The Ethereum blockchain is suffering a period of heavy congestion, partly caused by what appears to be a Ponzi scheme. Thousands of transactions are being pinged all across the network—all leading to a single address, which now holds .3 million worth of Paxos Standard (PAX) tokens.That address belongs to the operators of MMM Global – a multi-level marketing scheme that offers 1% returns on investment per day. Targets are urged to contract more people into the scheme, with the promise of increased returns for every person added.As pointed out by one cryptocurrency researcher, the same address was responsible for consuming 8.5% of daily gas on Ethereum in late April. And according to data on Etherscan, the address is now the 7th largest holder of the Paxos Standard stable coin on

Topics:

Greg Thomson considers the following as important: AA News, coinbase, crypto scams, Editorials, ETHBTC, ethusd

This could be interesting, too:

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

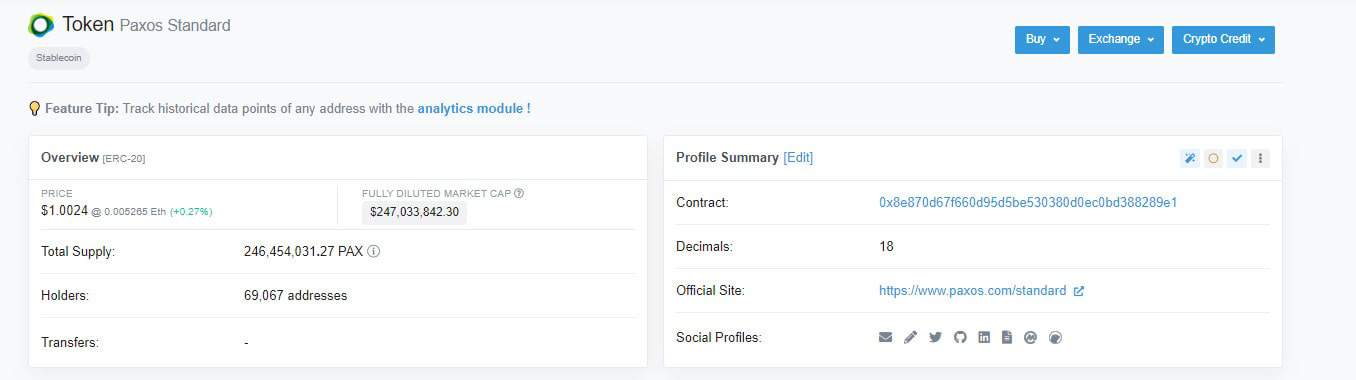

The Ethereum blockchain is suffering a period of heavy congestion, partly caused by what appears to be a Ponzi scheme. Thousands of transactions are being pinged all across the network—all leading to a single address, which now holds $5.3 million worth of Paxos Standard (PAX) tokens.

That address belongs to the operators of MMM Global – a multi-level marketing scheme that offers 1% returns on investment per day. Targets are urged to contract more people into the scheme, with the promise of increased returns for every person added.

As pointed out by one cryptocurrency researcher, the same address was responsible for consuming 8.5% of daily gas on Ethereum in late April. And according to data on Etherscan, the address is now the 7th largest holder of the Paxos Standard stable coin on Ethereum.

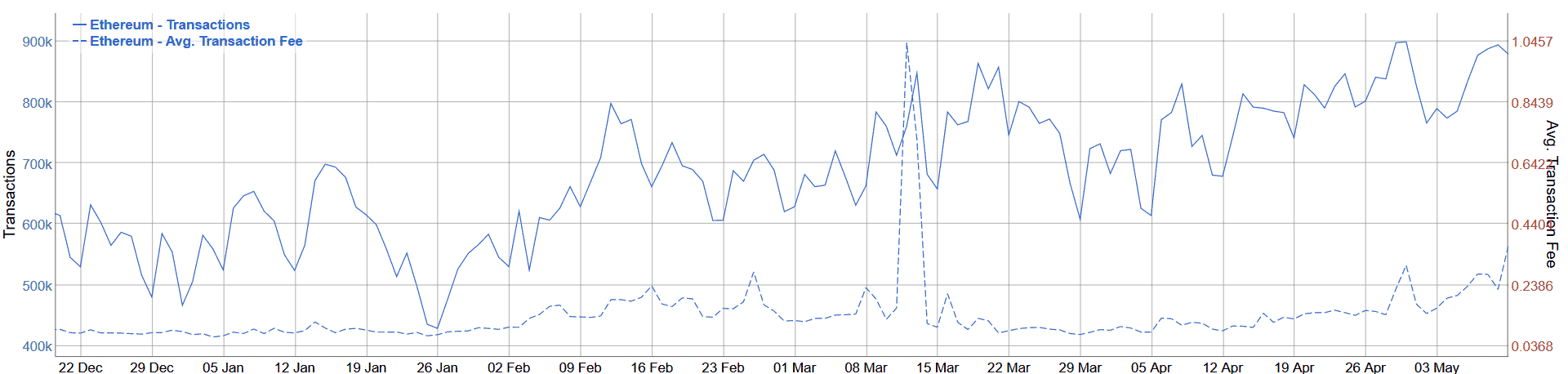

Amid all of this, the Ethereum network is experiencing some of its highest usage in recent times. Ethereum’s transaction count more than doubled since February, resulting in average transaction fees more than quadrupling in the process.

Ponzi in Progress?

Over 1.34 million seemingly valueless transactions continue to flood into the MMM Global address. Notably, the transaction fee on all of the transfers are marked as ‘pending’. These seemingly valueless transactions typically represent the interactions of ERC20 contracts where no ETH is transferred.

MMM Global’s ETH address continues to swell as more and more PAX tokens are sent to it. The PAX balance grew from $5.3 to $5.4 million while writing this article.

Mark A, of Hydro Labs, told CryptoPotato that he thinks it looks like a Ponzi in progress. According to him:

“I initially thought it was something Paxos was doing (considering there’s about $5M going in there), but looks like it’s just some random person who created a smart contract that is operating sort of like a ponzi. Can’t 100% confirm that it is, but it looks like it from what I’m seeing.”

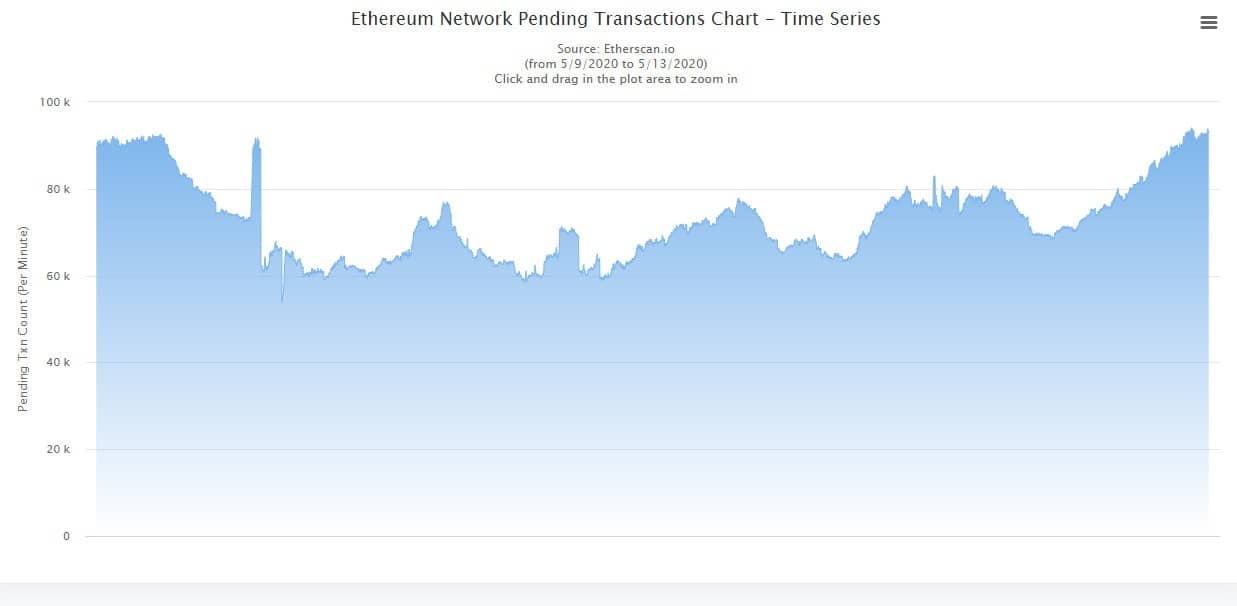

Ethereum’s blockchain explorer shows a backlog of over 90,000 pending transactions at the time of writing. The backlog has already affected Coinbase’s ability to move their ETH and ERC20 tokens.

Coinbase ETH and ERC20 Transactions Delayed

This network congestion might have been the reason why Coinbase’s ETH and ERC20 transactions were temporarily halted a couple of days ago. As Coinbase notified its users on May 9:

“Sends delayed for ETH and ERC20 tokens, due to network congestion.”

Coinbase had resolved the problem by the next day, but briefly, Ethereum and a host of ERC20 tokens were blocked up, including 0x, Basic Attention Token, USD Coin, Augur REP, DAI, Chainlink, Orchid, and Kyber Network.

The exchange didn’t comment on the source of the network slowdown, however the mass of transactions referenced above could be a factor.

Network Usage and Fees Explode in 2020

Data from Bitinfocharts shows the average Ethereum transaction fee hit $0.36 on Sunday, May 10. That’s more than a 50% increase from the previous day and a four-fold increase since January.

The same data also shows that Ethereum transactions have more than doubled since January alone—climbing to nearly 900,000 per day, from 428,000 at the turn of the year.

A doubling of Ethereum’s daily transaction count would typically be a cause for celebration among cryptocurrency advocates. But with a gas-sucking Ponzi scheme in process and a mass of unconfirmed transactions resulting in near unuseable fees, the celebrations may need to hold off a little while longer.