The Ethereum transaction fees reached a new all-time high following the latest DeFi craze YAM. A simple approval operation on some decentralized exchanges like Uniswap costs upwards of on occasions.ETH Gas Fees Through The RoofThe Ethereum blockchain is the underlying technology behind the majority of the DeFi-based projects. Investors wanting to allocate funds into such assets can do so by swapping ETH on platforms like Uniswap.The multitude of emerging projects, as well as the increased usage of Ethereum, result in a clogged network. There are about 150,000 pending transactions at the time of this writing. Consequently, users who want their transactions to be prioritized are paying higher gas prices, driving the overall fees higher.As per data from Glassnode, ETH fees have been

Topics:

Jordan Lyanchev considers the following as important: AA News, defi, ETHBTC, ethusd

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

The Ethereum transaction fees reached a new all-time high following the latest DeFi craze YAM. A simple approval operation on some decentralized exchanges like Uniswap costs upwards of $13 on occasions.

ETH Gas Fees Through The Roof

The Ethereum blockchain is the underlying technology behind the majority of the DeFi-based projects. Investors wanting to allocate funds into such assets can do so by swapping ETH on platforms like Uniswap.

The multitude of emerging projects, as well as the increased usage of Ethereum, result in a clogged network. There are about 150,000 pending transactions at the time of this writing. Consequently, users who want their transactions to be prioritized are paying higher gas prices, driving the overall fees higher.

As per data from Glassnode, ETH fees have been surging continuously for the past several weeks. This resulted in miners receiving over 42% of their revenue from fees, which was another ATH.

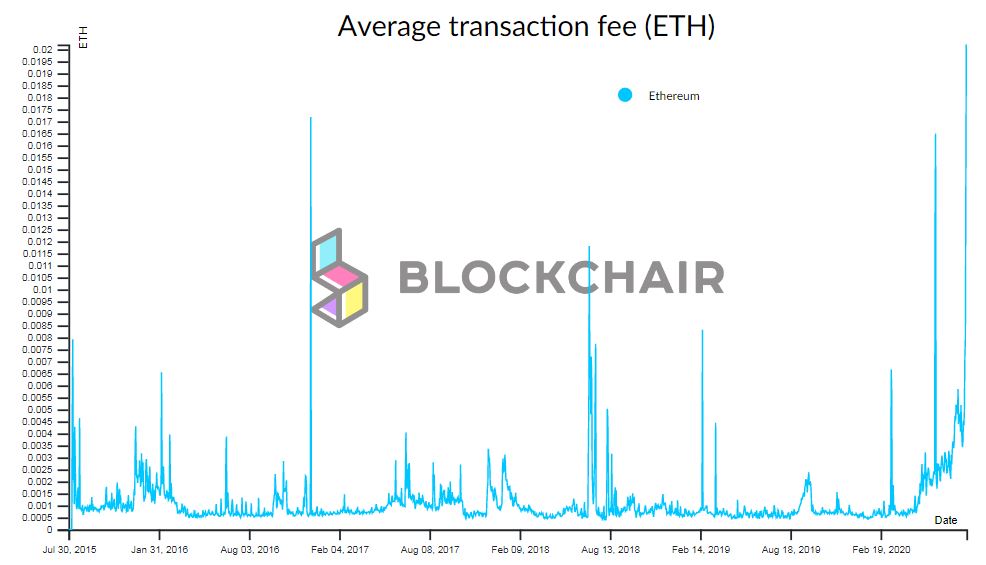

Furthermore, information from Blockchair shows the rising fees as the average gas spent while transferring ETH tokens has just reached a fresh all-time high of over 0.02 ETH. This amount (worth about $8) has surpassed the previous record registered in December 2016 of 0.017 ETH.

Is It All Yam?

The most apparent reason for this particular surge could be attributed to the latest DeFi boom – Yam Finance. Marketed as an innovative experimental protocol with an elastic token (YAM) supply, it offered investors significant yields through a fair farming ecosystem.

The interest in farming YAM was so high that the total value locked reached over $500 million a day after launching. Moreover, the massive demand drove most prices within the DeFi sector higher yesterday.

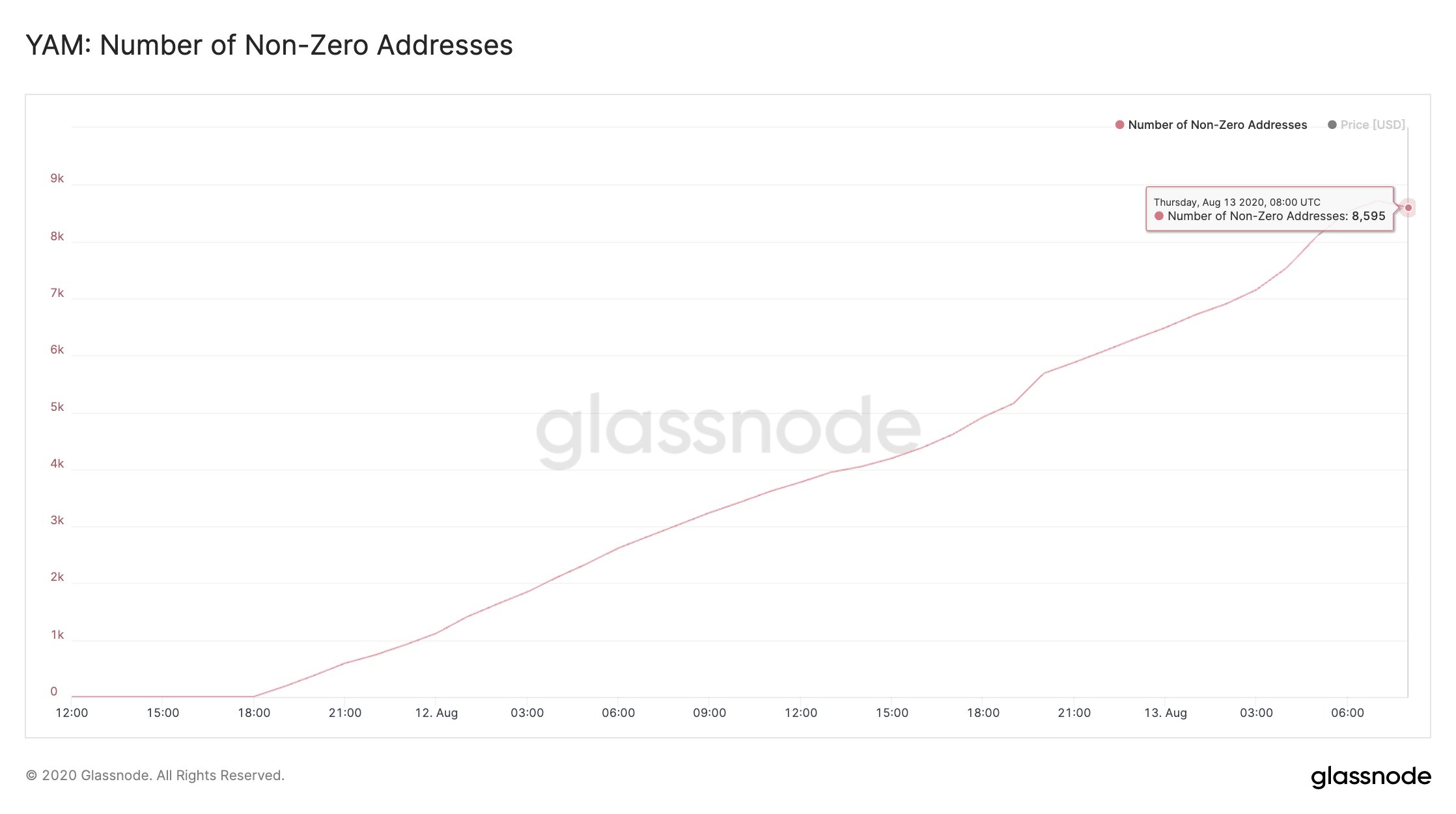

Further data from Glassnode reveals that within the first two days of being live, over 8,600 unique addresses were holding the token.

The story of Yam Finance, however, had an unfortunate end. The financial experiment that started on August 11thcrashed after an error in its rebasing mechanism that the team failed to address in time. The value of the token also tanked from over $100 yesterday to less than $1 today.

Although the situation appears gloomy, to say the least, the team has published a Medium post in which they outlined that YAM, despite its failure, has “brought together an immensely special community around YAM.” As such, they “plan to support the launch of YAM 2.0 via migration contract from YAM,” as long as they raise enough funds through a Gitcoin grant.