Bitcoin has been experiencing some extremely bullish patterns as of late. The currency has managed to spike by roughly $2,000 in just a matter of weeks, jumping from the low $9,000 range beyond $11,100 at the time of writing.The Bitcoin Price Surge Could Easily ContinueThe currency recently rose by more than 12 percent in a single 24-hour period, marking the highest it’s been in more than six months. This represents a nice change for the world’s number one cryptocurrency by market cap, which...

Read More »Charles Edwards: BTC Could Shoot Up with Banks’ Help

Charles Edwards – the digital asset manager at Capriole – says the price of bitcoin could easily shoot up to $20,000 if U.S. banks put in at least one percent of their assets into crypto.Charles Edwards: Banks Can Make BTC Hit $20,000This may be asking much from banks, but one percent, for the most part, isn’t much, and it looks like interest in bitcoin has been increasing over the past several months between both retailers and institutional players alike, so perhaps the figure he’s...

Read More »Banks Now Offer Bitcoin and Crypto-Related Services

Bitcoin has shot up at the time of writing, and while Live Bitcoin News just reported two hours ago that that the reason may have something to do with a second round of stimulus checks, perhaps the reasoning for bitcoin’s sudden surge has more to do with the fact that banks and crypto suddenly appear to be getting along.Banks Have Opened the Door to CryptoBanks and crypto have never been the best of friends. For the most part, it seemed as if banks were terrified of cryptocurrencies in that...

Read More »Breakthrough? US Banks Can Now Provide Crypto Custody Services

National banks and federal saving associations can now offer crypto custody services to customers following approval from regulators in the country.OCC Okays Crypto Custody Operations for US Federal BanksAccording to a letter issued by the Office of the Comptroller of the Currency (OCC) on Wednesday, U.S. Federal banks can now offer crypto custody services. The decision follows last month’s request by the OCC for public input on the matter.As part of the letter, the OCC explained the...

Read More »Japanese Giant SBI To Acquire A $30M Stake In Crypto Liquidity Provider B2C2

A strategic partnership between the two companies is to begin soon. The internet-based conglomerate SBI Financial Services (a subsidiary of SBI Holdings, “SBI”) has made an agreement with B2C2 to acquire a $30 million minority stake at the firm as a first leap into future cooperation.First Steps In A Strategic Partnership According to a recent report, the two companies are to collaborate on providing cryptocurrency assets and services to millions of clients across the globe. They also intend...

Read More »COVID-19 Highlights the Need For Central Bank Digital Currency, BIS Reports

In its latest report, the Bank of International Settlements doubled-down on its narrative that the COVID-19 pandemic has exemplified the need for central banks to accelerate the development of central bank digital currencies (CBDCs).BIS outlined the ongoing payment digitalization phase and predicted that whoever launches such currency first will ultimately prevail.BIS: Payment Digitalization Comes FastThe report noted that the financial sector is currently in a significant transitioning stage...

Read More »Millennials Prefer Bitcoin Over Gold, Real Estate, and Government Bonds, Survey Says

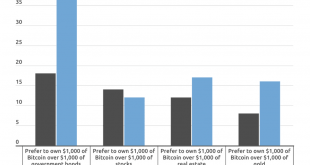

While Bitcoin encountered lots of turbulence in the past three years, people’s perception regarding the primary cryptocurrency has improved significantly, a recent study revealed. By comparing data from 2017 and April 2020, it concluded that more people are ready to trust it over traditional financial institutions and assets, especially after the COVID-19 pandemic.2017 Vs. 2020 Millennials Love BitcoinThe Tokenist compiled the survey among nearly 5,000 participants in 17 countries. The...

Read More »The Federal Reserve Gets Bitcoin Right, Says Peter Schiff: Here’s The Catch

According to a new publication of the Federal Reserve Bank of New York, Bitcoin is not a new type of money. The authors argue that it’s a new type of exchange mechanism, capable of supporting money transfer.The well-known economist and author Peter Schiff backed up the claims, reiterating that once savers lose confidence in it, they will return to gold.Bitcoin is Not a New Type of Money, Fed SaysAccording to Bitcoin’s whitepaper, Bitcoin: A Peer-to-Peer Electronic Cash System, BTC is a...

Read More »Thailand’s Central Bank Unveils Plans For National Digital Currency Prototype In July

The Bank of Thailand (BOT) has announced plans to develop a payment system prototype for businesses through the use of Central Bank Digital Currency (CBDC), according to a report published by the bank on Thursday.CBDC For BusinessesThe prototype will allow Thailand’s central bank to conduct a feasibility study and also develop ways to integrate the CBDC with the procurement and financial management systems platform developed by Siam Cement.The CBDC prototype will commence in July 2020 and...

Read More »Bank Of Korea Will Examine Central Bank Digital Currencies Closer

Despite the lacking demand as of yet, the Bank of Korea (BOK) has set up a legal advisory group to review any legal issues before possibly launching a central bank digital currency (CBDC) in the future.BOK To Review Legal Matters Around CBDCAccording to a local report from today, South Korea’s central bank has established a group consisting of a six-member panel. Among those are law professors and legal practitioners, including lawyers and BOK’s legal policy office. They will provide...

Read More » Crypto EcoBlog

Crypto EcoBlog