Despite its popularity as a platform for DeFi applications, the rampant growth in both the number of DeFi applications and the number of users has put a strain on Ethereum’s infrastructure, leading to a number of challenges that many Ethereum DeFi users now face on a regular basis.Arguably the most significant of these are scalability and cost.With Ethereum pushed to its limits and fees hitting record highs, other platforms may be set to muscle in on its DeFi turf in the near future. Here, we take a look at the current state of play for Ethereum and arguably its biggest challenger – Polkadot.Ethereum’s LimitationsIn its current iteration, the Ethereum blockchain is capable of processing roughly 10-14 transactions per second (tps) at full load, or just over 30 if blocks were fully

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Despite its popularity as a platform for DeFi applications, the rampant growth in both the number of DeFi applications and the number of users has put a strain on Ethereum’s infrastructure, leading to a number of challenges that many Ethereum DeFi users now face on a regular basis.

Arguably the most significant of these are scalability and cost.

With Ethereum pushed to its limits and fees hitting record highs, other platforms may be set to muscle in on its DeFi turf in the near future. Here, we take a look at the current state of play for Ethereum and arguably its biggest challenger – Polkadot.

Ethereum’s Limitations

In its current iteration, the Ethereum blockchain is capable of processing roughly 10-14 transactions per second (tps) at full load, or just over 30 if blocks were fully optimized.

This is because Ethereum can only fit an absolute maximum of around 476 transactions into each block and each block is mined every fifteen seconds, while most transactions are more complicated (and hence larger) than a minimum weight transaction.

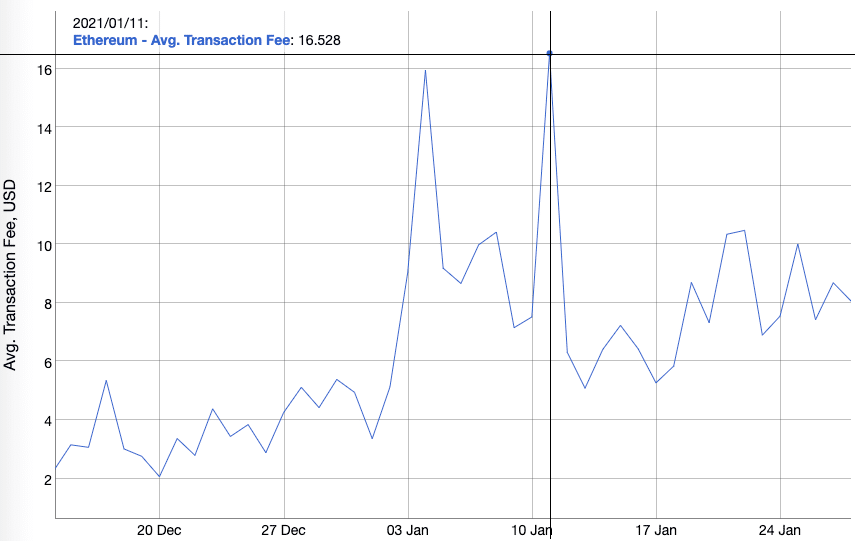

Unfortunately, this limited throughput has led to a significant issue that impacts most DeFi applications today – high fees. Since the number of transactions per day has more than tripled in the past year, largely as a result of increased DeFi usage, so too have the fees that are needed to ensure quick confirmation times.

On top of this, since the utility of many Ethereum-based DeFi applications is contingent upon achieving a quick transaction turnaround – such as trading on Uniswap – and require users to invoke a smart contract, fees have skyrocketed to reach record highs at an average of $16/transaction in mid-January.

Photo: BitInfoCharts

As you might expect, this has made interacting with DeFi apps an expensive task that many users simply cannot afford.

But more than this, it is clear that DeFi apps are trending towards interoperability. With more dApps than ever before looking to build upon the utility of others and support tokens from other blockchains. Right now, this is mainly achieved using wrapped assets and synthetics, but it’s a half baked solution, since even these suffer from eye-watering fees to transfer.

These issues, along with several others, have sent both users and developers searching for an alternative solution.

Is Polkadot The Answer?

First envisioned more than three years ago, Polkadot has long been heralded as a potential solution to the scalability and fee issues that plague many blockchains – Ethereum included.

Rather than acting as a one-size-fits-all solution like many platforms, Polkadot wants to enable multiple heterogeneous blockchains to interoperate with one another through its central relay chain. Various application-specific blockchain implementations can be launched on Polkadot as a parachain, whereas pre-existing blockchains can connect to the ecosystem via specialized adapters known as bridges.

This has two main benefits. For one, it massively improves the scalability of the system, since each parachain or native blockchain (connected via a bridge) acts as a single shard in the Polkadot ecosystem – massively boosting the overall capacity of the network and bringing the fees down as a result.

Although Polkadot has the capabilities to benefit other blockchains, some believe that its parachain technology makes the perfect base for the future of DeFi – including Clover, an all-in-one open DeFi platform built on a Polkadot parachain.

Clover is committed to providing easy-to-use blockchain infrastructure and creating a one-stop EVM compatible framework for Substrate-based applications. https://t.co/zrhPEWLlG6

— Clover (@clover_finance) January 28, 2021

The Bithumb backed project looks to provide the infrastructure that developers can use to easily launch their DeFi applications on Polkadot, including a variety of plug and play modules that cover standard DeFi functionality, such as swap, stablecoin, and governance protocols. Being based on Polkadot, these applications will also benefit from its cross-chain interoperability capabilities, enabling developers to build more powerful DeFi apps than previously possible.

With Polkadot parachains like Clover set to pop up left, right, and center in the coming months, it’s just a matter of time before we see if Polkadot lives up to its tall ambitions.

Kseniia is the Chief Content Officer of Coinspeaker, holding this position since 2018. Now she is very passionate about cryptocurrencies and everything connected with it, so she tries to ensure that all the content presented on Coinspeaker reaches the reader in an understandable and attractive way. Kseniia is always open to suggestions and comments, so feel free to contact her for any questions regarding her duties.