There’s never a dull day in the cryptocurrency market. From food-based meme coins that attract billions of locked value and generate extremely high yield, to a likely mistake that caused the price for a token to surge half a million percent in a few hours – there’s something for everyone.Buying the Wrong UNIUNI (the latest one) is the governance token of the largest decentralized exchange protocol and automated market maker, Uniswap.As CryptoPotato reported yesterday, the token generated tremendous buzz in the industry, especially as everyone who used Uniswap before September 1st received 400 UNI tokens that currently trade at a price of each.This had a serious effect on Ethereum’s network as fees took for the sky, and miners generated as much as a million dollars in transaction fees in

Topics:

George Georgiev considers the following as important: AA News, defi, ETHBTC, ethusd, uniswap

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

There’s never a dull day in the cryptocurrency market. From food-based meme coins that attract billions of locked value and generate extremely high yield, to a likely mistake that caused the price for a token to surge half a million percent in a few hours – there’s something for everyone.

Buying the Wrong UNI

UNI (the latest one) is the governance token of the largest decentralized exchange protocol and automated market maker, Uniswap.

As CryptoPotato reported yesterday, the token generated tremendous buzz in the industry, especially as everyone who used Uniswap before September 1st received 400 UNI tokens that currently trade at a price of $5 each.

This had a serious effect on Ethereum’s network as fees took for the sky, and miners generated as much as a million dollars in transaction fees in an hour.

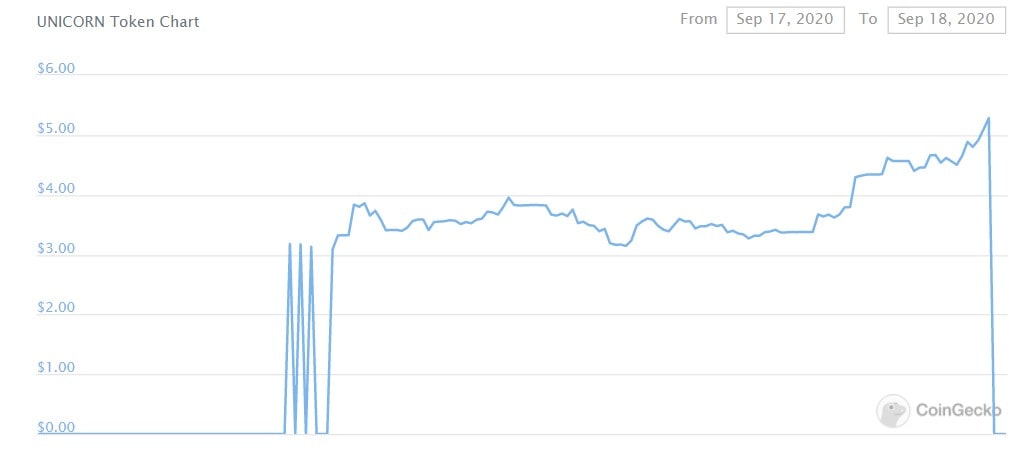

But that’s not the most bizarre thing that happened. A token, carrying the same ticker as Uniswap’s token but called Unicorn Token, surged an amazing 500,000% before crashing back to the abyss it came out of.

Unicorn token’s price surged from approximately $0.001 to a whopping $5 in a matter of minutes and actually traded at this astonishing rate for a while before crashing back.

A Human Error?

A human error appears to be the most obvious and probable explanation of what happened. Confused investors might have rushed to the market in hopes to purchase Uniswap’s new UNI token, without paying much attention to details.

It’s also worth noting that the token was mostly traded on a relatively lesser-known cryptocurrency exchange and generated a 24-hour volume upwards of $46 million. To compare, the only other exchange that supports the token accounts for less than $5,000 of the 24-hour volume.

In any case, other tokens with the same ticker, such as Universe Token, have also seen a slight increase in their value, likely for the same reason.