Bitcoin’s halving, one of the most highly-anticipated events for the cryptocurrency community, is currently expected to take place on May 16, 2020. However, some are suggesting that the true date could be closer to April 2020 because of the rapid acceleration in the network’s hash rate. Bitcoin’s Hash Rate Accelerates QuicklyIn order to understand the significance of Bitcoin’s hash rate, it’s important to understand how mining works. When someone has a Bitcoin wallet and he or she wants to send some BTC from their wallet’s address to another one, they have to create a transaction and sign it with their private and public key and broadcast the transaction on the Bitcoin network. The goal is to add this new transaction to one of the blocks which will be added to the blockchain. The job of

Topics:

George Georgiev considers the following as important: Crypto News

This could be interesting, too:

Nick Marinoff writes Parrot Media Is Getting a Crypto Division All Its Own

Yuval Gov writes Bitcoin Price Analysis: Another Attempt To Break The Crucial Resistance Line – Will This End-Up In ,000 Or ,000 For BTC?

Yaz Sheikh writes Following The New US Traders’ Ban, Binance Coin Plunging Towards

George Georgiev writes 300 Million Tether (USDT) Had Just Reached Binance. Here Is Why

Bitcoin’s halving, one of the most highly-anticipated events for the cryptocurrency community, is currently expected to take place on May 16, 2020. However, some are suggesting that the true date could be closer to April 2020 because of the rapid acceleration in the network’s hash rate.

Bitcoin’s Hash Rate Accelerates Quickly

In order to understand the significance of Bitcoin’s hash rate, it’s important to understand how mining works.

When someone has a Bitcoin wallet and he or she wants to send some BTC from their wallet’s address to another one, they have to create a transaction and sign it with their private and public key and broadcast the transaction on the Bitcoin network. The goal is to add this new transaction to one of the blocks which will be added to the blockchain.

The job of miners is to pick up those transactions and add them to a given block’s list of transactions. During this process, the miners also need to verify each transaction in order to prevent double-spending.

In order to broadcast a transaction to the network, the miner has to come up with a 64-digit hexadecimal number, known as a nonce. It will have unique mathematical characteristics when calculating a particular function called a hash function. The catch is that the only way to find this nonce number is to guess.

Here’s where the hash rate comes into play. The number of “guesses” that a computer produces per second is known as its hash rate. Hence, the higher the hash rate of your machine, the higher the chance of you adding a block to the network and receiving the associated block reward.

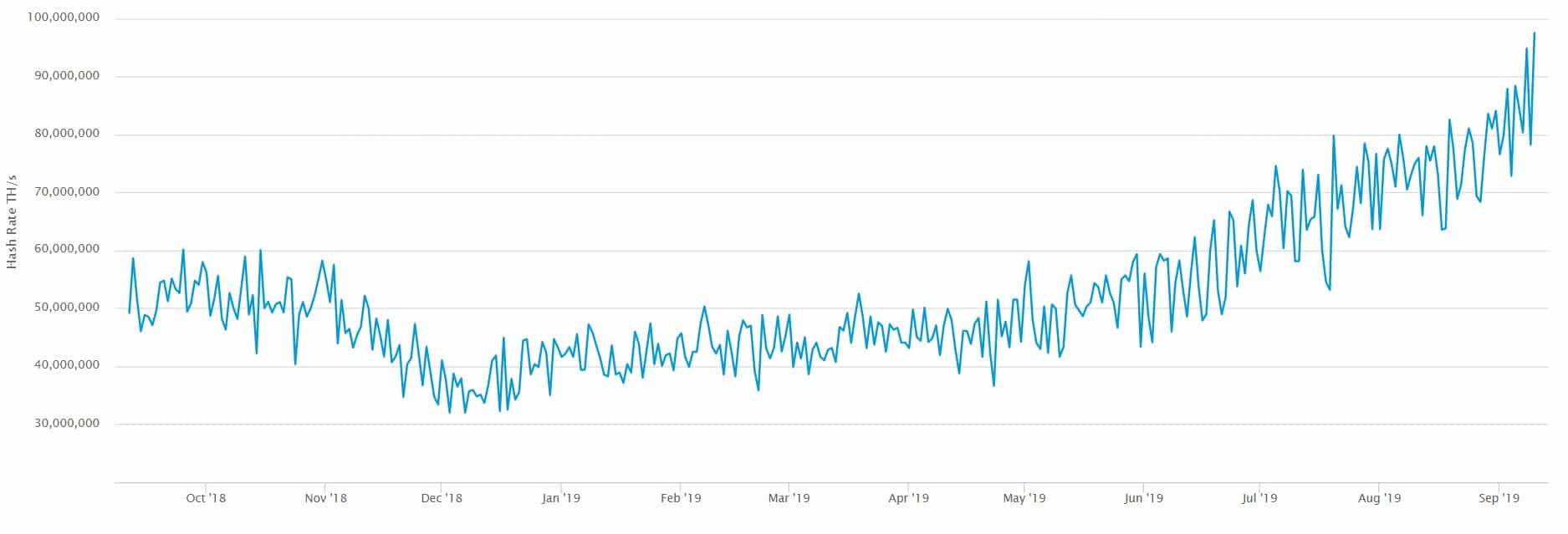

As it happens, the network’s hash rate has increased substantially throughout 2019. On January 1, it was around 41 quintillion hashes per second. Yesterday, September 10, it was 97.5 quintillion hashes per second, which represents an increase of about 130%.

Could the Bitcoin Halving Come Sooner?

Now, back to Bitcoin’s halving. It’s supposed to take place whenever 210,000 blocks are added to the blockchain. But as we explained above, the higher the hash rate, the quicker the network adds new blocks.

The rapid increase in Bitcoin’s hash rate has already caused some prominent members of the crypto community to believe that the halving won’t take place in May, but rather in April. Among them is popular Bitcoin proponent hodlnaut, known for starting the famous Lightning Torch initiative.

The way hashrate is accelerating, the halving will happen in April 2020, not May.

— hodlonaut?⚡? (@hodlonaut) September 10, 2019