Bitcoin just had its biggest plunge since May 2020. During the weekend, Bitcoin continued to trade downward and even declined to as low as ,900. More than billion was wiped off in the market. Altcoins also traded lower in tandem and ETH shed almost 20% of its value. Analysts believed some of the reasons behind the decline were the new COVID variant, Fed’s concern with the high inflation rate which might drive it to curb stimulus, and the crisis of China real-estate giant Evergrande. In fact, not only the crypto market but also the stock markets suffered from market angst. The sell-off may also come from investors who want to lock in a profit before the end of 2021. What happens now? While most analysts uphold the idea that Bitcoin could explode in 2022, it is

Topics:

Guest considers the following as important: Featured News

This could be interesting, too:

Suraj Manohar writes Sony to Step Into the Exchange Business, Operate Japanese Exchange Whalefin

Live Bitcoin News writes Bitcoin Soars 7.5% in 24 Hours, Here’s Why Someone Makes More Than 750% ROI

Guest writes Bexplus Offers 100x Leverage Crypto Trading & Doubles Your Deposit

Live Bitcoin News writes Bexplus Launches Copy Trading, Allowing Superior Traders to Make Profits for You

Bitcoin just had its biggest plunge since May 2020. During the weekend, Bitcoin continued to trade downward and even declined to as low as $41,900. More than $1 billion was wiped off in the market. Altcoins also traded lower in tandem and ETH shed almost 20% of its value.

Analysts believed some of the reasons behind the decline were the new COVID variant, Fed’s concern with the high inflation rate which might drive it to curb stimulus, and the crisis of China real-estate giant Evergrande.

In fact, not only the crypto market but also the stock markets suffered from market angst. The sell-off may also come from investors who want to lock in a profit before the end of 2021.

What happens now?

While most analysts uphold the idea that Bitcoin could explode in 2022, it is too early to tell where Bitcoin will head in the short term. Here are some important events that could determine bitcoin’s action in the coming weeks.

Omicron variant remains the most-watched factor

To date, there are more than 40 countries that have detected cases caused by the Omicron variant. While scientists are still working to see if they could discern more information, all the reported cases now are only showing mild symptoms, which is small comfort. But it is clear that the new variant is more contagious than Delta. Public-health officials said that they might work on the approval of Omicron-specific vaccines if needed. It is advised that investors should watch closely for any news regarding covid.

Could Congress inject more liquidity into markets?

Congress will decide in the next week whether the debt limit will be raised. And the Senate will need to decide whether to approve Biden’s nearly $2 trillion Build Back Better plan. “The president is optimistic” Congress will pass it by Christmas, White House spokeswoman Karine Jean-Pierre told MSNBC on Sunday. The passing of a series of plans will add confidence to the market and relieve some fear.

The lower bitcoin goes, the more opportunities to make profit

Futures trading is one of the most popular tools to grow your wealth. You can benefit from price swings to earn money by speculating the direction of crypto’s price.

Assume we used 1 BTC to open a short contract when bitcoin was trading at $55,000. Please note that with 100x leverage, 1 BTC can open a contract worth 100 BTC.

If the price of bitcoin dropped to $50,000.The profit will be ($55,000 – $50,000) * 100 BTC/$50,000 *100% = 10 BTC, making the ROI 900%.

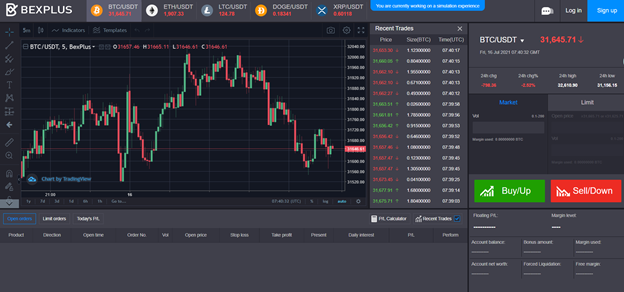

Bexplus offers 100x leverage in BTC, ETH, ADA, DOGE, and XRP futures contracts. Headquartered in Hong Kong, Bexplus is trusted by over 800K traders from over 200 countries/regions, including the USA, Japan, Korea, and Iran. No KYC, no deposit fee, traders can receive the most attentive services, including 24/7 customer support.

How to start?

Bexplus requires no KYC so you only need to open an account with an Email address, in just 1 minute. Once registration is complete, a trading account and a demo account with 10 BTC will be opened automatically.

Practice Your Skills: A Demo Account

Successful traders are those who learn to analyze the market and could always keep a clear head. The best way to improve your skills and mindset is by practicing in the free demo account.

Every user is given 10 BTC at the beginning and they are replenishable, so you can try out different strategies as much as you like.

Make A Deposit And Claim Bonuses

No deposit fee is needed. You can start your deposit at 0.001 BTC. Bexplus supports Bitcoin, ETH, etc, as well as USD, EUR, and GBP deposits.

To help traders earn more profits, Bexplus offers a 100% deposit bonus to every trader. Deposit 1 BTC and you will get 2 BTC, and up to 10 BTC is available for each deposit. The bonus is not withdrawable but could be used as margin.

Earn Passive Income With Bexplus

When you are not trading, you can transfer your BTC to the interest-bearing wallet and enjoy up to 21% annualized interest.

The interest is calculated daily and the revenue of the deposit will be settled monthly. The monthly interest is calculated as (S*I/365*30)=MI. S represents the sum of the deposit, I stands for interest, and MI is the monthly interest.

The crypto market is full of opportunities, don’t hesitate to join and claim your profit!Sign up now!