An average of million worth of ETH has been locked into Ethereum’s DeFi protocols each day for the past week. That equates to more than four times the amount of Ethereum, which is produced every day as a result of mining.Ethereum’s DeFi Protocols See Huge InfluxAccording to data from DeFiPulse.com, over 0 million entered various DeFi protocols in the past seven days, averaging just over million per day. Lock-ins of ETH specifically numbered 461,000 in that time, equating to an average of ,946,071 per day.Based on Ethereum’s mining difficulty, the blockchain’s miners currently produce around 15,483 ETH per day or ,746,977 in dollar terms. That means users are pouring more than four times as much ETH into DeFi protocols than is being issued via inflation.The sudden influx of

Topics:

Greg Thomson considers the following as important: AA News, coinbase, compound, ETHBTC, ethusd, makerdao

This could be interesting, too:

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

An average of $15 million worth of ETH has been locked into Ethereum’s DeFi protocols each day for the past week. That equates to more than four times the amount of Ethereum, which is produced every day as a result of mining.

Ethereum’s DeFi Protocols See Huge Influx

According to data from DeFiPulse.com, over $500 million entered various DeFi protocols in the past seven days, averaging just over $78 million per day. Lock-ins of ETH specifically numbered 461,000 in that time, equating to an average of $15,946,071 per day.

Based on Ethereum’s mining difficulty, the blockchain’s miners currently produce around 15,483 ETH per day or $3,746,977 in dollar terms. That means users are pouring more than four times as much ETH into DeFi protocols than is being issued via inflation.

The sudden influx of over half a billion dollars into DeFi in the past week can be explained largely by the rise of Compound (COMP). Compound is a lending/borrowing application that rewards lenders for providing liquidity, and allows users to borrow as much as 50-75% of their staked collateral – depending on the perceived quality of the collateralized asset.

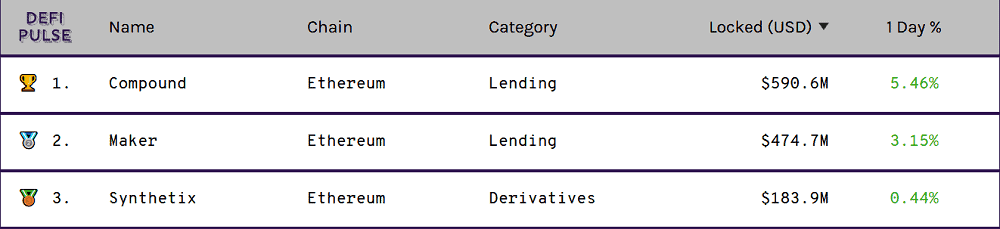

By June 23, Compound had risen to become the number one DeFi protocol on Ethereum – replacing the previous long-term leader, Maker (MKR). According to DeFiPulse, Compound has over $590 million locked in at the current time, compared to Maker’s $474 million.

Coinbase Helps COMP to 443% Gains In 3 Days

On June 18, Coinbase announced it would open its doors for COMP deposits, with a view to commencing trading against BTC and USDT. That resulted in a sudden and spectacular 443% growth spurt for the COMP token, which saw its value rise from $63.94 to $347.49 within just three days.

By the time of writing, the token price had dropped to $295.97, leaving COMP on 362% growth since June 18, and placed in 20th spot by market cap.

As reported by CryptoPotato, not everyone is convinced that Compound’s sudden moonshot will be sustained. Some speculate that the system is currently being gamed by users who worked out how to increase their reward payouts by borrowing against non-stablecoin assets.

How long can Compound’s moonshot last?