DeFi will likely continue to amass more users at the current pace of innovation as systems become scalable and interoperable. This raises the probability of crypto users opting for alternative DeFi environments despite Ethereum’s current market dominance.Uniswap, a Decentralized Application (DApp) built on the Ethereum blockchain, is making headlines in the crypto market following a decision by Uniswap Labs to delist some tokens from the interface. The Brooklyn based firm shared a list of about 100 tokens that it has delisted, most of which are tokenized stocks and derivative instruments.However, Uniswap Labs was keen to note that its protocol will remain open-source, allowing DeFi users to leverage the Interface code to access the delisted tokens through other platforms. While the

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

DeFi will likely continue to amass more users at the current pace of innovation as systems become scalable and interoperable. This raises the probability of crypto users opting for alternative DeFi environments despite Ethereum’s current market dominance.

Uniswap, a Decentralized Application (DApp) built on the Ethereum blockchain, is making headlines in the crypto market following a decision by Uniswap Labs to delist some tokens from the interface. The Brooklyn based firm shared a list of about 100 tokens that it has delisted, most of which are tokenized stocks and derivative instruments.

However, Uniswap Labs was keen to note that its protocol will remain open-source, allowing DeFi users to leverage the Interface code to access the delisted tokens through other platforms. While the protocol remains open-source, Uniswap’s decision to limit access to some tokens has raised doubts about the true nature of the so-called ‘decentralized’ projects.

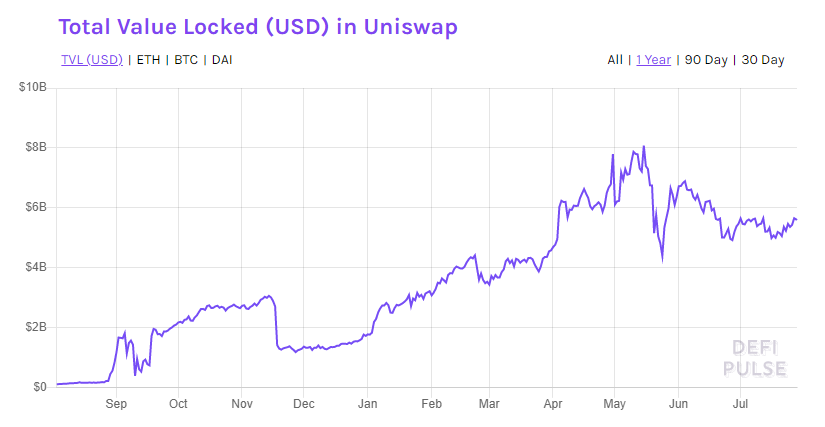

Built on the Ethereum blockchain, Decentralized Finance (DeFi) projects made a hallmark debut by pivoting as a distributed financial ecosystem. The past year has been particularly successful with the likes of Uniswap rising the ranks; this platform’s total value locked (TVL) is currently at $5.6 billion, according to DeFi Pulse metrics.

Notably, several blockchain environments currently support DApp development, although Ethereum still leads the pack. This is not to say that Alternative DApp oriented platforms have no value proposition; in fact, there has been a significant shift by DeFi projects this year following the invention of cross-chain bridges, amongst other interoperability solutions.

Ethereum’s Decentralized Finance (DeFi) Ecosystem

Ethereum is the pioneer blockchain network to have featured DApp development. The project was proposed in 2013 by Vitalik Buterin and went live in 2015. This DApp oriented blockchain ecosystem allows developers to deploy decentralized applications with the help of smart contract technology and the Ethereum Virtual Machine (EVM).

The year 2020 was a big success for Ethereum’s blockchain as DeFi projects came to life. Some of the DeFi projects launched on this blockchain feature decentralized financial services ranging from exchanges, lending, borrowing, and derivative instruments. Uniswap is among the pioneer decentralized exchanges (DEX), while popular lending and borrowing DeFi platforms include Aave, Compound and Maker.

Like any upcoming sector, DeFi projects on Ethereum have had their fair share of challenges, with the latest raising questions on their decentralized nature. Crypto ecosystems led by Bitcoin are known for their decentralized architecture, a path that DeFi projects seem to be deviating from recently.

This gradual shift to a ‘centralized’ like ecosystem can be seen in Uniswap’s move to delist tokenized stocks. In addition, Aave, the leading lending and borrowing DeFi platform, recently revealed a permissioned pool for institutional investors. A move that stakeholders have touted to be instrumental in attracting more liquidity to the DeFi market, although critics disagree, arguing it compromises crypto innovations’ decentralised nature.

Alternative DeFi Ecosystems

While Ethereum may have dominated the game for some time, the network’s shortcomings have forced crypto innovators to develop alternative DApp building environments. The Ethereum blockchain is infamous for high network fees and scaling inefficiencies that have limited DApp developers from expanding their projects.

Some of the alternative solutions to Ethereum include non-proprietary cross-chain protocols such as Wanchain. This project introduces a distributed ‘bank’ ecosystem by connecting several blockchains and facilitating information exchange in a distributed manner. Unlike Ethereum, Wanchain’s protocol is designed to record intra-chain and cross-chain transactions, enabling DApp projects to scale across multiple networks.

In addition, the Wanchain distributed ledger features token exchange privacy protection. This means that DeFi developers can set up their virtual windows and offer decentralized financial services, including digital asset transaction settlements, credit payments, asset exchanges and loan origination.

Wanchain currently hosts a cross-chain DEX dubbed WanSwap, which functions similarly to Uniswap while leveraging Wanchain’s additional features. Some of the functionalities that DeFi users can access from this DEX include token swapping, liquidity provision, bridging solutions and yield farming.

What Is the Future of DeFi?

The DeFi market currently accounts for 5.3% of the total $1.6 trillion crypto market capitalization. This nascent sector ballooned within the past year as DeFi projects launched incentives to kickstart their services. Today, some enthusiasts believe that DeFi is the future of finance or crypto slang, ‘the future France’.

That said, there is still a lot that needs to be executed for DeFi to be adopted mainstream. It is not surprising that stakeholders are now considering scalability and interoperability solutions. As per the ongoing development trend, the next phase of DeFi innovations will be marked by Layer-2 rollups and cross-chain protocols.

However, Ethereum’s upcoming 2.0 launch might change the course completely. This much-awaited launch will mark Ethereum’s shift from a proof-of-work (PoW) consensus to a proof-of-stake (PoS) consensus, allowing DApp projects to scale more efficiently. Should the launch be successful, the DeFi ecosystem stands to gain significantly.

Meanwhile, cross-chain protocols and Layer-2 solutions will continue to fill in for the shortcomings in Ethereum’s ecosystem. Given their value proposition, some of the projects within this space might be the long-term solutions to sustainable DeFi environments.

Conclusion

Cryptocurrencies are some of the most recent financial market instruments, although they are yet to be legally recognized in most jurisdictions. This is currently a significant challenge in the development of the crypto industry as projects build with the fear of being clamped down any minute – Uniswap’s delisting is a case in point.

Nonetheless, this vibrant industry has a massive potential of changing the fundamentals of traditional finance. For starters, DeFi projects make financial services accessible to anyone based on their decentralized architecture. There are also other rising innovations such as Non-fungible tokens (NFTs), which complement existing DeFi projects.

DeFi will likely continue to amass more users at the current pace of innovation as systems become scalable and interoperable. This raises the probability of crypto users opting for alternative DeFi environments despite Ethereum’s current market dominance.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.