Top global assets closed the month of April in the green, with Bitcoin coming through as the best-performing asset of April. BTC was up roughly 34%, rising from the ,400 range at the start of the month to just over ,700 on the last day. The S&P 500 gained 12.7% while gold rallied by .7% in April. This marks a recovery from the market crash in March when Bitcoin, S&P 500 and gold dropped 26.7%, 12.51% and 0.5% respectively.COVID-19 Outbreak Caused Markets To Pause in March, Recover in AprilJust before the middle of March, global markets started bleeding to the hard-hitting effect of the COVID-19 outbreak. High volatility in the U.S. stock market triggered trading circuit-breakers four times in March. Toward the end of the month, the S&P 500 bottomed out at roughly -35% from its Feb.

Topics:

Craig Adeyanju considers the following as important: AA News, btcusd, btcusdt, federal reserve, s&p 500, United States

This could be interesting, too:

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin Schweiz News writes USA-Goldreserven bald als Krypto-Token? Die Blockchain-Revolution für Staatsgold

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

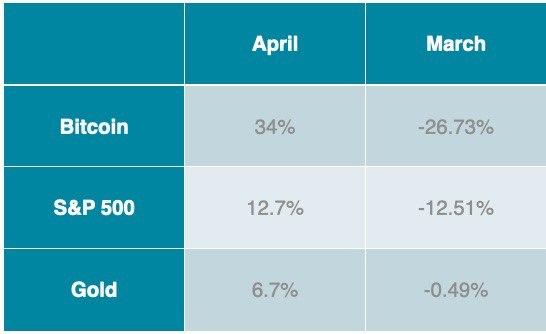

Top global assets closed the month of April in the green, with Bitcoin coming through as the best-performing asset of April. BTC was up roughly 34%, rising from the $6,400 range at the start of the month to just over $8,700 on the last day. The S&P 500 gained 12.7% while gold rallied by $6.7% in April. This marks a recovery from the market crash in March when Bitcoin, S&P 500 and gold dropped 26.7%, 12.51% and 0.5% respectively.

COVID-19 Outbreak Caused Markets To Pause in March, Recover in April

Just before the middle of March, global markets started bleeding to the hard-hitting effect of the COVID-19 outbreak. High volatility in the U.S. stock market triggered trading circuit-breakers four times in March. Toward the end of the month, the S&P 500 bottomed out at roughly -35% from its Feb. 20 peak.

The circuit breaker is a U.S. Securities and Exchange Commission (SEC) provision that mandates a trading halt of the S&P 500 index drops below certain levels. The breaker had only been triggered once, in 1997, since it was introduced following the market crash of October 19th, 1987.

Although the SEC breaker rule doesn’t apply to BTC, crypto derivatives operator BitMEX experienced a system outage just as Bitcoin was crashing. By March 13, the most prominent cryptocurrency had lost 50% of its value since the 2020 peak reached on Feb. 13.

Toward the end of March, however, the stock market launched a rally that extended through April, thanks to governmental help through a series of stimulus packages. Some experts, such as Bloomberg markets editor Joe Weisenthal, believe that Bitcoin is still pretty much correlated to the stock market, which explains the rally in April.

Bitcoin continues to basically just track S&P futures. (Higher beta though) pic.twitter.com/0yWrj7zn2M

— Joe Weisenthal (@TheStalwart) April 29, 2020

Uncertain Times Ahead for Bitcoin?

The U.S. Federal Reserve said it will continue to support the economy until full recovery is achieved.

“The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term,” the U.S. monetary policy committee wrote. “The Committee expects to maintain this target [interest rate] range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

If Bitcoin is indeed correlated to the stock market as some believe, the fate of the most prominent cryptocurrency looks bleak in the short-term. The bitcoin halving event might also not be a key catalyst in the short term, according to Garrick Hileman, Head of Research at Blockchain.com.

“It’s going to take at least four to six months post halving before we can say if we’re seeing a similar pattern to what we say four and eight years ago in terms of the upward price movement.”

Despite Uncertainties, Bitcoin Still Has Strong Investment Case

Periods of economic uncertainties such as this usually see investors seek wealth preservation in safe-haven assets, a class to which Bitcoin supposedly belongs. Some experts, including Michael Novogratz, believe that the case for Bitcoin as a hedge against economic uncertainties is even stronger now.

“Bitcoin will continue to be volatile over the next few months, but the macro backdrop is WHY it was created. This will be and needs to be BTC’s year.” – he said.

Coincidentally, the ongoing money printing is happening antithetically around the same period of the Bitcoin halving event — a reminder of the cryptocurrency’s limited and scarce supply.