[unable to retrieve full-text content]CoinspeakerTether Decides to Discontinue Bitcoin Stablecoin amid Lack of Usage Along with Bitcoin Omni Layer, Tether has also decided to discontinue the stablecoin versions of Bitcoin Cash and Kusama. Tether Decides to Discontinue Bitcoin Stablecoin amid Lack of Usage

Read More »Telegram’s Wallet Rolls Out In-App Crypto Payment Options, Offering New Opportunities for Merchants

[unable to retrieve full-text content]CoinspeakerTelegram’s Wallet Rolls Out In-App Crypto Payment Options, Offering New Opportunities for Merchants While certain jurisdictions impose restrictions, Wallet's initiative aims to provide users with a seamless and convenient way to engage in digital asset transactions. Telegram’s Wallet Rolls Out In-App Crypto Payment Options, Offering New Opportunities for Merchants

Read More »Für diese Anwendungen ist Skrill geeignet

Mit Skrill Bitcoin kaufen, Screenshot aus dem Web In der heutigen digitalen Welt sind Online-Zahlungssysteme unverzichtbar geworden. Eine solche Plattform, die weltweit immer mehr an Bedeutung gewinnt, ist Skrill. Skrill ist ein E-Wallet-Service, der es Benutzern ermöglicht, Geld sicher und bequem online zu senden und zu empfangen. Mit einer Vielzahl von Funktionen und Integrationen eignet sich Skrill für verschiedene Anwendungen in verschiedenen...

Read More »Die Argumente der Bitcoin-Maximalisten gegen CBDC

Mit dem Aufkommen von Kryptowährungen und der wachsenden Beliebtheit von Bitcoin haben sich verschiedene Standpunkte und Überzeugungen entwickelt. Unter den Anhängern von Bitcoin gibt es eine Gruppe, die als „Bitcoin-Maximalisten“ bekannt ist. Diese Gruppe glaubt fest daran, dass Bitcoin die einzige wahre Kryptowährung ist und alle anderen digitalen Währungen überflüssig sind. Als Reaktion auf die wachsende Diskussion über...

Read More »Tether USDT: Das sind die 7 Pluspunkte der Genialen Digitalen Währung

Tether ist eine unregulierte Kryptowährung mit Token, die vom Unternehmen Tether Limited ausgegeben werden. Tether Limited wird von den Akteuren hinter der Börse Bitfinex kontrolliert. Tether ist eine Kryptowährung, die als „Stablecoin“ bekannt ist, da sie an den Wert eines realen Vermögenswertes, normalerweise einer Fiatwährung wie dem US-Dollar, gekoppelt ist. Hier sind sieben potenzielle Pluspunkte von Tether: Stabilität: Als Stablecoin ist...

Read More »SEC und Binance schliessen provisorischen Deal

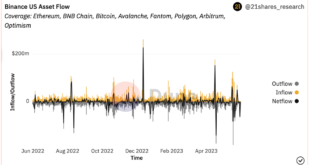

Binance und die US-Börsenaufsichtsbehörde Securities Exchange Commission haben nun eine Einigung in Bezug auf das von der SEC vorgeschlagene Einfrieren von Vermögenswerten von Binance erzielt. Damit soll sichergestellt werden, dass diese Vermögenswerte innerhalb der USA bleiben – eine Entscheidung, die bis zu einem endgültigen Urteil zur Klage der SEC aufrecht bleibt. 2,2 Milliarden Dollar an US-Kundengeldern Es stehen rund 2,2 Milliarden Dollar an...

Read More »Tether (USDT) Launches on Kava L1 Blockchain, KAVA Price Jumps More Than 10%

Kava layer one blockchain joins other chains – like Ethereum, Solana, Algorand, EOS, Liquid Network, Omni, and Tron – that support USDT. The leading United States dollar-pegged stablecoin, Tether (USDT) has found a new channel to mainstream adoption through the Kava network, a layer one (L1) blockchain that was designed with scalability and speed in mind. According to the announcement, Tether USDT will work closely with the Kava blockchain to reshape the future of decentralized finance....

Read More »Tether (USDT) Hit New Market Cap ATH as Adoption Grows

USDT has become the most traded stablecoin, especially after the de-pegging of Circle’s USD Coin (USDC) earlier this year. United States-dollar-backed stablecoin Tether (USDT) has hit an all-time high in its market capitalization based on existing market data. The new milestone has helped Tether exceed its previously set all-time high of $83.2 billion which was announced back in May 2022. USDT is currently the third largest cryptocurrency by market cap which at the time of writing is...

Read More »Die Gesamtzahl der Kryptowährungen ist um 58 % gestiegen

Die Marktkapitalisierung von Bitcoin macht 46,40 Prozent des gesamten Marktes aus. Kryptowährungen haben an Popularität gewonnen. Im Mai 2023 sind 9’182 verschiedene Währungen verfügbar. Bitcoin bleibt die beliebteste, gefolgt von Ethereum. Eine Studie hat herausgefunden, dass die gesamte Marktkapitalisierung für Kryptowährungen 1,14 Billionen Dollar beträgt, wobei Bitcoin mit 46,40 % dominiert. Die Akzeptanz variiert weltweit, wobei Deutschland...

Read More »USDT Issuer Tether to Enhance Reserves via Regular Bitcoin Purchase

Stablecoin issuer Tether has announced plans to purchase Bitcoin with 15% of realized operating profits routinely. Tether International Limited (Tether) seeks to further consolidate its reserves by purchasing Bitcoin (BTC) with its operating profits. An official post states that beginning this month, the stablecoin company will regularly allocate up to 15% of its realized net operating gains toward BTC purchases. The report also states that Tether does not see current and future BTC...

Read More » Crypto EcoBlog

Crypto EcoBlog