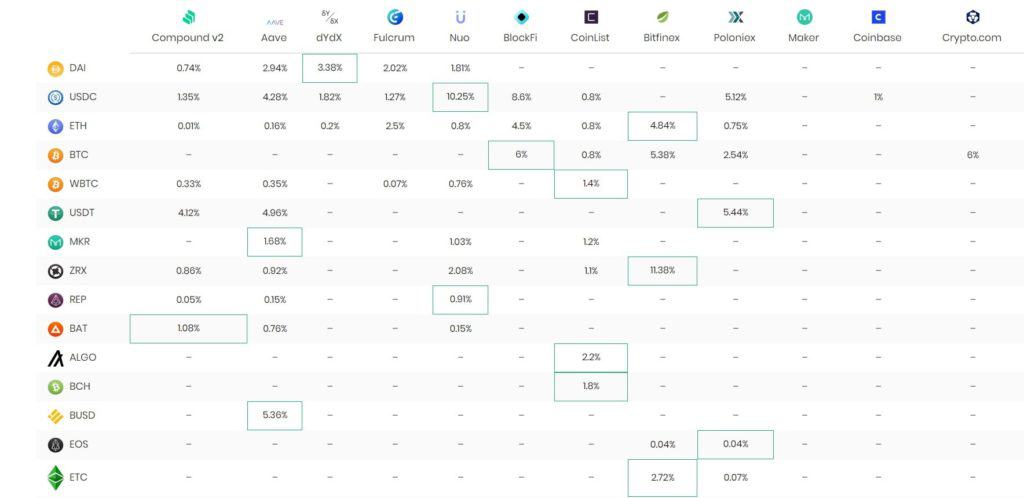

According to DeFi Rate, lending interest rates on specific protocols such as Nuo for USDC have a 30-day average percentage of 10.25. One of the more popular protocols, Aave, averages 4.28% for USDC lending, while Compound, which is currently the biggest DeFi protocol, offers 4.12% on its USDT deposits.

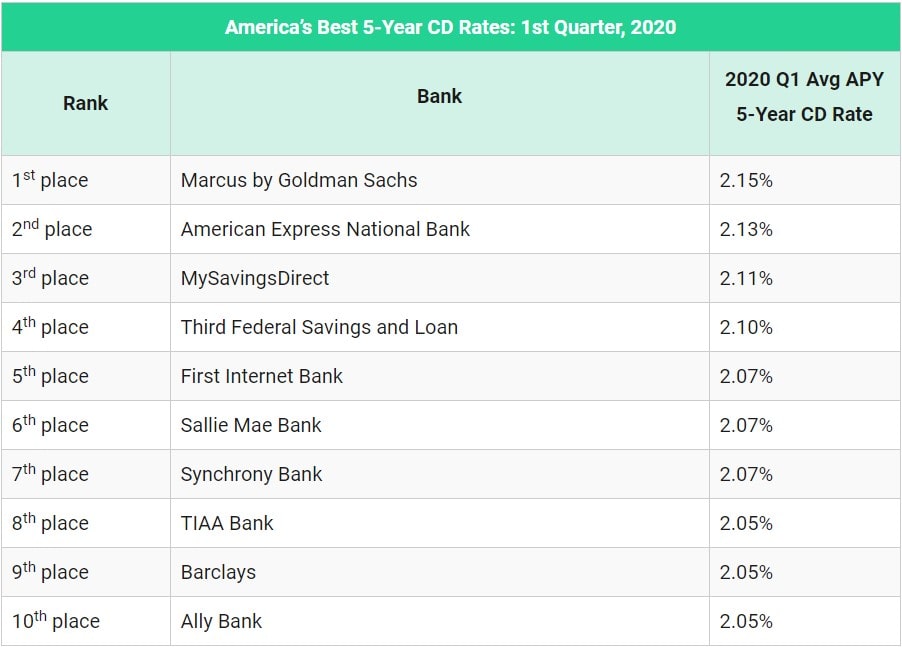

On the other hand, legacy financial institutions offer considerably lower interest rates. According to research by Money Rates, Marcus, a borrowing instrument by Goldman Sachs, offers 2.15% average annual percentage yield (APY) on its 5-year deposits as of Q1 2020.

Moreover, the study also reveals that the average 5-year CD rate has dropped by 0.555% and is currently around 1.181%.