While WisdomTree is expanding its investment options with Bitcoin, the asset manager has also decided to liquidate five of its ETFs. WisdomTree, one of the major players in the financial industry, is considering the addition of Bitcoin (BTC) as part of its commodity exchange-traded fund (ETF), providing its customers with exposure to the crypto market without direct investment in the asset. According to a recent document released on Tuesday, the company proposed allocating around 5% of the...

Read More »Bitcoin Addresses Holding Minimum of $1,000 in BTC Shoot Above 8 Million

Analysts explain why Bitcoin price can continue to rally with the next immediate target in sight being $40,000. The number of blockchain addresses holding at least $1,000 worth of Bitcoin (BTC), equivalent to 0.028 BTC at the current price of $35,115, has reached an all-time high of 8 million, as reported by data from Blockware Solutions and Glassnode. According to Blockware, this figure could continue to surge as Bitcoin advances in monetization, a favorable long-term trend for the...

Read More »Vanguard CEO Rules Out Bitcoin ETF, Stresses Long-Term Investment

With the US SEC edging closer to potentially approving a Bitcoin ETF, experts and industry leaders are offering their predictions on the potential impact of this milestone on the crypto market. In a recent interview on CNBC’s ‘The Exchange’, Tim Buckley, Chairman and CEO at Vanguard Group, the world’s second-largest asset manager, stated that the company has no plans to pursue a Bitcoin (BTC) spot Exchange Traded Fund (ETF). Vanguard to Focus on Core Values Buckley’s firm stance on this...

Read More »Valkyrie CIO Expects Bitcoin ETF Approval This Month in Preparation for February Launch

The Valkyrie CIO says that the SEC will ask for comments and possibly approve an ETF proposal this month after all issues are addressed. A Valkyrie Investments exec has hinted at a strong possibility for a spot Bitcoin ETF approval this month. According to Chief Investment Officer (CIO) Steven McClurg, the United States Securities and Exchange Commission (SEC) will likely confirm an ETF approval by the end of the month. McClurg is hopeful because applicants have adequately addressed issues...

Read More »SEC to Possibly Reevaluate Grayscale Spot Bitcoin Application at November 2 Closed Meeting

Experts continue to speculate on what the SEC’s next course of action regarding crypto-based ETF applications could be. The United States Securities and Exchange Commission (SEC) appears to be gearing up to reexamine Grayscale’s application to convert its Bitcoin trust into a spot exchange-traded fund (ETF). This comes after a recent decision by the D.C. Circuit Court of Appeals to scrape the regulator’s rejection of Grayscale’s spot Bitcoin ETF application. The court described the SEC’s...

Read More »Valkyrie Amends Prospectus for Spot Bitcoin ETF Application

As of late October, the SEC is reportedly reviewing eight to ten potential spot Bitcoin spot ETF filings. Asset manager Valkyrie has recently made waves due to its decision to amend its prospectus for a spot Bitcoin (BTC) ETF filed with the US Securities and Exchange Commission (SEC). The Valkyrie Bitcoin ETF Update James Seyffart, a renowned analyst at Bloomberg, shared this development on social media platform X, shedding light on Valkyrie’s efforts to meet the SEC’s requirements for its...

Read More »Chainlink (LINK) Shines with Remarkable 50% Surge smid Crypto Rally

With how LINK is moving in recent times and its historical precedent, there are indications that it may serve as a market leader once again, potentially triggering another bullish trend. Chainlink (LINK), a decentralized blockchain oracles service provider has emerged as a standout performer, witnessing an astounding 50% increase in its price as the crypto market witnessed a significant uptick in valuation. Understanding the Chainlink Surge The recent surge in Chainlink’s price can be...

Read More »SEC’s Potential Approval of Bitcoin ETFs Sparks Speculation and Legal Concerns

While the prospect of a Bitcoin ETF is undoubtedly exciting, it is essential to acknowledge the potential challenges and roadblocks that may surface. The crypto community is abuzz with anticipation as the US Securities and Exchange Commission (SEC) considers multiple filings for spot Bitcoin (BTC) Exchange Traded Funds (ETFs). SEC Chair Gary Gensler recently revealed that the regulatory body has between eight to ten such filings on its plate for consideration. Bitcoin’s Rally and Market...

Read More »BlackRock Fined $2.5M by SEC for Misleading Investment Disclosures

It is worth noting that the SEC’s action come only days after BlackRock unveiled its ticker symbol (IBTC) in anticipation of the approval of its spot Bitcoin Exchange Traded Fund (ETF). The US Securities and Exchange Commission (SEC) recently fined BlackRock Advisors LLC, a subsidiary firm of BlackRock Inc (NYSE: BLK), $2.5 million for failing to provide accurate and transparent disclosures about investments in the entertainment industry within a publicly traded fund it managed....

Read More »BlackRock iShares Bitcoin ETF Appeared on DTCC Website since August

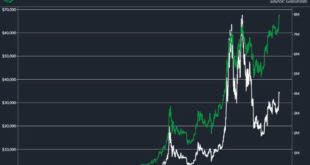

A DTCC spokesperson confirmed that the IBTC ticker for the BlackRock iShares Bitcoin ETF has appeared since August through a unique ID code called CUSIP. Bitcoin has made a strong move moving to $35,000 earlier this week and clocking more than 20% gains on the weekly chart. This typically happened as the BlackRock iShares Bitcoin ETF ticker IBTC surfaced on the Depository Trust and Clearing Corporation’s (DTCC) website. Interestingly, one spokesperson from DTCC recently confirmed with...

Read More » Crypto EcoBlog

Crypto EcoBlog