When it comes down to investing, Bitcoin and gold have been heavily compared. According to a new poll initiated by the former Congressman of Texas, however, Bitcoin is seriously preferred over Gold and other investment options.10-year Investment SurveyRon Paul, the former congressman from Texas, initiated a poll on Twitter asking people what they would invest in if a wealthy person gifted them ,000. The voters can choose between 4 options – 10-year US Treasury Bond, Federal Reserve Notes, Gold, and the largest cryptocurrency by market capitalization – Bitcoin.Bitcoin Over Gold. Source: Ron Paul’s TwitterAt the time of this writing, Federal Reserve Notes have received the lowest number of votes with just 2%, and the 10-year US Treasury Bond follows with 7%. The battle for the top comes

Topics:

Jordan Lyanchev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

When it comes down to investing, Bitcoin and gold have been heavily compared. According to a new poll initiated by the former Congressman of Texas, however, Bitcoin is seriously preferred over Gold and other investment options.

10-year Investment Survey

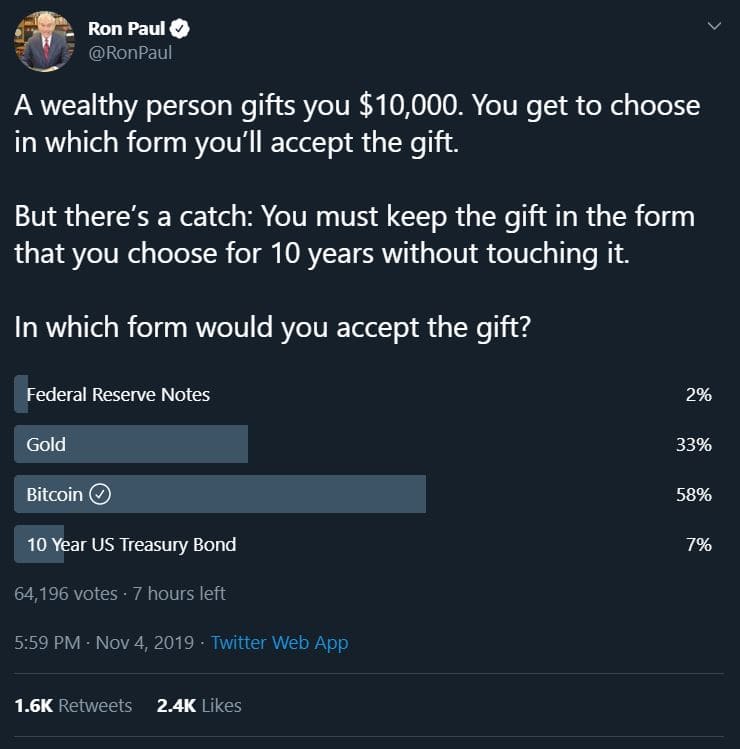

Ron Paul, the former congressman from Texas, initiated a poll on Twitter asking people what they would invest in if a wealthy person gifted them $10,000. The voters can choose between 4 options – 10-year US Treasury Bond, Federal Reserve Notes, Gold, and the largest cryptocurrency by market capitalization – Bitcoin.

At the time of this writing, Federal Reserve Notes have received the lowest number of votes with just 2%, and the 10-year US Treasury Bond follows with 7%. The battle for the top comes between gold and Bitcoin. While the former represents 33% of all votes, the latter is far ahead with 58%. Even though the poll is still not over, there are more than 64,000 people who have voted already.

Since the poll asked about 10-year investments, the results are showing that people would rather choose Bitcoin as a long-term holding option.

Why Bitcoin Over Gold?

Over the last several years, these two assets have been compared numerous times. Many people have said that they have similarities, mainly being a store of value. Bitcoin was even officially defined as a commodity recently – the same category as gold.

Another comparison can be made in the scarcity of both assets. Only a finite supply of gold exists in the world and the same is true for Bitcoin. Yet, there are some notable differences as well.

While we don’t know how much gold there is, Bitcoin’s protocol stipulates that only 21 million will ever be in circulation, making it the first-ever scarce digital object. Additionally, the online currency can also be easily transferred online, while gold, being a physical asset, could present transportation and protection issues due to its weight in larger quantities.

The total supply could be viewed from a different perspective, as well. Bitcoin is preprogrammed to cut in half the rewards given to miners every four years in a process called Halving. Basically, every time this event takes place, the speed of creating new bitcoins will decrease with 50%, meaning that in just 12 years, that speed will be 90% less than what it is now. Simple economic principles dictate that when the supply of a certain asset decreases while the demand for it remains the same or increases, its price should go up. Two halvings have occurred so far, both pushing Bitcoin’s price to go up, and the next one will happen in 2020.