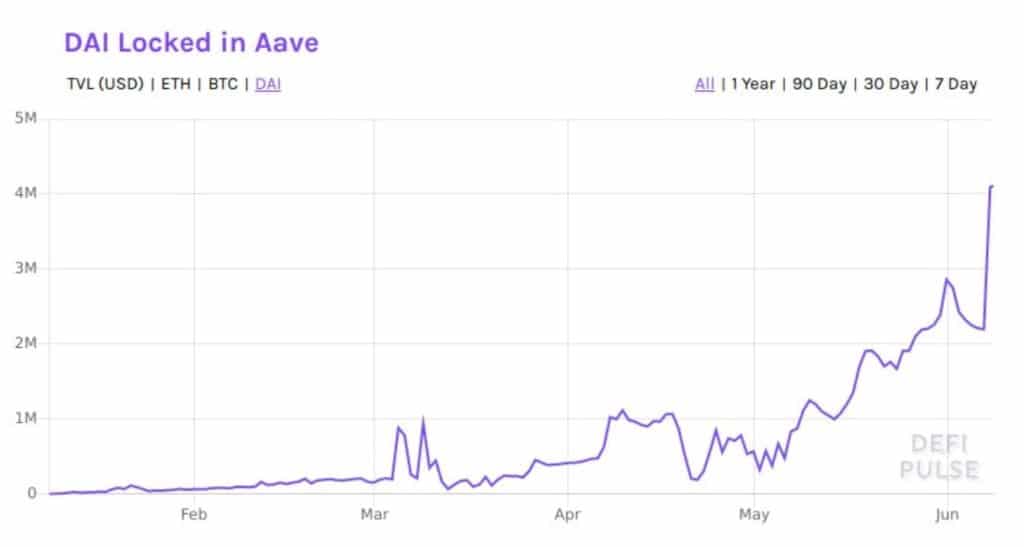

The number of DAI locked up in the Ethereum based Aave lending protocol almost doubled, leading into June 8.Aave is a prominent protocol in Ethereum’s decentralized finance (DeFi) ecosystem. Users can lend cryptocurrency at stable or variable rates, earning daily payouts to the wallet of their choice. They can take advantage of uncollateralized, trustless flash-loans, paid back within the same transaction block.DAI Locked in Aave Almost Doubles OvernightAccording to data from DeFi Pulse, the number of DAI locked in the decentralized finance protocol jumped 86% overnight – climbing from 2.1 million, to just over 4 million.The amount of DAI locked up in Aave nearly doubled over the weekend. Source: DeFi PulseDeFi Pulse ranks Aave as the fourth most utilized decentralized finance application

Topics:

Greg Thomson considers the following as important: AA News, defi

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

The number of DAI locked up in the Ethereum based Aave lending protocol almost doubled, leading into June 8.

Aave is a prominent protocol in Ethereum’s decentralized finance (DeFi) ecosystem. Users can lend cryptocurrency at stable or variable rates, earning daily payouts to the wallet of their choice. They can take advantage of uncollateralized, trustless flash-loans, paid back within the same transaction block.

DAI Locked in Aave Almost Doubles Overnight

According to data from DeFi Pulse, the number of DAI locked in the decentralized finance protocol jumped 86% overnight – climbing from 2.1 million, to just over 4 million.

DeFi Pulse ranks Aave as the fourth most utilized decentralized finance application operating on Ethereum, behind Maker DAO, Synthetic, and Compound, respectively. There is currently $73.7 million locked up in Aave, compared to just over half a billion locked up in the Maker protocol.

In total, Ethereum’s DeFi lineup currently hosts over $1 billion worth of value, composed predominantly of BTC, ETH, and DAI.

As reported recently by CryptoPotato, the number of Bitcoin locked up in the Maker DAO protocol exceeds the amount hosted on Bitcoin’s own Lightning Network.

Aave Gains Traction

Aave originally launched in 2017 as ETHLend before undergoing a rebrand, which saw the project expand to offer a broader range of features. Unlike other DeFi lending platforms, Aave allows users to earn interest in the same currency as that which they loan.

Aave founder and CEO Stani Kulechov said the protocol has provided profitable yields for its users in recent times. This, he said, has led to an increase in the number of DAI being locked up on the platform. Kulechov told CryptoPotato:

“Aave Protocol has recently gained traction… and has provided good yields for aToken holders such as aDai. This has led to an increase in Dai deposits on Aave. aDai is an interest-bearing token that credits any accrued interest directly to the depositors address in the form of aDai. Any aDai can be converted in 1:1 ratio from the Aave protocol.”

When users pledge capital to Aave’s lending pool, they receive an equivalent amount of the relevant “aTokens” – in this case, aDAI. Unlike with many interest-accruing tokens, the value of the aTokens doesn’t increase as interest accrues. Instead, the number of tokens increases. These can then redeemed at a 1:1 ratio against the original currency loaned.