There are three categories of currency pairs in the forex market; major pairs, minor pairs, and exotic pairs. Major currency pairs are pairs that contain the US dollar as the base or quote currency. Examples include AUD/USD, USD/CAD, and EUR/USD. Minor currency pairs consist of currencies of major economies, excluding the US dollar, such as AUD/JPY and EUR/CHF. Exotic pairs are created by pairing currencies of emerging economies with that of developed economies. These emerging economies include Thailand, Mexico, South Africa, Turkey, and Norway. Exotic pairs are a unique set of currency pairs due to the nature of these emerging economies. They are a great way to diversify your trading portfolio, and in this article, you will learn the characteristics of exotic pairs

Topics:

Guest considers the following as important: Guest Article

This could be interesting, too:

Guest User writes The Role of Bitcoin in the Evolution of Gaming Economies

Guest User writes The Role of Bitcoin in the Evolution of Gaming Economies

Antony Jackson writes The Web3 Epic Challenge with OGCommunity, Hello Pixel, Xyro, TweetScout and 7 big projects where you get a chance to claim ,000 USDT and fantastic prizes in tokens and NFTs

Guest User writes Beyond the cultural value ―how useful are Bitcoin NFTs?

There are three categories of currency pairs in the forex market; major pairs, minor pairs, and exotic pairs. Major currency pairs are pairs that contain the US dollar as the base or quote currency. Examples include AUD/USD, USD/CAD, and EUR/USD.

Minor currency pairs consist of currencies of major economies, excluding the US dollar, such as AUD/JPY and EUR/CHF.

Exotic pairs are created by pairing currencies of emerging economies with that of developed economies. These emerging economies include Thailand, Mexico, South Africa, Turkey, and Norway. Exotic pairs are a unique set of currency pairs due to the nature of these emerging economies. They are a great way to diversify your trading portfolio, and in this article, you will learn the characteristics of exotic pairs and the top 5 exotic pairs to trade.

Top 5 Exotic Pairs to Trade

Exotic pairs are highly volatile currency pairs, and this volatility comes with lots of trading opportunities that allow traders to make a lot of profit in very little time. High volatility means significant price swings and displacements regularly occur while trading these pairs. However, their high volatility makes them less liquid.

Liquidity is the ease with which an asset can be traded – exotic pairs are less liquid because of the reduced number of market participants compared to major and minor currency pairs. Consequently, exotic pairs provide numerous trading opportunities, but the low liquidity can lead to erratic price swings. Make sure you trade these pairs on a regulated broker like Oanda with favorable trading conditions.

EUR/TRY

The Euro was introduced in 1999, and it is currently the official currency of 19 European countries. As the second-largest economy in the world, the European economy has been quite strong and resilient, and this has caused the EUR/TRY pair to remain in an uptrend for several years.

The Turkish Lira is the legal tender used in Turkey. Turkey’s domestic macroeconomic and financial challenges (such as inflation) largely contributed to the devaluation of the Turkish Lira.

However, the EUR/TRY pair is a great pair to trade due to the stability of its trend. The contrast between the European and Turkish economies has sustained the upward momentum of the currency pair.

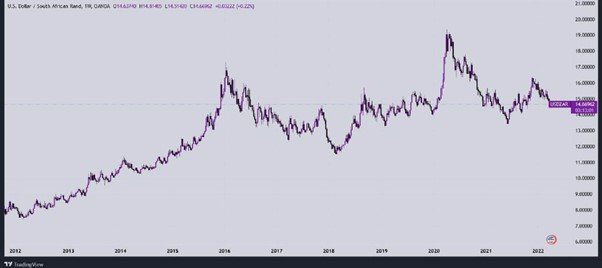

USD/ZAR

The USD/ZAR pair is an exotic pair consisting of the United States dollar and the South African Rand. The United States economy is the largest globally, while the South African economy is the second-largest in Africa. The US dollar is a lot stronger than the South African Rand for various reasons, including the monetary policies of the US and the inflation in South Africa.

https://www.tradingview.com/x/fE0m61bW/

Therefore, the USD/ZAR currency pair has been in an uptrend for years. The large size of these economies largely contributes to the high liquidity of the USD/ZAR currency pair compared to other exotic pairs. This relatively high liquidity makes the USD/ZAR pair easy to trade because the erratic price movements found in other exotic pairs are reduced in this instance.

AUD/MXN

The Australian dollar/Mexican Peso pair is a highly volatile exotic pair. The movement of this pair largely depends on the economic situation of both countries. The Australian dollar is regarded as a commodity currency because the currency’s valuation and performance are tied to the Australian exports – iron ore, oil, gold, and other metals.

The Mexican economy is strong and diversified. But, the development of the Australian economy, as well as its high interest rate, makes the Australian dollar overall stronger than the Mexican Peso.

This exotic pair is volatile and easy to trade, with favorable spreads and trading commissions among several brokers.

EUR/NOK

The Norwegian Krone is a unique currency because it isn’t tied to any other country’s currency. Despite the rising oil prices in the early 2000s, the Norwegian Krone steadily declined against the euro. Thus, the EUR/NOK rallied upwards and peaked in 2020. Since then, the currency pair has been steadily declining as the Norwegian Krone began to strengthen, thanks to its responsiveness to investments.

https://www.tradingview.com/x/3dLnLmQ5/

The EUR/NOK pair is a great exotic pair to trade because it moves steadily, despite its volatility. This makes it easy for new traders to trade using simple trading strategies.

GBP/ZAR

The British pound is the official currency of the UK and is currently one of the strongest currencies in the world. The United Kingdom’s economy is mainly globalized yet fiercely independent. Hence, the British pound has strengthened against most currencies, including the dollar.

https://www.tradingview.com/x/gWgjxM9x/

The GBP/ZAR exotic pair is known for its high volatility and rapid price expansions. This pair is excellent for scalpers and could be a great addition to your portfolio.

Ultimately, exotic pairs are often highly volatile and less liquid than major pairs. However, some have evolved as the global economies improved and now provide excellent trading opportunities. Before trading an exotic currency pair, you need to find a profitable strategy, then learn about the economies in question. This helps you make informed trading decisions and improve your trading results.

References

Image: Pixabay