Q DeFi Rating is already in operation. It aggregates and analyzes information on Ethereum, Binance Smart Chain, Heco, Matic, Tron, Polkadot as well as other blockchains.The “never invest money that you can’t afford to lose” rule applies just as much to the crypto world as it does to investments in traditional finance. Asset volatility, the complexity of strategies and the very nature of investments themselves make it a high-risk affair. Failing to understand the risks involved can lead to losses.Q DeFi Rating aims to help users allocate their funds smartly with its advanced portfolio management toolkit and a fully-fledged database of information on the DeFi market. Focused on providing accurate and comprehensive analytics on every position, the platform enables users to better assess the

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Q DeFi Rating is already in operation. It aggregates and analyzes information on Ethereum, Binance Smart Chain, Heco, Matic, Tron, Polkadot as well as other blockchains.

The “never invest money that you can’t afford to lose” rule applies just as much to the crypto world as it does to investments in traditional finance. Asset volatility, the complexity of strategies and the very nature of investments themselves make it a high-risk affair. Failing to understand the risks involved can lead to losses.

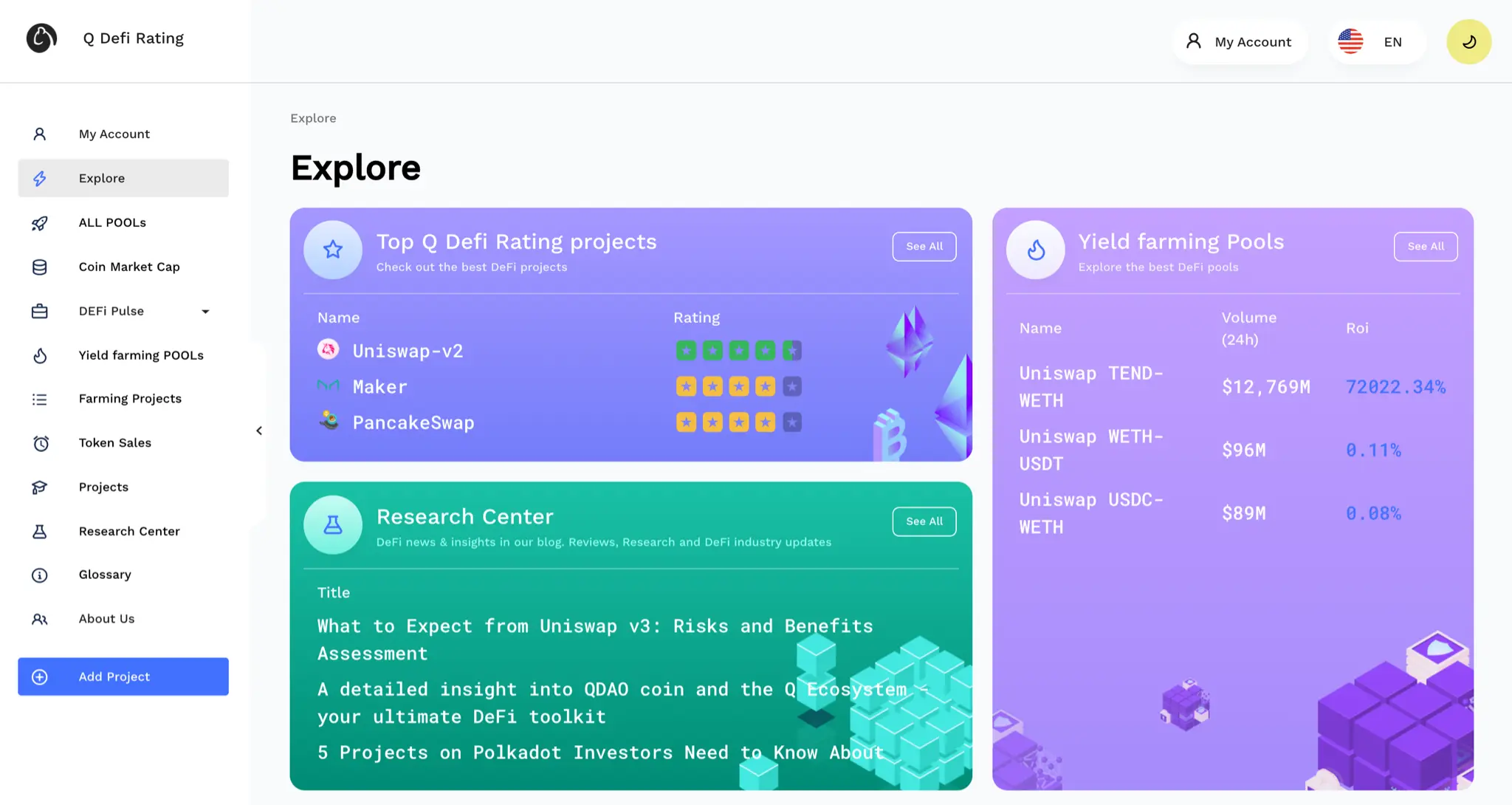

Q DeFi Rating aims to help users allocate their funds smartly with its advanced portfolio management toolkit and a fully-fledged database of information on the DeFi market. Focused on providing accurate and comprehensive analytics on every position, the platform enables users to better assess the performance of their funds and the risks involved, enabling them to react to market changes in a timely manner. Our project and pool ratings along with our Research Center provide the essential data users need to make well-informed decisions.

Users can create a personal account on Q DeFi Rating by simply logging in with their wallet and adding all the addresses they want to track.

APY and ROI Feature Puts a Stop to Miscalculated Returns

APY together with ROI is often used to assess a position’s performance and gains, compared to other investment opportunities. Judging by the numbers displayed by projects, users are always left with misleading information. By design, APY is a fluctuating metric that depends on token volatility, liquidity in the pool, demand for supplied assets and impermanent loss. The APYs presented by projects are an estimation of what users receive only if all of the underlying factors remain the same, which is impossible.

Q DeFi Rating addresses this issue by displaying the average APY which a pool could generate in the next 3 days, one month or three months. The system analyzes how the pool performed in the past and estimates the returns based on historical data. Thus, investors can better understand liquidity flow and what rewards to expect so that they can adjust their strategy accordingly.

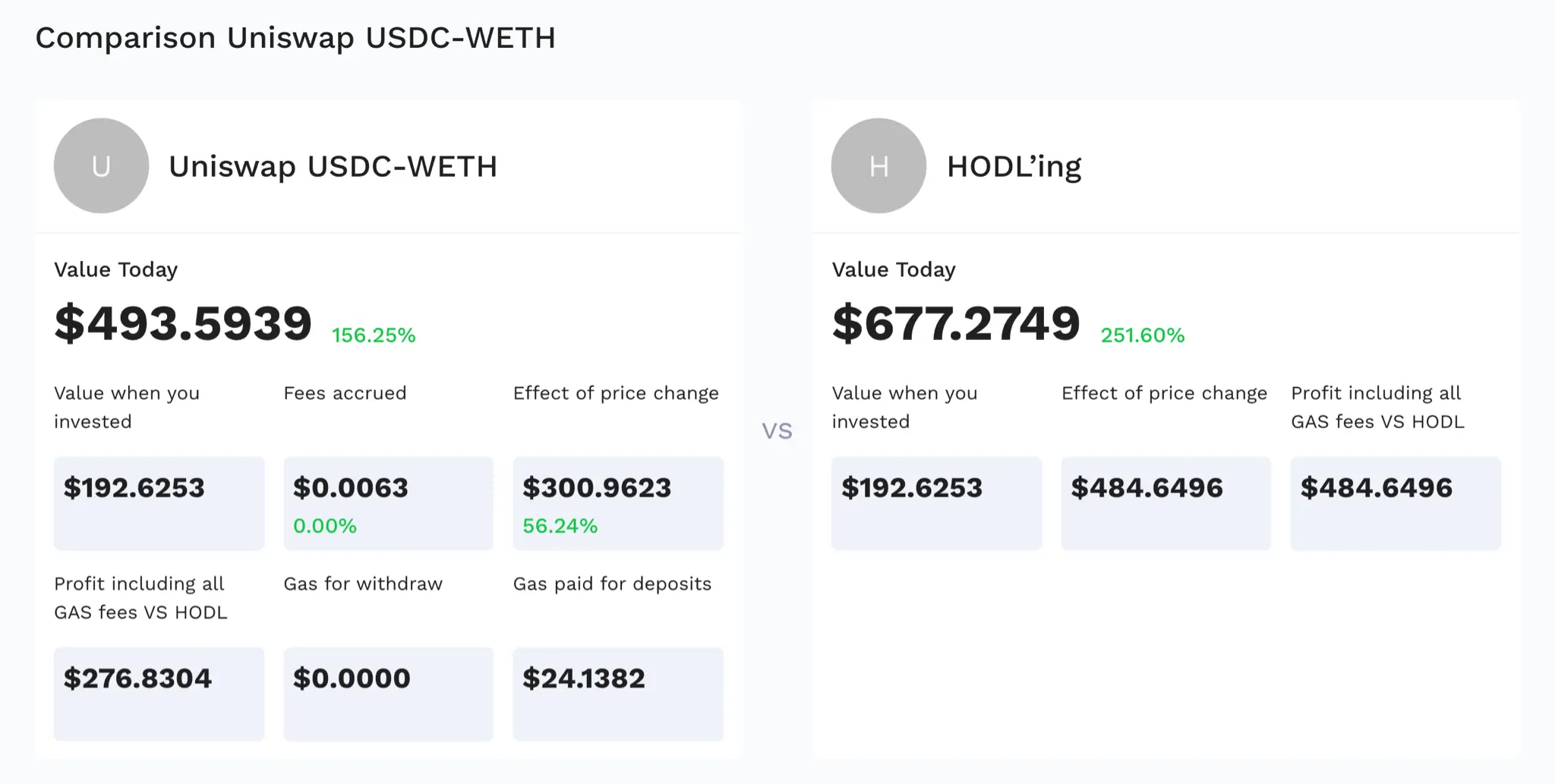

The Q DeFi Rating system also considers aspects of liquidity flow that are often overlooked. APY and ROI are the returns that users accumulate while lending, staking or farming. These metrics don’t consider the steps taken to participate in the pool or to harvest the returns. Q DeFi Rating in turn tracks the Gas fees paid for the deposit, estimates the withdrawal fee and displays the actual profit users make after taking care of all the costs.

Furthermore, the data is presented alongside a comparison with how the same assets would have performed under a HODLing strategy. This feature gives users a better understanding of which strategy could generate the biggest gains and how it might be better to act next time.

Mitigating Impermanent Loss with the Help of Q DeFi Rating

Impermanent loss is a problem no crypto investor can stay away from. The risk can be minimized by playing safe and investing only in stablecoin pairs and avoiding volatile cryptocurrencies. In all other cases, it comes down to the degree of risk a user is ready to take.

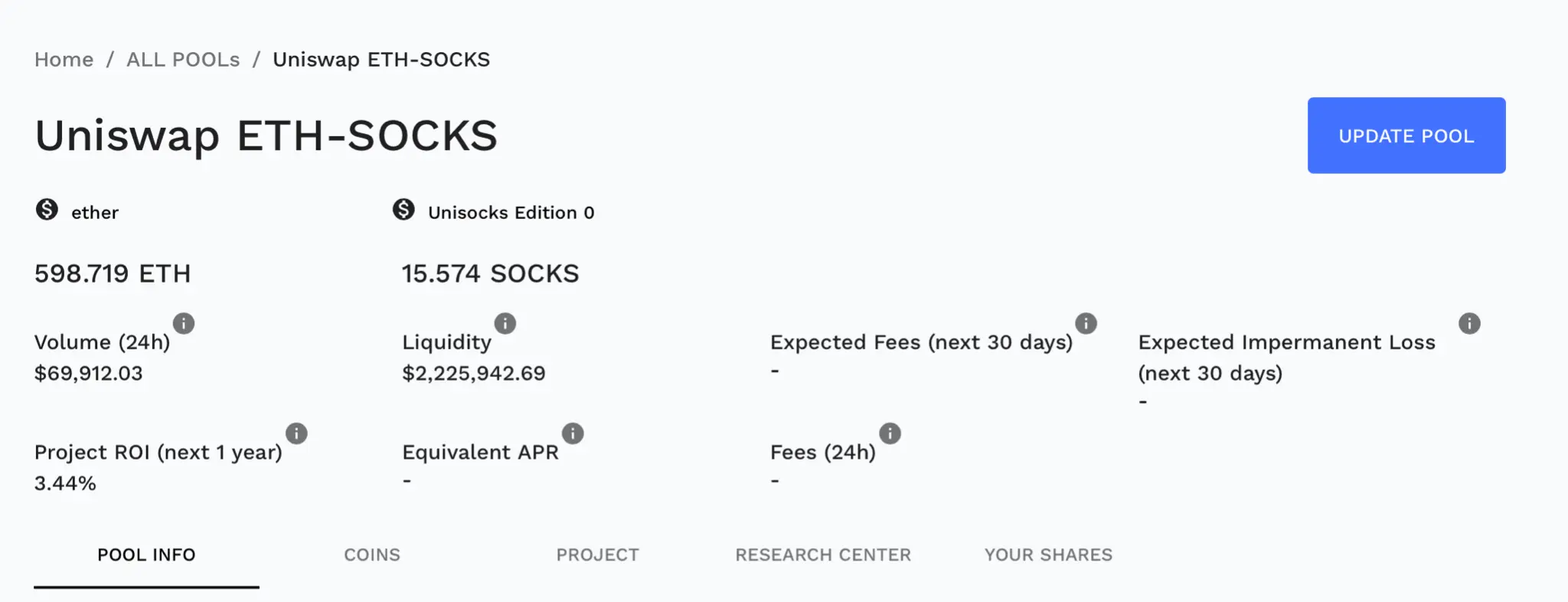

Q DeFi Rating makes it easier to estimate the amount of loss that will occur in the foreseeable future, to help users decide whether it’s worth it at all. Users can check the Expected Impermanent Loss by going to the page dedicated to the pool they are interested in.

Once the funds are invested, users can track the impact that impermanent loss is having on their positions via the dashboard.

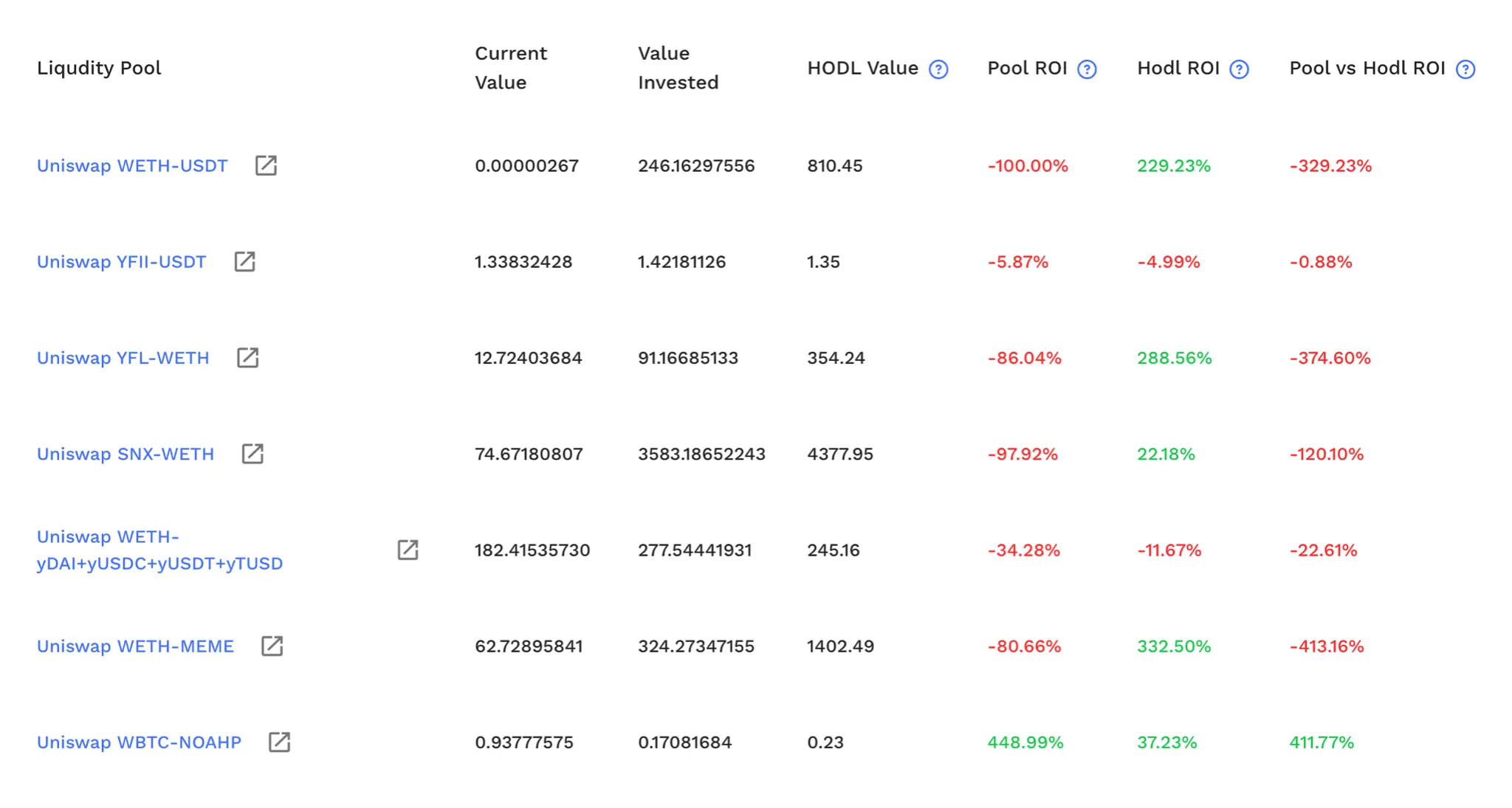

The performance of each position is measured by six metrics:

- The Current Value and Value Invested columns are straightforward.

- The HODL Value calculates what the value of users’ assets would be if they had kept them in their wallet, without investing anywhere.

- Pool ROI is the sum of Price ROI and Exchange ROI. Price ROI indicates the percentage of returns that occur purely as a result of asset volatility between the date of the initial investment and the current moment. Exchange ROI shows the combination of fees accumulated during the staking period, possible impermanent loss and earnings in platform governance tokens.

- HODL ROI is much like HODL Value but is expressed as a percentage.

- Pool ROI vs. HODL ROI is simply the difference between the two.

Thus, users can see exactly how their funds are performing, what effect each factor has on their final returns and what strategy works best.

Researching and Validating New Investment Opportunities

Q DeFi Rating has investors’ pain covered during the whole journey. A big part of this is discovering new projects and checking their reliability. Q DeFi Rating aggregates information on the whole DeFi industry and helps users to search for and analyze new projects and pools, even if they lack knowledge in tech and economics.

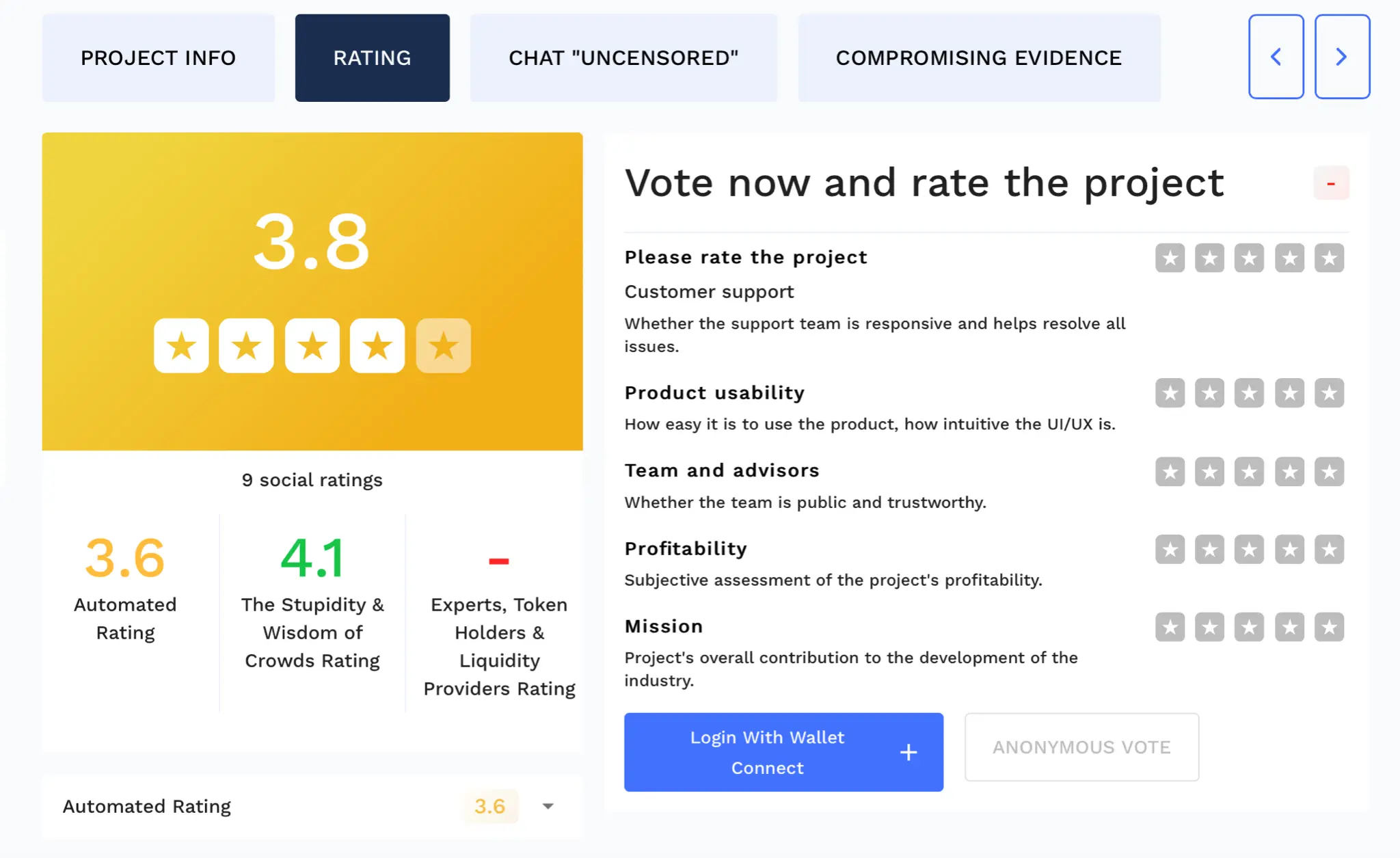

Each project has its own page that features its general information and rating. The rating system is based on a proprietary formula and considers factors such as liquidity, trade volume, pool duration, governance token supply, smart contract vulnerability, how the customer support works and what token holders and liquidity providers have to say about it. Finding new gems comes down to browse through the pages on Q DeFi Rating.

Q DeFi Rating is already in operation. It aggregates and analyzes information on Ethereum, Binance Smart Chain, Heco, Matic, Tron, Polkadot as well as other blockchains. Powered by its unique methodology, it provides users with comprehensive analytics in a simple and intuitive form.

You can create your account here. Also join the Telegram chat to discuss platform updates and follow Q DeFi Rating on Twitter to stay in the loop.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.