Following very calm and steady trading days, where Bitcoin couldn’t overcome the significant 200-days moving average line (marked light green on the attached daily chart), the recent hours saw Bitcoin breaking down below 00 for the first time in the past ten days.Many see the market bearish as long as Bitcoin is trading below the mentioned MA-200 (currently around 00). After several failures trying to break back above the moving average line, Bitcoin price had gone away from the area, and now trading more than 10% below it.As of now, the coin found support on-top of the short-term ascending trend-line (shown on the following 4-hour chart. However, the situation is very choppy.After another week of dull trading, with minor volume and low interest in Bitcoin as seen by Google trends,

Topics:

Yuval Gov considers the following as important: bitcoin price, BTCanalysis

This could be interesting, too:

Bilal Hassan writes Cathie Wood Predicts Bitcoin Will Reach .5 Million by 2030

Bena Ilyas writes CleanSpark CEO Forecasts Bitcoin’s 0,000 Peak in 18 Months

Bhushan Akolkar writes China Stimulus Package Can Push Bitcoin Price to New All-Time High

Mayowa Adebajo writes Bitcoin Surges after Fed Rate Cut but Bank of Japan Holds Steady

Following very calm and steady trading days, where Bitcoin couldn’t overcome the significant 200-days moving average line (marked light green on the attached daily chart), the recent hours saw Bitcoin breaking down below $8000 for the first time in the past ten days.

Many see the market bearish as long as Bitcoin is trading below the mentioned MA-200 (currently around $8800). After several failures trying to break back above the moving average line, Bitcoin price had gone away from the area, and now trading more than 10% below it.

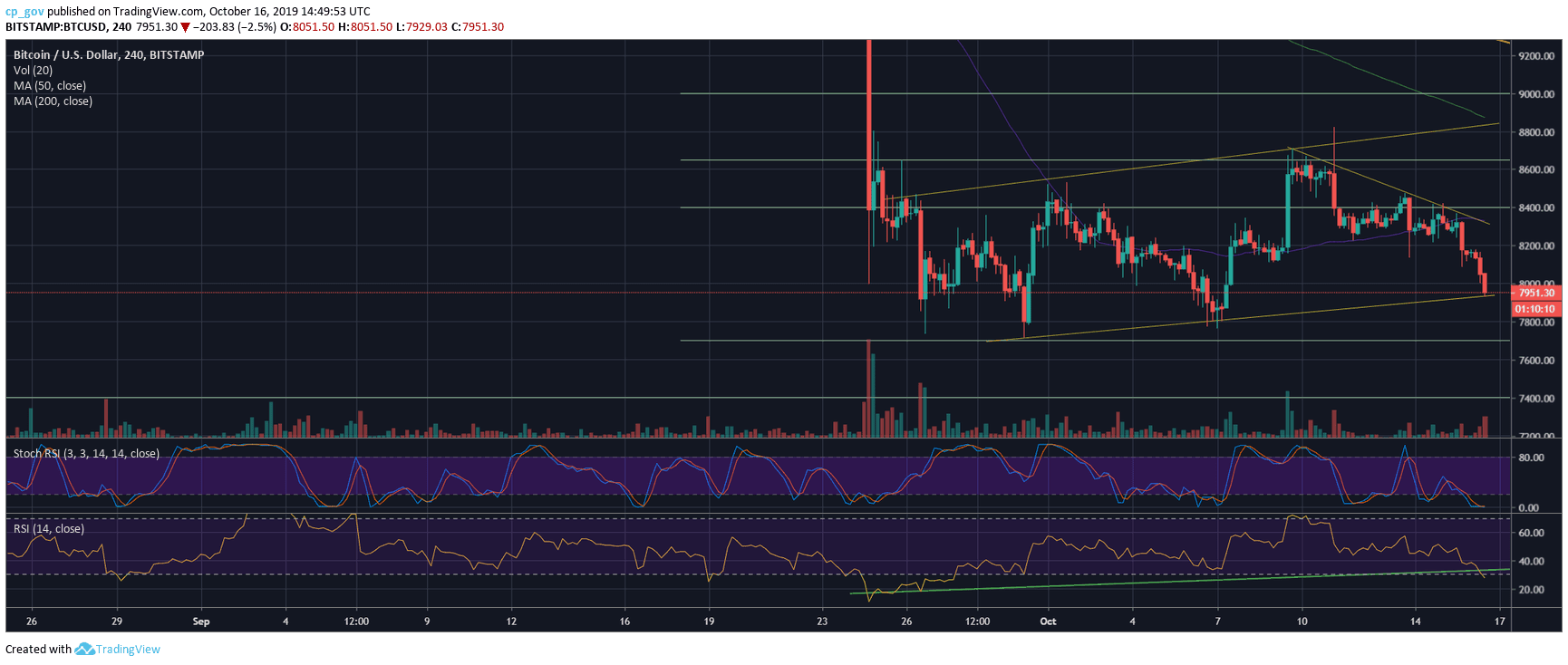

As of now, the coin found support on-top of the short-term ascending trend-line (shown on the following 4-hour chart. However, the situation is very choppy.

After another week of dull trading, with minor volume and low interest in Bitcoin as seen by Google trends, the cryptocurrency is anticipating a huge move.

Most of the crypto community think that it’s time to explore new bottoms, but as we already noticed, the majority is wrong. It doesn’t mean that BTC will not discover lower price areas, but before calling out the bearish forecasts, there are some more indicators to watch.

Total Market Cap: $216 billion

Bitcoin Market Cap: $144 billion

BTC Dominance Index: 66.5% (Since its 2-year high at 72% a month ago, the altcoins are getting stronger)

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance: Looking on the 4-hour chart, Bitcoin’s nearest support level is the marked ascending trend-line precisely at the current daily low ($7920). Further below is the $7800 level, which was the low of the past week. Below is $7700, which supported Bitcoin twice so far, since its negative momentum started on September 26.

In case of a breakdown, we will expect to see Bitcoin reaching quickly to $7500, and from there, the next target is the significant level of $7200, which is the Golden Fibonacci level (61.8%) measured from Bitcoin’s all-time high (December 2017).

In case Bitcoin finds support around the current price levels, the nearest resistance will be support turned resistance level at $8000 and $8200. The next level from above is the MA-50 on the 4-hour (marked purple) along with the short-term descending trend-line (around $8300).

– The RSI Indicator (Daily): The indicator is maybe the sole positive light, as the higher lows trajectory is being kept alive, as of writing this. The RSI is now facing a key support level around 33-34, along with an ascending trend line of support.

In our previous analysis, we mentioned the bearish crossover that the Stochastic RSI oscillator had gone through. Since then, Bitcoin had lost more than 5%, and unfortunately, by looking at the current stage of the oscillator, there’s more room to move down.

– The Trading Volume: As mentioned in our last analysis: ‘One of the reasons that the breakout (to $8800) turned to be fake is the lack of buyers’ volume.”

To summarize, the bulls need to come back in order to turn the market back to the positive side. So far, the volume is in favor of the sellers. However, despite the recent action, the past days were very dull in means of volume, as stated above.