Stablecoins are touted as a hedge against the high volatility in the cryptocurrency markets since they are pegged to a relatively stable asset or a basket of assets like fiats or precious metals. However, new findings reveal that some of these tokens have ties with illicit activities like Ponzi schemes.In its latest state of the network report, crypto analytics firm Coin Metrics analyzed the supply and activity distribution of stablecoins, including market leaders Tether (USDT), USD Coin (USDC), and Paxos (PAX).PAX Used In Alleged Ponzi SchemeInterestingly, the findings claimed that more than 40% of PAX transactions are directly related to MMM BSC, an alleged Ponzi scheme pertaining to MMM Global, created by Sergei Mavrodi in 2011.Source: Coin MetricsBuilt on the Ethereum network, PAX is

Topics:

Mandy Williams considers the following as important: AA News, ETHBTC, ethusd, Stablecoins

This could be interesting, too:

Bitcoin Schweiz News writes Die USA werden zum Bitcoin-Land: Banken benötigen keine spezielle Lizenz mehr für Krypto-Services

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin Schweiz News writes USA-Goldreserven bald als Krypto-Token? Die Blockchain-Revolution für Staatsgold

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Stablecoins are touted as a hedge against the high volatility in the cryptocurrency markets since they are pegged to a relatively stable asset or a basket of assets like fiats or precious metals. However, new findings reveal that some of these tokens have ties with illicit activities like Ponzi schemes.

In its latest state of the network report, crypto analytics firm Coin Metrics analyzed the supply and activity distribution of stablecoins, including market leaders Tether (USDT), USD Coin (USDC), and Paxos (PAX).

PAX Used In Alleged Ponzi Scheme

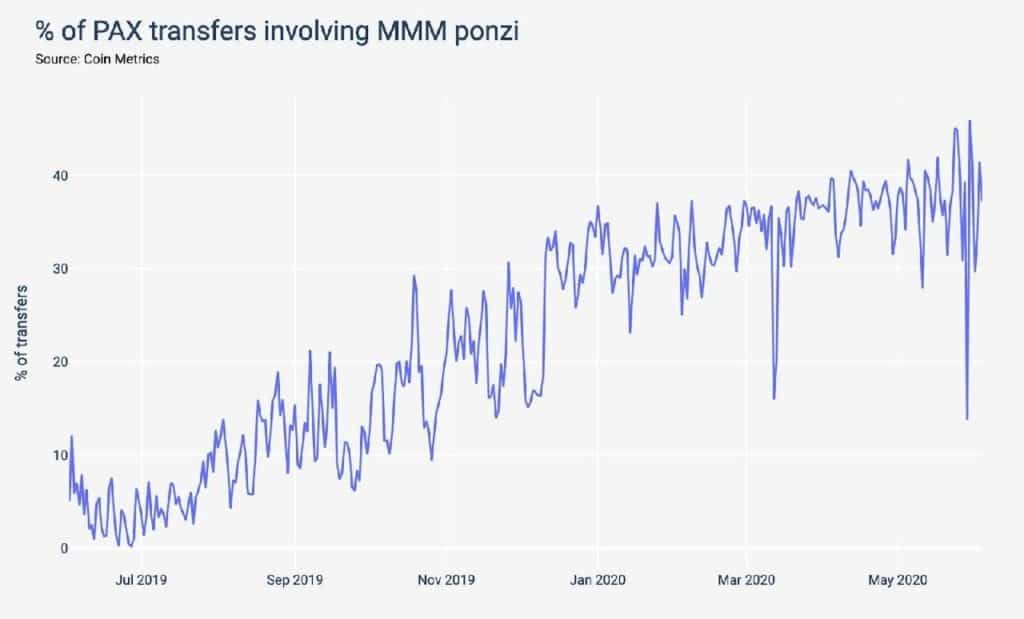

Interestingly, the findings claimed that more than 40% of PAX transactions are directly related to MMM BSC, an alleged Ponzi scheme pertaining to MMM Global, created by Sergei Mavrodi in 2011.

Built on the Ethereum network, PAX is the third-largest stablecoin in the market and the 36th largest cryptocurrency in the world, according to CoinMarketCap’s ranking. The token maintains a 1:1 parity with the US dollar, and it boasts of a market cap of $245,383,324, at the time of this writing.

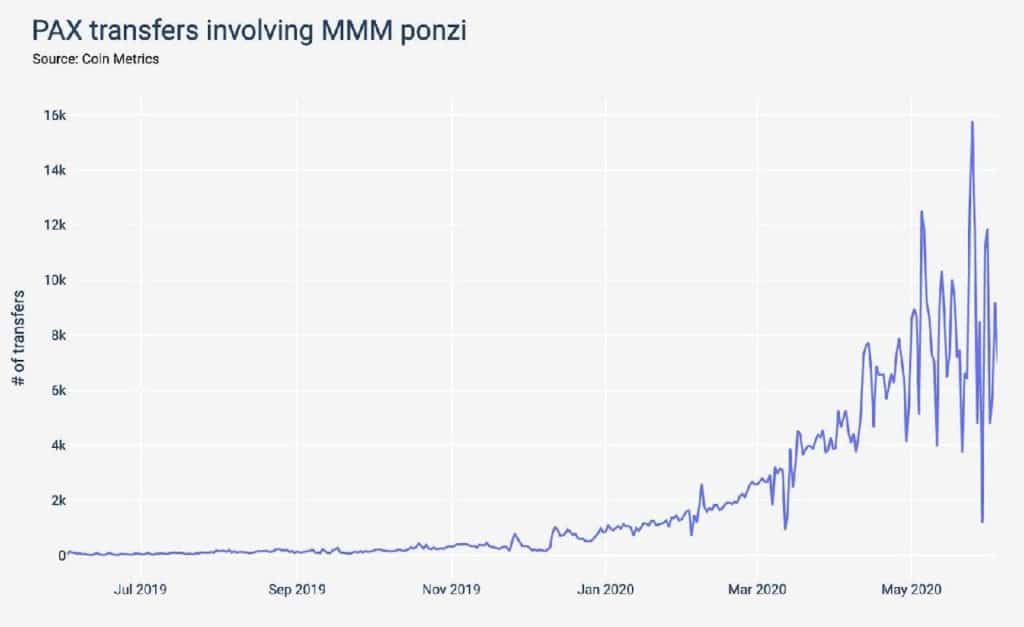

Coin Metrics said that although the stablecoin seemingly has plenty of users, a closer look at the top transactors revealed that two of the most active accounts are linked to MMM BSC.

Promising a 40% to 50% ROI monthly, MMM BSC recorded massive growth in 2019, but the report further revealed that PAX transactions relating to the scheme reached its highest level of nearly 16,000 transfers in May 2020.

Paxos: We Are Not Affiliated To MMM BSC

Long before the Coin Metrics’ latest report, Paxos, the issuer of the PAX stablecoin, had already noticed the use of its token in Ponzi schemes. Last month, the company issued a notice that it does not have ties with MMM BSC while warning PAX users to stay clear of Ponzi schemes.

“Paxos is a trust company and committed to acting with transparency. We are not affiliated with MMM Global in any way. Any PAX users should do careful analysis and not interact with Ponzi schemes and affiliated organizations. Please be cautious with your trust and funds,” the project said.

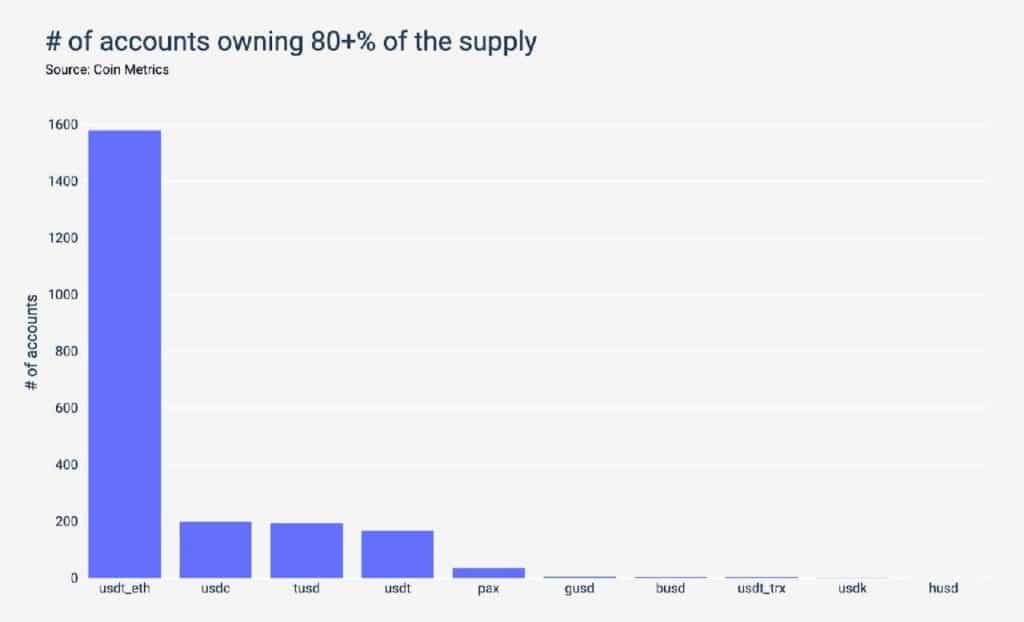

In terms of PAX distribution, Coin Metrics noted that almost 50% of the token holders are responsible for 80% of PAX activity with daily volume at $178.6 million. On the other hand, more than 80% of the token supply is owned by very few accounts.

Not Just PAX. Tron-Based USDT Too

Sadly, PAX is not the only stablecoin that was linked to Ponzi schemes. The report noted that Tron-based Tether also has this problem, with about 80% (up to 90% in some days) of USDT on Tron transfers relating to dividend payout schemes.

As for distribution, six accounts or less own more than 80% of the supply for Tether on Tron, making it much more centralized than the ERC-20 variant of Tether, which has about 1,600 accounts controlling 80% of its supply.

Other stablecoins like Gemini Dollar, Binance USD, USDK, and HUSD also have centralized distribution as 80% of their supplies are owned by six accounts or less.

Featured image courtesy of Silicon Angle