According to a recent publication, Chinese investors are using a lot of the ETH they buy on centralized exchanges to pursue DeFi opportunities.This essentially reduces liquidity, and exchanges are forced to limit or even suspend withdrawals.DeFi Growth In China Causes Issues For ExchangesThe DeFi craze exploded earlier this year. Projects began surfacing daily with new developments, promising high returns to lure investors into locking their cryptocurrency assets in their protocols.The total value locked (TVL) in such protocols skyrocketed from 0 million to its recent all-time high of nearly .5 billion in about six months.Interestingly, some reports suggest that Chinese investors were somewhat late to the party, having to bear the country’s conservative approach towards the digital

Topics:

Jordan Lyanchev considers the following as important: AA News, China, defi

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

According to a recent publication, Chinese investors are using a lot of the ETH they buy on centralized exchanges to pursue DeFi opportunities.

This essentially reduces liquidity, and exchanges are forced to limit or even suspend withdrawals.

DeFi Growth In China Causes Issues For Exchanges

The DeFi craze exploded earlier this year. Projects began surfacing daily with new developments, promising high returns to lure investors into locking their cryptocurrency assets in their protocols.

The total value locked (TVL) in such protocols skyrocketed from $500 million to its recent all-time high of nearly $9.5 billion in about six months.

Interestingly, some reports suggest that Chinese investors were somewhat late to the party, having to bear the country’s conservative approach towards the digital asset industry. However, the TVL’s latest pump coincided with an ATH for DeFi searches on the popular Chinese social media platform – WeChat.

Data provided by a local reporter confirmed the rapidly growing demand from Chinese investors towards DeFi. He noted that users have been buying lots of ETH, the most widely used token for swapping for DeFi coins, especially when the asset’s price tanked a few days ago.

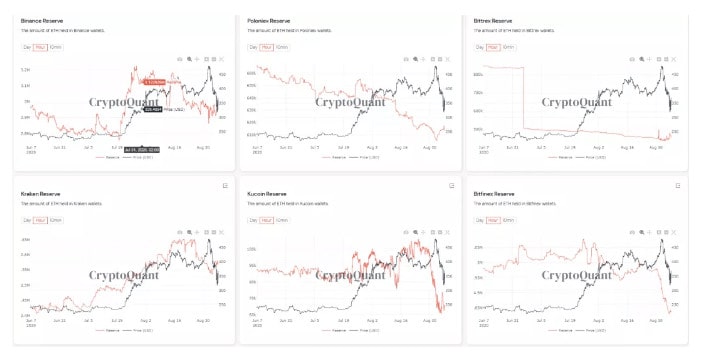

Investors use the purchased ETH and transfer it to decentralized exchanges (DEX) for farming. As a result, he concluded that the liquidity on centralized exchanges (CEX) is “falling frantically.”

Exchanges Fight Back

The reporter claimed that the exchanges are taking some radical measures to prevent further declines in their liquidity.

A few days ago, users experienced “difficulties in withdrawing coins,” and even shutdowns as CEX operating in China limited and, in some cases, entirely suspended withdrawals for undisclosed periods. The Chinese community reportedly reacted by launching a “coin withdrawal campaign,” urging investors to withdraw all of their cryptocurrency holdings from the exchanges and delete their accounts.

Following the latest developments, CEX reversed their approach. The reporter asserted that they started to list numerous DeFi tokens to “make users gamble in the secondary market, and helping users with yield farming.”