Bitcoin’s correlations with gold and the traditional financial markets have been challenged in the past several days. However, some members of the community believe that it needs to separate itself entirely to continue growing.Bitcoin Compared To Gold And StocksThe largest cryptocurrency has a compelling history when compared to other assets. For instance, it has a few examples of negative correlations with the traditional stock market. During the most intense days of the U.S. – China Trade War, most stocks were plummeting, and BTC was surging.On the other hand, Bitcoin has generally stayed in the same lane as gold. When the tension between Iran and the U.S. was at its highest point in January 2020, both assets increased their value. Interestingly, stocks took a hit at that point again.The

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin’s correlations with gold and the traditional financial markets have been challenged in the past several days. However, some members of the community believe that it needs to separate itself entirely to continue growing.

Bitcoin Compared To Gold And Stocks

The largest cryptocurrency has a compelling history when compared to other assets. For instance, it has a few examples of negative correlations with the traditional stock market. During the most intense days of the U.S. – China Trade War, most stocks were plummeting, and BTC was surging.

On the other hand, Bitcoin has generally stayed in the same lane as gold. When the tension between Iran and the U.S. was at its highest point in January 2020, both assets increased their value. Interestingly, stocks took a hit at that point again.

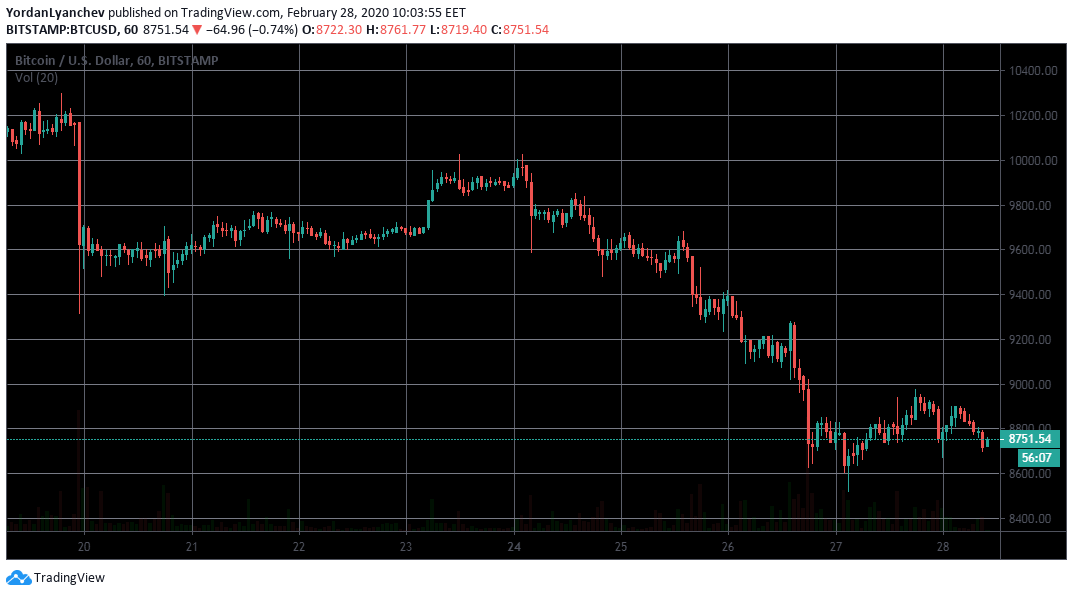

The past several days have been somewhat different. The coronavirus is expanding with confirmed cases coming from South Korea, Japan, Italy, the U.S., and more. Stock markets continue to bleed, even after President Trump’s attempt to remedy the situation.

Gold, the most widely used hedge, noted its highest price in seven years on Monday. Even though it has retraced slightly, it’s still showing positive signs. Bitcoin, however, is on the downfall. During this week, the largest digital asset lost over $1,000 of its value.

Bitcoin Needs To Be Entirely Uncorrelated

In this time of uncertainty, the community raised the question if Bitcoin’s aureole of serving as safe-haven, similar to gold, has disappeared. However, some members believe that even if its correlations with the other assets are no longer on the table, it could be beneficial for BTC.

Popular cryptocurrency commentator Alex Saunders believes that Bitcoin has to separate itself from the crowd. If it’s to continue growing, it has to be “completely uncorrelated.”

Best best thing for #Bitcoin to do right now is not to go up when stocks down down, or go down when gold goes down, it is to be completely uncorrelated. At the moment it’s not doing a good job at that. That can all change very quickly though.

Blue: S&P 500

Orange: BTC

Black: Gold pic.twitter.com/2KOWmiQrLq— Alex Saunders (@AlexSaundersAU) February 27, 2020

Interestingly enough, Virgin Galactic chairman Chamath Palihapitiya recently stated that Bitcoin is entirely uncorrelated with the traditional financial world. He outlined this as a positive feature, recommending to accumulate it and to “hope that that insurance under the mattress never has to come due.”