Palo Alto-based crypto custody firm BitGo has launched a new stablecoin, USDS, that is set to go live in January 2025. The company says the stablecoin will be fully backed by U.S. dollars through a mix of short-term Treasury bills, overnight repos, and cash in a bid to ensure liquidity and minimize risk. New Approach to Stablecoin Rewards According to a September 18 statement from BitGo, its proposed offering will differ from existing dominant stablecoins like Tether (USDT)...

Read More »Tether Under Fire for Not Disclosing Reserves Transparently

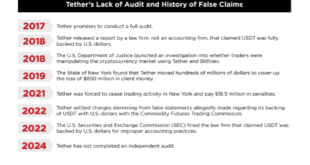

A consumer watchdog has warned about the lack of transparency Tether exhibits in confirming the reserves backing its stablecoin and it ignoring the amount of crime USDT facilitates. Non-profit organization Consumers’ Research has released a warning to alert the crypto community and everyone else of Tether’s lack of transparency in revealing the reserves backing its USDT stablecoin. This report comes after S&P Global rated it 4 out of 5 after a risk assessment, with 5 being the worst...

Read More »Stablecoin Adoption Is Soaring In Emerging Markets: Castle Island Ventures

Think stablecoins are just a vehicle for anonymous crypto trading? A new survey from Castle Island Ventures would suggest otherwise. In a report sponsored by Visa, the firm showed that crypto users in five developing countries – Nigeria, India, Indonesia, Turkey, and Brazil – are turning to stables largely as a means of payment and a savings technology. Stablecoins: Crypto’s Killer Use Case In a survey of 2541 crypto users across those countries, crypto trading was found to...

Read More »Tether, Tron, and TRM Labs Join Hands to Launch the T3 Financial Crime Unit

The T3 Financial Crime Unit will work to reduce criminal activity associated with USDT on Tron, collaborating with law enforcement agencies to hold criminals accountable and make victims whole. The largest stablecoin issuer, Tether, Justin Sun-created Tron, and blockchain intelligence platform TRM Labs have collaborated to launch the T3 Financial Crime Unit (T3 FCU). The alliance will allow Tether to identify and report crime-related USDT transactions on the Tron network. The Majority of USDT...

Read More »New Money Preparing to Buy the Dip? Tether and Dai Wallet Creations Suggest So

The Tether network quietly achieved a 5-month high in new wallet creation, surpassing 31.3K addresses in a single day, and the highest since March 2024. This surge has coincided with rising network growth in Multi Collateral Dai, indicating a broader trend across stablecoins. According to Santiment’s analysis, 732 new DAI wallets were created, representing the fourth-highest figure since March 2024. Interestingly, the timing of these new wallets, emerging after a market...

Read More »Binance to List Eurite (EURI) with Zero-Fee Trading Promotion Starting August 28

Binance, a leading cryptocurrency exchange, is set to list Eurite (EURI) and open trading for new spot trading pairs on August 28, 2024, at 10:00 (UTC). In celebration of this launch, Binance is introducing a zero-fee promotion for trading EURI pairs. It makes this an attractive opportunity for traders. It is also pivotal for EURI as it is one of the earliest EURO stablecoins under the MiCA regulation in the EU and the EEA. EURI Deposits Open Ahead of August 28 Launch on Binance; Withdrawals...

Read More »Stablecoin Market Sets New Record at $168 Billion

The stablecoin market has reached a new milestone, with its total market capitalization hitting an all-time high of $168 billion. This achievement follows 11 consecutive months of growth, as shown by data from DefiLlama. The current potential exceeds the maximum of $167 billion recorded in March 2022, indicating a clear recovery and growth stage for stablecoins. It is important to note that this data does not include a category often referred to as algorithmic stablecoins, where the value is...

Read More »Stablecoins Hit Record Market Cap of Nearly $170 Billion After Year of Growth

Stablecoins have reached an all-time high market cap of $169.57 billion following nearly a year of uninterrupted growth. Leading assets such as Tether’s USDT and Circle’s USDC have seen a significant resurgence this year, in addition to a newcomer. Stablecoin Market Cap Surge Data compiled by DefiLlama revealed that this is the highest market cap for stablecoins, surpassing the previous peak of $167 billion established in March 2022, which later declined to $135 billion by...

Read More »Stablecoin Issuer Tether Has Reclaimed Over $108 Million for Victims and Law Enforcement Agencies

Tether recently assisted the US DoJ in recovering close to $5 million worth of USDT lost in a romance scam. It has reclaimed $108 million from scams since it launched in 2014. Tether, the firm behind the largest stablecoin by market capitalization, USDT, claimed it has helped victims of fraud and law enforcement agencies reclaim $108.8 million worth of USDT since its inception in 2014. The stablecoin issuer can track the flow of its asset, possessing the capability to block wallets from...

Read More »12,000 Bitcoin Removed from USDD Reserves, Sun Responds

Tron founder Justin Sun has downplayed concerns following the removal of 12,000 Bitcoin, worth over $729 million, from the reserves backing Decentralized USD (USDD), a stablecoin governed by the Tron DAO Reserve. The action was recorded on August 19, when the blockchain observer Blockchair discovered that the Bitcoin was taken out of the address that was linked to the USDD collateral. This led to concerns on the social media platform x (former Twitter), where some of the users said that Sun...

Read More » Crypto EcoBlog

Crypto EcoBlog