Two days ago, while Bitcoin was attempting to stay above the critical ,000 mark, we have pointed out two scenarios in the bigger picture:“The bigger picture from below is the crucial support line around ,400, which is the last barrier before the triangle breaks to the downside. From the top, the triangles’ trend-line sits around the resistance level of ,300 – ,400.”, as taken from the previous Bitcoin price analysis.As you could see, the wedge shown on the 4-hour chart had been breached to the bullish side, what ignited the later scenario out of the two, whereas Bitcoin reached the area of resistance at ,300 – ,400. The area which Bitcoin is currently trading at.This area consists of a lot of supply that might be a decision point for Bitcoin: the 50-days (purple) and the

Topics:

Yuval Gov considers the following as important: BTCanalysis, Crypto News

This could be interesting, too:

Nick Marinoff writes Parrot Media Is Getting a Crypto Division All Its Own

Yuval Gov writes Bitcoin Price Analysis: BTC Struggles To Maintain Critical Support Level, Drop To 00 Very Soon?

Yuval Gov writes Bitcoin Completes 3-Day 00 Plunge: Where Is The Bottom? Price Analysis & Weekly Overview

Yuval Gov writes Bitcoin Price Analysis: After 0 Plunge In 48 Hours, Bitcoin Is Facing Huge Critical Support Area

Two days ago, while Bitcoin was attempting to stay above the critical $10,000 mark, we have pointed out two scenarios in the bigger picture:

“The bigger picture from below is the crucial support line around $9,400, which is the last barrier before the triangle breaks to the downside. From the top, the triangles’ trend-line sits around the resistance level of $10,300 – $10,400.”, as taken from the previous Bitcoin price analysis.

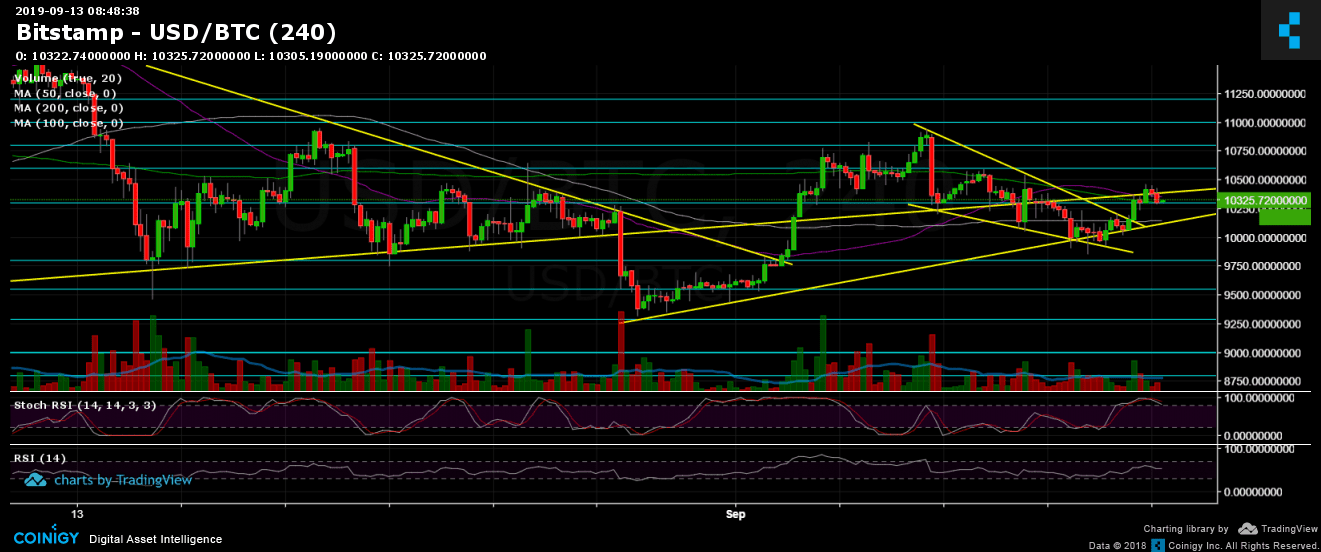

As you could see, the wedge shown on the 4-hour chart had been breached to the bullish side, what ignited the later scenario out of the two, whereas Bitcoin reached the area of resistance at $10,300 – $10,400. The area which Bitcoin is currently trading at.

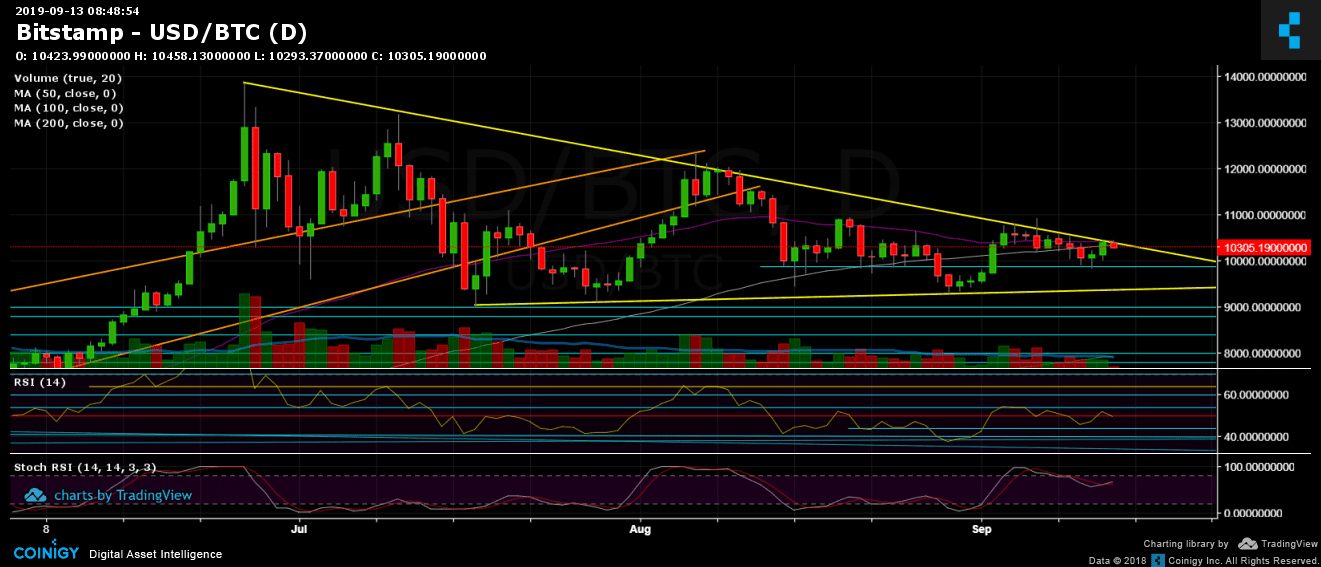

This area consists of a lot of supply that might be a decision point for Bitcoin: the 50-days (purple) and the 100-days (white) moving average lines, along with the significant descending trend-line – marked in yellow on the following daily chart. That line was started forming when Bitcoin recorded its 2019 high of $13,880 last June.

Can Bitcoin overcome this, in what could send the coin to a decent rally? Will it be another roof before another plunge towards $10K and $9,400? Some near-future events, such as Bakkt’s futures launch, can be the triggers for such huge moves. Keep in mind that the Bitcoin dominance is only upon a decision point – at the 70% mark.

Total Market Cap: $264 billion

Bitcoin Market Cap: $185 billion

BTC Dominance Index: 70.3%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance:

As mentioned above, Bitcoin is facing the critical support area of $10,300 – $10,400. In case of a breakout, this is likely to lead a decent price move. The next resistance levels are $10,600, $10,800 and $11,000. The last is the latest daily high. The last time Bitcoin opted for breaking it, turned out to be a plunge of quick $700.

From below, the nearest area of support is the ascending trend-line marked on the 4-hour chart (around $10,200 as of now), followed by the famous $10,000 level. Further down is the $9,880 support along with the 4-hour’s chart ascending trend-line. Further below lies $9600 (weak support level), before the crucial $9,400 level (the bottom yellow ascending trend-line, the bottom line of the triangle). If broken down, Bitcoin is likely to produce a quick move down to $8,800 – $9,000 at first.

– Daily chart’s RSI: Following another failed tryout to break above the 54-55 level, the RSI is now facing the significant 50 level. Overall, there’s a bit of bullish divergence in the RSI, but for this to be considered, the indicator needs to overcome 55.

– Trading Volume: Like mentioned previously, not a massive amount of volume is following the recent price action. Adding to the above, the daily volume is decreasing over time; this might tell on a coming-up more significant price move.