Bitcoin marked a slight decrease of less than 2% in the past 24 hours, but its price remains above ,000 for now. Things are looking relatively calm, as 30-day volatility has dropped to a low not seen since May. Yet if history is any indicator, it’s times like these that portend a violent move. Bitcoin Trading Between ,000 and ,000For the past eight days, Bitcoin has been trading between ,000 and ,000, while its dominance rate has hovered around 70%. BTC/USD. Source: TradingViewHowever, the past 30 days have seen relatively low levels of volatility. In fact, it has not been this low since May. As CryptoPotato reported back in June, Bitcoin’s volatility, especially when raging, is a double-edged sword. Some believe it to be a good thing because it shakes out ‘weak hands’ and

Topics:

George Georgiev considers the following as important: Crypto News

This could be interesting, too:

Nick Marinoff writes Parrot Media Is Getting a Crypto Division All Its Own

Yuval Gov writes Bitcoin Price Analysis: Another Attempt To Break The Crucial Resistance Line – Will This End-Up In ,000 Or ,000 For BTC?

Yaz Sheikh writes Following The New US Traders’ Ban, Binance Coin Plunging Towards

George Georgiev writes 300 Million Tether (USDT) Had Just Reached Binance. Here Is Why

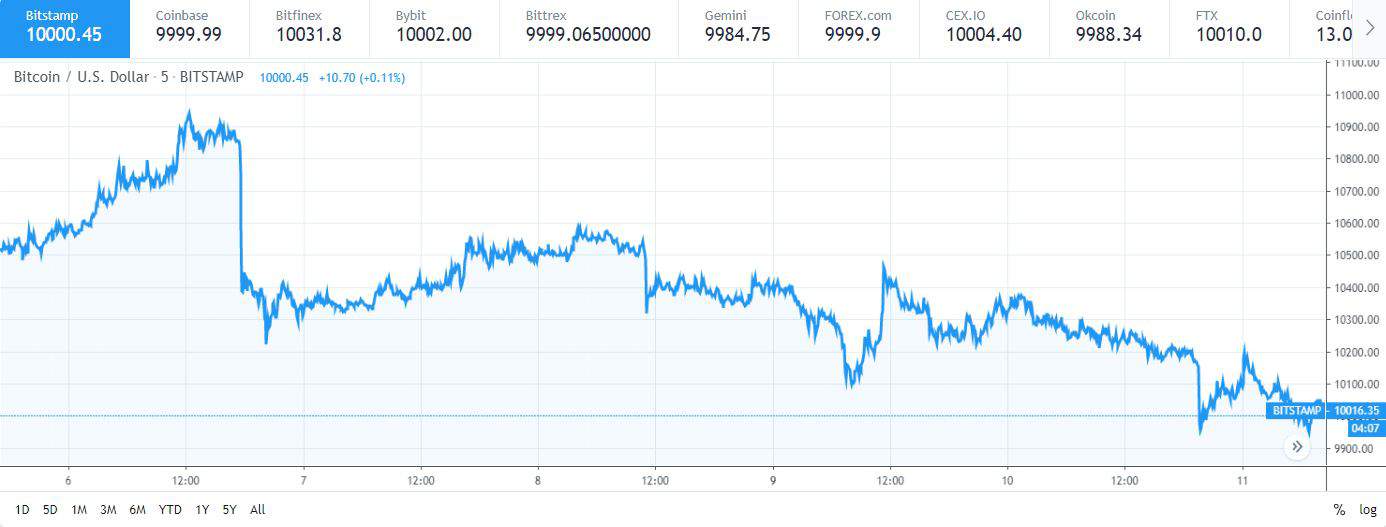

Bitcoin marked a slight decrease of less than 2% in the past 24 hours, but its price remains above $10,000 for now. Things are looking relatively calm, as 30-day volatility has dropped to a low not seen since May. Yet if history is any indicator, it’s times like these that portend a violent move.

Bitcoin Trading Between $10,000 and $11,000

For the past eight days, Bitcoin has been trading between $10,000 and $11,000, while its dominance rate has hovered around 70%.

However, the past 30 days have seen relatively low levels of volatility. In fact, it has not been this low since May.

As CryptoPotato reported back in June, Bitcoin’s volatility, especially when raging, is a double-edged sword. Some believe it to be a good thing because it shakes out ‘weak hands’ and guarantees that BTC goes to the strongest holders. It’s also a function of the cryptocurrency’s scarcity because as the supply is static, the price can be volatile.

On the other hand, it also contains quite a bit of downside. It’s commonly associated with price and market manipulation. This is among the reasons why the US Securities and Exchange Commission (SEC) hasn’t yet approved a Bitcoin ETF.

Bitcoin’s volatility also makes trading a lot riskier. Expert traders typically see this as an advantage because they can capitalize on sudden price moves, but those who are less advanced can experience serious losses due to the frequent swings.

Calm Before the Storm?

Bitcoin’s fundamentals are looking stronger than ever. Its hash rate is increasing rapidly which could be tied to increased network security. At the same time, we are anticipating the launch of Bakkt on September 23, which has been one of the most awaited events within the crypto community. Bitcoin’s halving is less than 250 days away. That will decrease the supply of freshly-minted bitcoins, which should, in theory, drive its price higher, as it has always done.

In other words, the current range-bound trading pattern may not be accurately reflecting these underlying factors, among many others.

Back in May, when volatility levels were as low as they are now, the price marched forward and almost doubled in June. Of course, should any violent price swing occur, it could be in the opposite direction.