In 2023, the Bitcoin hashrate has surged by a staggering 130% which shows growing competition and reduced profitability for miners. The computing power of the Bitcoin network, also known as the mining hashrate, hit a record high on Christmas Day, adding to the challenges faced by miners in the wake of declining profitability. Blockchain.com reported that on December 25, Bitcoin’s hash rate achieved an unprecedented level of 544 exahashes per second (EH/s), a data point corroborated by...

Read More »2 Bitcoin ETF Hazards: SEC Rejection and Competition From Funds

A U.S. circuit court in Washington D.C. has ordered the Securities and Exchange Commission to revisit its rejection of a Bitcoin ETF application by crypto hedge fund Grayscale. But that doesn’t mean the SEC won’t find new reasons to reject it or any of the dozen other applications. SEC Rejection or Delay Could Tank Bitcoin Price Crypto industry investors and insiders expect the price of Bitcoin and other crypto assets to surge if and when the SEC approves an exchange-traded...

Read More »With Bitcoin Spot ETF Approvals, Halving and Incoming Upgrades, What Should You Expect from BTC in 2024?

The timing aligns perfectly in 2024 for a spot ETF approval to have already attracted significant investment, and then the halving decreases Bitcoin’s supply right when demand shoots higher. After yet another banner year in 2023 with over 150% gains, all eyes are on Bitcoin (BTC) to see if the flagship cryptocurrency can sustain its epic run in 2024. Key factors stacking up in Bitcoin’s favor for the coming year have analysts extremely bullish on its prospects. From the possibility of the...

Read More »SEC Chair Gary Gensler Warns of ‘Far Too Many Frauds and Bankruptcies’ in Crypto Industry

Gensler disclosed that the SEC is actively reviewing rules that could potentially hurt the crypto industry. In a recent interview with CoinDesk, Gary Gensler, chairman of the United States Securities and Exchange Commission (SEC), voiced his concerns regarding the crypto industry, noting that the space is rife with fraud and bankruptcies. The SEC chair said while he respects investors’ decision to explore the crypto market, he does not believe they receive adequate disclosures regarding...

Read More »Crypto Users May Hit 1B in 2024, Bitfinex Analysts Claim

According to analysts at Bitfinex, crypto is undoubtedly gaining more traction globally. Moreover, considering the current state of the crypto market, especially with asset prices, it appears that even more global acceptance is on the way for crypto. Bitfinex analysts have made a bold prediction about the number of users that we might expect to see in the crypto industry come 2024. Their prediction, which was detailed in a recent report suggests that the number of crypto users may be...

Read More »Coinbase (COIN) Stock Could Indicate Index Play for TradFi Institutions Looking for Crypto Exposure

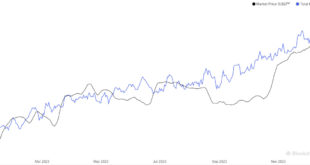

The analyst said TradFi institutions trying to get into crypto, but are unsure how to begin, may use Coinbase stock to enter. According to the co-founder of research firm Reflexivity Research Will Clemente, shares of major cryptocurrency exchange Coinbase Global Inc (NASDAQ: COIN) could serve as an indicator for the crypto sector. Clemente says Coinbase shares could be an “index play” for traditional finance (TradFi) firms looking for a way into the industry. Clemente offered his opinion...

Read More »Bitcoin to Hit $160K in 2024 after Halving, Spot ETF Approval, Fed Interest Rate Cuts: CryptoQuant

CryptoQuant says factors like the halving, ETF, approval, and rate cuts, could push Bitcoin to $160K next year. Analysts are bullish on the potential of Bitcoin (BTC) for next year, indicating several factors that could pump the price to $160,000. According to a blockchain analytics firm CryptoQuant report, Bitcoin may already be on its way to more than double its current all-time high (ATH). Multi-Factorial Push for Bitcoin, According to CryptoQuant CryptoQuant highlighted several...

Read More »Coinbase Builds Runway for Mass Adoption of Crypto Assets and Web 3.0 Industry

With about 425 million owning crypto and more than 80 percent of G20 countries moving towards enabling digital assets, Coinbase is confident the industry will unlock economic freedom to billions of users. The cryptocurrency industry has continued to evolve with the market needs and the fast-changing global regulatory landscape. The trillion-dollar industry is preparing for mass adoption with about 425 million global investors owning various crypto assets. Moreover, more governments around...

Read More »SEC Delays Decision on These Ethereum ETFs Until May

The United States Securities and Exchange Commission (SEC) has delayed its decision on whether to approve applications from several asset management firms for Ethereum exchange-traded funds (ETFs) till May 2024. According to several filings, the securities regulator has issued delay orders for Ethereum ETF applications from Ark Invest/21Shares, VanEck, and Hashdex. SEC Extends Deadline For 3 ETH ETFs Ark Invest/21Shares, VanEck, and Hashdex filed to launch Ethereum ETFs in...

Read More »Bitcoin Price Reacts Positively with 5% Increase as BlackRock Nears ETF Deal

BlackRock has agreed to exclude in-kind creations and redemptions from its ETF application. The Bitcoin price has responded positively to this news. Of the many companies that have been pegged to secure a Bitcoin ETF approval in the United States, BlackRock seems to be the one with the best chance. From individual investors to the crypto market as a whole, everyone seems convinced that BlackRock will make history with the ETF by next year. The company has scored another coup in this...

Read More » Crypto EcoBlog

Crypto EcoBlog