The milestone comes as TVL across all DeFi protocols hits a record high of billion according to Defi Pulse. So far this month, over billion has been added to DeFi protocols in terms of dollar value crypto collateral, but some of that may be attributed to the increase in Ethereum prices. In terms of ETH, there is now 8.5 million, or 7.5% of the total supply, locked in DeFi and 3.3 million ETH on Uniswap alone. Uniswap, The King of DeFi Uniswap remains at the top of the pile in terms of TVL with a market share of 23%. According to Uniswap.info, liquidity has reached a record .3 billion while volumes are at 0 million per day. Almost half of that liquidity is in Ethereum. Charts – uniswap.infoMessari researcher Ryan Watkins has looked into volumes on Uniswap

Topics:

Martin Young considers the following as important: AA News, defi, UNIBTC, UNIUSD, UNIUSDT

This could be interesting, too:

Emily John writes Ripple Unveils Institutional Roadmap Driving XRP Ledger Growth

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

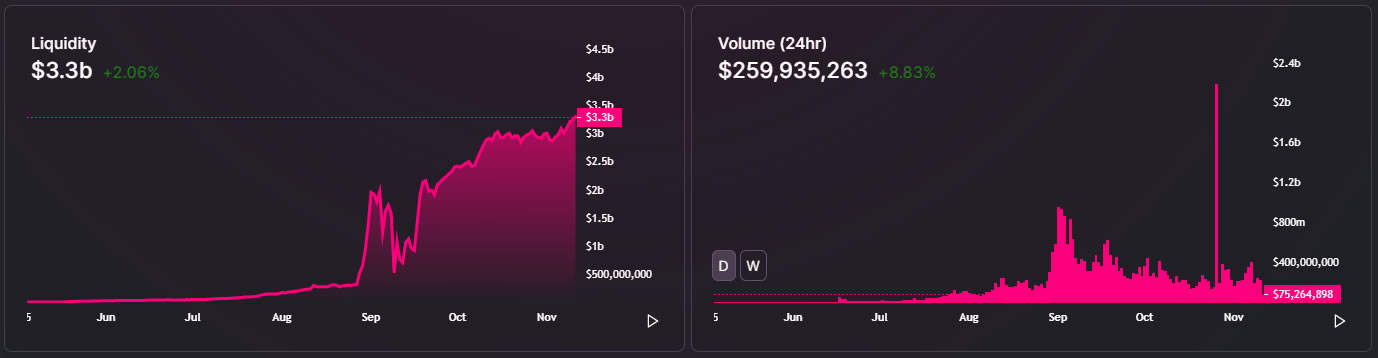

The milestone comes as TVL across all DeFi protocols hits a record high of $13 billion according to Defi Pulse. So far this month, over $2 billion has been added to DeFi protocols in terms of dollar value crypto collateral, but some of that may be attributed to the increase in Ethereum prices.

In terms of ETH, there is now 8.5 million, or 7.5% of the total supply, locked in DeFi and 3.3 million ETH on Uniswap alone.

Uniswap, The King of DeFi

Uniswap remains at the top of the pile in terms of TVL with a market share of 23%. According to Uniswap.info, liquidity has reached a record $3.3 billion while volumes are at $260 million per day. Almost half of that liquidity is in Ethereum.

Messari researcher Ryan Watkins has looked into volumes on Uniswap stating that although they have declined a little since September, its fundamentals are still very strong.

Uniswap’s volumes have come down quite a bit since September, but even still it’s fundamentals are very strong.

Extrapolating Uniswap’s worst day over the last 3mo ($135mm in volume) over the next year still gets you to ~$25mm in annual earnings assuming the 5bp fee switch.

— Ryan Watkins (@RyanWatkins_) November 10, 2020

Over the past 24 hours, that collateral has increased by 2.5% as liquidity in its four UNI farms also increases. Around $2.35 billion is spread across these four farms with the largest share sitting in the ETH/wBTC pool holding over $810 million.

There is a mounting concern, however, that there could be a liquidity exodus from Uniswap when UNI distribution to these pools ends on November 17. This could have a huge impact on UNI prices, which are currently up 15% on the day to reach $3.20.

UNI Price Discovery … or Another Gas Spike?

There is a possibility that Uniswap will launch new farms for ETH/UNI or stablecoins and UNI, offering greater incentives than just the trading fee share in order to retain the collateral on the platform. Nothing has been announced yet on any official channels as the clock counts down with just six days to go.

Industry observers have suggested that the end of farming will create a pivotal price discovery moment for UNI.

Alpha in plain sight: in one week, the farm N dump pressure against $UNI will lift. Liquidity mining stops.

It will be interesting to see the price discovery then.

This is financial advice. Profit or your money back guaranteed (whatever money you paid me anyway). pic.twitter.com/vyxH2Nvear

— Tetranode (@Tetranode) November 10, 2020

The highly anticipated launch of Uniswap v3 is likely to usher in further incentives for UNI holders which could also boost prices.

Another side effect of the potential movement of over $2 billion in crypto collateral is a surge in gas prices again. Average Ethereum transaction fees have settled down to around $1.60 according to Bitinfocharts.com, though the last time they surged into double digits was almost two months ago when Uniswap launched the four farms.

Either way, there will be some volatility for Uniswap and DeFi farmers next week so buckle up.