The amended ETF application came after a series of meetings between Grayscale and the SEC in December. Leading asset manager Grayscale Investments has filed an amended S-3 application seeking to convert its Grayscale Bitcoin Trust (GBTC) to a spot Bitcoin ETF. Bloomberg analyst James Seyffart confirmed the reapplication with the Securities and Exchange Commission (SEC) on Tuesday, just a few hours after the CEO of the firm’s parent company, Barry Silbert, resigned. Grayscale Finally...

Read More »Grayscale Investments’ Top Executives Barry Silbert and Mark Murphy Resign from Board of Directors

In addition to top executives stepping aside from the board of directors, Grayscale Investments also filed an updated spot Bitcoin ETF application with the SEC on Tuesday. Top cryptocurrency investor Grayscale Investments LLC has been preparing to offer spot Bitcoin exchange-traded funds (ETF) in a bid to widen its market share. On Tuesday, the company made several moves to ensure an imminent approval of spot BTC ETF, which is anticipated to happen in the next few weeks. Grayscale...

Read More »Grayscale Leadership Shuffle: Barry Silbert, Mark Murphy Resign

In a surprising turn of events, Barry Silbert, the founder and CEO of Digital Currency Group (DCG) – the parent company of Grayscale – has resigned from the asset manager’s board of directors. Silbert, a key figure in the cryptocurrency industry, has played a crucial role in shaping the growth of Grayscale Investments. His departure from the board signals a significant shift in leadership and strategy for the firm. The official 8-K filing with the US Securities and Exchange...

Read More »Bitcoin (BTC) Hashrate Hits New High but Profitability on Decline

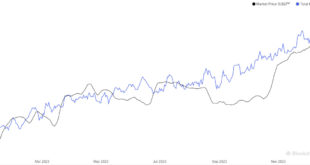

In 2023, the Bitcoin hashrate has surged by a staggering 130% which shows growing competition and reduced profitability for miners. The computing power of the Bitcoin network, also known as the mining hashrate, hit a record high on Christmas Day, adding to the challenges faced by miners in the wake of declining profitability. Blockchain.com reported that on December 25, Bitcoin’s hash rate achieved an unprecedented level of 544 exahashes per second (EH/s), a data point corroborated by...

Read More »This Is How ETFs Managed by TradFi Firms Could ‘Completely Destroy’ Bitcoin: Arthur Hayes

Arthur Hayes, the founder of the BitMEX crypto exchange, believes the success of the much anticipated Bitcoin exchange-traded funds (ETFs) will “completely destroy” the leading digital network. In a recent blog post titled “Expression,” Hayes opined that Bitcoin could die if all the BTC in circulation end up in the hands of traditional finance asset managers, most of whom are vying for the ETFs. Destroying Bitcoin Hayes explained that his prediction is based on the difference...

Read More »2 Bitcoin ETF Hazards: SEC Rejection and Competition From Funds

A U.S. circuit court in Washington D.C. has ordered the Securities and Exchange Commission to revisit its rejection of a Bitcoin ETF application by crypto hedge fund Grayscale. But that doesn’t mean the SEC won’t find new reasons to reject it or any of the dozen other applications. SEC Rejection or Delay Could Tank Bitcoin Price Crypto industry investors and insiders expect the price of Bitcoin and other crypto assets to surge if and when the SEC approves an exchange-traded...

Read More »With Bitcoin Spot ETF Approvals, Halving and Incoming Upgrades, What Should You Expect from BTC in 2024?

The timing aligns perfectly in 2024 for a spot ETF approval to have already attracted significant investment, and then the halving decreases Bitcoin’s supply right when demand shoots higher. After yet another banner year in 2023 with over 150% gains, all eyes are on Bitcoin (BTC) to see if the flagship cryptocurrency can sustain its epic run in 2024. Key factors stacking up in Bitcoin’s favor for the coming year have analysts extremely bullish on its prospects. From the possibility of the...

Read More »Can BlackRock “Front Run” The Bitcoin ETF Approval? Bloomberg Explains

With Bitcoin (BTC) spot ETFs seemingly just weeks away, some crypto investors are curious whether asset managers like BlackRock can “front run” their approvals using insider knowledge before their highly anticipated funds reach the market. In an X space on Friday, Bloomberg ETF analyst James Seyffart cleared the air on what BlackRock can and cannot do to the Bitcoin market prior to approval – and how they’ll go about handling customers’ claims. BlackRock’s BTC Position...

Read More »BlackRock Bitcoin ETF Potential Approval Faces Questions, SEC Could Make Decision by January 10

In its initial filing, BlackRock mentioned that the Prime Execution Agent would obtain BTC to support the ETF’s shares on a 1-to-1 ratio. Although the company didn’t disclose the name of the chosen agent, it did identify Coinbase as the proposed custodian. BlackRock Inc (NYSE: BLK), the world’s largest asset manager, is putting the final touches to its plan for a Bitcoin exchange-traded fund (ETF). As part of the process, the company intends to use a third-party broker, which it regards...

Read More »Grayscale CEO Says Spot Bitcoin ETFs to Allow Market Inflow of $30T in Advised Wealth

Michael Sonnenshein, the CEO of leading asset management firm Grayscale Investments, believes the approval of spot Bitcoin exchange-traded funds (ETFs) could allow the crypto market to enjoy an inflow of $30 trillion in advised wealth. During an interview with CNBC’s Squawk Box, Sonnenshein said there is a lot of market optimism for Bitcoin (BTC) next year as many investors are adding the digital asset to their portfolios. Opportunity for $30T Advised Wealth Inflow...

Read More » Crypto EcoBlog

Crypto EcoBlog