Despite the lacking demand as of yet, the Bank of Korea (BOK) has set up a legal advisory group to review any legal issues before possibly launching a central bank digital currency (CBDC) in the future.BOK To Review Legal Matters Around CBDCAccording to a local report from today, South Korea’s central bank has established a group consisting of a six-member panel. Among those are law professors and legal practitioners, including lawyers and BOK’s legal policy office. They will provide...

Read More »$10K Is Getting Away From Bitcoin After Another Week of Failed Attempts: The Weekly Market Update

At this point, it seems like $10,000 indeed is a coveted level for Bitcoin bulls. Another week passed, and we saw yet one more failed attempt to reclaim this level.Interestingly enough, it happened minutes after the US Federal Reserve concluded its two-day June meeting, confirming near-zero interest rates for the short- and medium-term. In light of the news, Bitcoin’s price shot up to $10,000, where it was met with strong resistance, and it dropped almost immediately.The following day,...

Read More »Bitcoin Again Proves That $10K Is Too Much to Handle

It looks like bitcoin may have been hovering at around $10K all over again, though at the time of writing, it has failed to cross that mark. In fact, the currency has fallen by about $300 or so.Bitcoin Rises and Falls… AgainJust yesterday, the currency spent the early morning hours meandering about the high $9,900 position. This was its highest position in a little over a week, but as we’ve seen before, $10K is proving to be yet another hardcore resistance point on the bitcoin ladder. On...

Read More »President Trump’s Head of OCC Is Bullish on Bitcoin and Blockchain

Brian Brooks, the former chief legal officer of Coinbase, was recently appointed to serve as the interim head at the Office of the Comptroller of the Currency (OCC) in the Trump administration.Brooks has shown openness to exploit the merits of blockchain and cryptocurrency at his new position, according to a recent interview.Trump’s Head Of OCC Likes Blockchain And CryptoBrooks served as the chief legal officer of the largest US-based cryptocurrency exchange from 2018 until just recently. He...

Read More »Fedеral Reserve Philadelphia: CBDCs Could Disrupt Current Financial Systems

The Federal Reserve of Philadelphia believes that central bank digital currencies (CBDCs) could significantly impact global finance. In a recent paper, the Fed even suggested that digital currencies could replace commercial banks if they manage to tone down any associated risks.Fed Philadelphia Pro-CBDCIn its comprehensive report on the matter, the Fed examined the potential merits and drawbacks of CBDCs in an ever-digitalizing world.“The introduction of a CBDC can represent an important...

Read More »Jerome Powell Interview Causes Some to Tout BTC

Many people are comparing bitcoin favorably to the centralized banking system of the United States following an interview on “60 Minutes” with U.S. Federal Reserve chairman Jerome Powell.Jerome Powell: We Printed Money DigitallyPowell appeared to discuss the country’s reaction to the ongoing coronavirus pandemic and the issuance of over $2 trillion in federal relief aid to small businesses and American individuals alike. Many people have already received checks of a full $1,200 as required by...

Read More »Rich Dad Poor Dad Author Predicts $75K Bitcoin Price Amid Dying Economy, And States When

According to Robert Kiyosaki, Bitcoin will be valued at $75,000 in three years, as an incompetent Fed oversees a dying economy.The author of the global phenomenon, Rich Dad, Poor Dad, took to Twitter on May 16, where he revealed his recent investments in hard assets such as gold and silver – and also Bitcoin.He made three bold price predictions about the assets mentioned above, citing a dying economy and Fed bailouts as the main catalysts. Kiyosaki tweeted:ECONOMY dying. FED incompetent. Next...

Read More »Bitcoin Was Born in a Recession: Negative Interest Rates Will Teach It To Walk

If the Federal Reserve decides to implement negative interest rates as many have anticipated, it could prove to be a key pivot point in the story of Bitcoin.That’s according to a May 14 report by Stack Funds, which states that an era of negative rates could be Bitcoin’s time to shine.Negative Rates a Pivot PointThe report notes that the threat of negative rates, coupled with the injection of $3.5 trillion newly printed dollars into the economy will cause investors to turn away from...

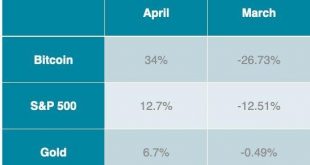

Read More »Bitcoin Increased 34% In April: S&P 500 And Gold Are Well Behind

Top global assets closed the month of April in the green, with Bitcoin coming through as the best-performing asset of April. BTC was up roughly 34%, rising from the $6,400 range at the start of the month to just over $8,700 on the last day. The S&P 500 gained 12.7% while gold rallied by $6.7% in April. This marks a recovery from the market crash in March when Bitcoin, S&P 500 and gold dropped 26.7%, 12.51% and 0.5% respectively.COVID-19 Outbreak Caused Markets To Pause in March,...

Read More »Bitcoin Price Almost Entirely Recovered From The March 12 Plunge: This, Without External Help From The Fed

Having suffered losses due to the COVID-19 led market onslaught, both Bitcoin and the United States stock market have had a good month. However, one analyst has pointed out how Bitcoin’s recovery has been entirely driven by market forces, while stocks have been rallying on the back of government intervention. Bitcoin Recovered Without External Intervention “Take a step back [to] think about how $BTC has almost completely recovered from the 50% drop in March. No limit down or trading halted,...

Read More » Crypto EcoBlog

Crypto EcoBlog