There are several ways of earning money on cryptocurrencies in the digital assets market. Unfortunately, not all of them deserve attention.Amid the coronavirus crisis in 2020 and its consequences that continue its influence in 2021, many people consider additional sources of income. Among other things, the special attention was drawn to cryptocurrencies and opportunities to make profits on them.One of the most popular ways to make profits on digital assets happens to be staking. Let’s compare it with other ways to earn money on cryptocurrencies. Staking Cryptocurrencies – All You Need to KnowIn the crypto community, the term “staking” stands for the passive income that comes from holding crypto on the account or freezing it for the projects’ needs. Different platforms offer different

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

There are several ways of earning money on cryptocurrencies in the digital assets market. Unfortunately, not all of them deserve attention.

Amid the coronavirus crisis in 2020 and its consequences that continue its influence in 2021, many people consider additional sources of income. Among other things, the special attention was drawn to cryptocurrencies and opportunities to make profits on them.

One of the most popular ways to make profits on digital assets happens to be staking. Let’s compare it with other ways to earn money on cryptocurrencies.

Staking Cryptocurrencies – All You Need to Know

In the crypto community, the term “staking” stands for the passive income that comes from holding crypto on the account or freezing it for the projects’ needs. Different platforms offer different terms and conditions. For example, in the decentralized finance (DeFi) market, one can find loan projects where users can get income from freezing the funds for startups’ needs.

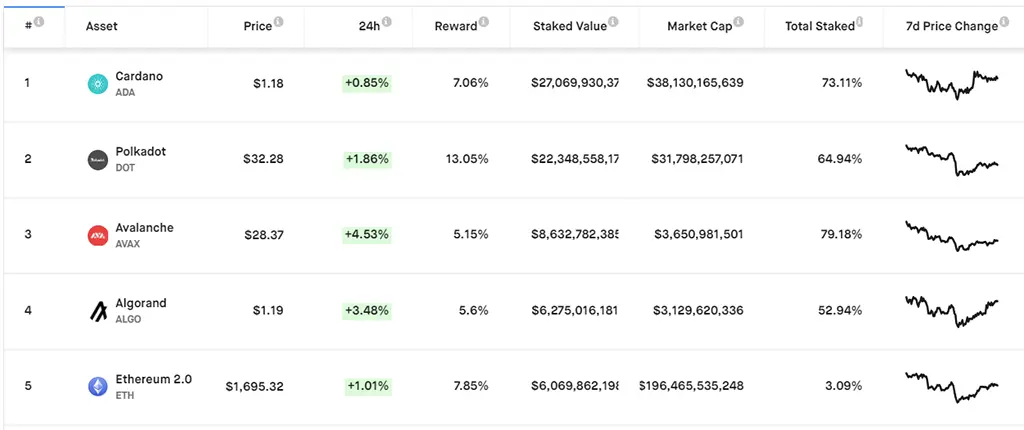

On average, staking brings about 5-15% annually. The profit depends on project characteristics and its terms and conditions. As of the end of March 2021, Top-5 cryptocurrencies by profit margins on staking, or Staking Value, looks in the following way:

Top-5 cryptocurrencies by staking value. Photo: Staking Rewards

Earlier crypto community members had to analyze the market by themselves when seeking opportunities for earning on staking. Today, thanks to platforms that serve as offers aggregators, it is much simpler to find a profitable option. One of such platforms, Tidex, launched the smart staking service the users of which get the following benefits:

- Information on the most profitable offers on staking on one platform.

- Security guarantees. Tidex developers analyze all available on the market offers before listing them on the platform. This approach allowed the team to minimize risks for those who are starting at staking. Users that seek offers on their own risk stumbling upon fraudsters.

- Favourable terms. The platform does not charge a fee for staking.

Another Tidex benefit is the availability of its own ecosystem, that among other things include digital assets exchange. By using the trading platform, project users can instantly convert earned on staking profits into the currency of their choice.

Interesting fact: The Tidex team, according to its representatives, is challenging the status quo that staking can bring no more than 15% profits. Some offers bring over 50% of annual income.

What else, if not staking?

There are also other ways to earn profits on cryptocurrencies in the digital assets market. Here are some of the most popular ones.

Cryptocurrencies Mining

The term “mining” stands for the process of the release of digital assets from the network. To mine crypto, one needs equipment with certain processing power. For example, mining on computers or via mining farms requires the installation of video cards.

Pros of crypto mining

- During the bullish periods, when the price is growing, it is possible to earn significant profits given the availability of powerful equipment.

- Miners can control the operating process on their own. There is no need to trust a third party.

Cons of crypto mining

- Mining requires powerful equipment. In 2021, mining on a slow computer can hardly bring profits – most probably, the user will spend all profits on electricity bills.

- Mining requires knowledge of digital assets market nuances and mining specifics.

- Mining is a high-risk business. In the case of a bearish market, when the price is going down, or other unexpected circumstances, the user risks losing the revenue.

- Mining equipment might take a significant amount of space. Moreover, it is important to mention the noise pollution and excess heating that comes from the equipment. All this makes mining at home not feasible.

Interesting fact: There is an alternative source to mining via “cloud” operational mode. It assumes renting the processing power from providers. Unfortunately, the majority of such offers come from fraudsters. Moreover, a few real providers with cloud mining offers bring modest profits. That is why this way of earning money is slowly losing its relevance.

Crypto Trading

Trading is about making money on exchange rates differences. A substantial part of the crypto community considers trading as one of the ways of earning profits on digital assets.

Pros of crypto trading

- It is possible to earn in a short period of time

- Low entry barrier: to start earning, the trader does not need substantial capital. In the market, there are also offers with leverage levels – an instrument that allows closing deals on a much bigger sum.

Cons of crypto trading

- High risk of losing money. In many cases, a crypto trader’s income depends on luck. As it happens, it is not that easy to precisely predict the behavior of digital assets with high volatility. At any moment, a market might face negative news that results in panic selling.

- To earn well on trading, a trader needs sustained training. A trader needs to understand the different behavioral aspects of digital assets, be knowledgeable in technical and fundamental market analysis and keep a close watch on the news media space. Good profits from trading take a substantial amount of time.

- Lack of stability. In crypto trading, it is a monumental challenge to predict the level of income and the time when it is possible to cash out.

Participating in Referral Programs

The majority of crypto projects are interested in acquiring new users. Many companies are willing to pay for those who will help them to attract these new clients. To start earning on attracting users to crypto platforms, one needs to become a member of a referral program of these projects.

Pros of participating in referral programs

- It is possible to simultaneously participate in the unlimited number of referral programs.

- Referral programs might be seen as a passive income source that does not require much attention.

Cons of participating in referral programs

- The profits on referral programs can hardly be called stable. The users can not predict how many clients will follow their recommendations.

- It is hard to earn much on referral programs. Unfortunately, most of the offers bring low profits.

Comparing Staking with Other Ways of Earning on Crypto

| Ways of earning on crypto | Possible level of income | Risks | Availability |

| Staking | 5-15%. In some cases, up to 50% annually. | When working with proven platforms, risks are reduced to zero. | It is available to everyone |

| Mining | Unlimited | There are risks of a substantial drop in profits (in case of a price drop of the cryptocurrency of your interest). | Efficient work is available for those who have powerful equipment. Earning on mining might require substantial investments. |

| Crypto trading | Unlimited | One can lose all with a wrong prediction | It is available to everyone |

| Referral programs | Unlimited. Moreover, referral programs rank below in profitability, in comparison with other ways of earning on crypto. | Minimum risks | Some crypto projects set requirements for members of their referral programs. For example, companies could limit the project user reach to certain jurisdictions. |

Summary

There are several ways of earning money on cryptocurrencies in the digital assets market. Unfortunately, only a few deserve attention.

One of the most effective ways in 2021 is the staking on cryptocurrencies. To find safe offers of getting profits, it is possible to use special platforms like Tidex.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.