By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.BTC/USD tech analysisThe Bitcoin miners become fewerThe BTC cannot replace the dollar — LaneOn W1, the Bitcoin is developing another impulse of decline inside the renewed channel. It seems that the market participants are playing the last quick growth, balancing the price. It might be that we will not see any new impulse of growth until the minimum is renewed. The bearish behavior of the price is aimed at 61.8% (30.00) and 76.0% (5700.00) Fibo. However, the main aim of the decline will be the key minimum of 21.90.On the MACD, the histogram remains in the red area, while the Stochastic has formed a Black Cross in the overbought area. The two signals indicate bearish dominance on the market.Photo: Roboforex / TradingViewOn D1, BTC/USD

Topics:

Dmitriy Gurkovskiy considers the following as important: bitcoin price, bitcoin price analysis, bitcoin price forecast, bitcoin price prediction, Blockchain News, BTC, btc price, btc price analysis, btc price forecast, btc price prediction, Cryptocurrency News, dmitriy gurkovskiy, Guest Posts, News, Reports, roboforex

This could be interesting, too:

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Bilal Hassan writes Morocco Cracks Down on Crypto Property Deals

Bilal Hassan writes Crypto Becomes a U.S. ‘Weapon,’ Says CryptoQuant CEO

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD tech analysis

- The Bitcoin miners become fewer

- The BTC cannot replace the dollar — Lane

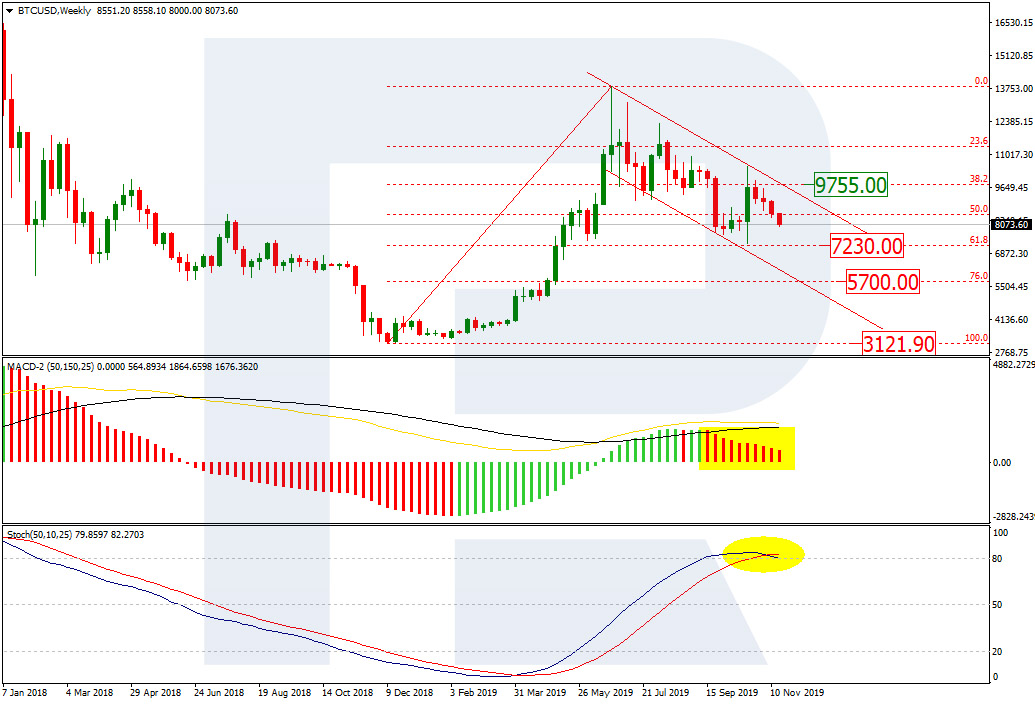

On W1, the Bitcoin is developing another impulse of decline inside the renewed channel. It seems that the market participants are playing the last quick growth, balancing the price. It might be that we will not see any new impulse of growth until the minimum is renewed. The bearish behavior of the price is aimed at 61.8% ($7230.00) and 76.0% (5700.00) Fibo. However, the main aim of the decline will be the key minimum of $3121.90.

On the MACD, the histogram remains in the red area, while the Stochastic has formed a Black Cross in the overbought area. The two signals indicate bearish dominance on the market.

Photo: Roboforex / TradingView

On D1, BTC/USD demonstrates a more detailed picture of an impulse of decline forming in the actualized channel. Regardless of the previous convergence, the MACD shows the development of a new red area, while its lines have entered the negative area. The overall tech picture suggests reaching $7230.00 and $5700.00 for sure, with the local barrier at the minimum $7302.00. The resistance is near $9755.00.

Photo: Roboforex / TradingView

On H4, the channel of the short-term downtrend can be seen in detail. The nearest aim of the decline is at the support line at $7705.00. However, attention should be paid to the Stochastic that has stuck in the overbought area. On the one hand, this signifies the stability of the current trend, on the other — reveals the possibility of a reversal at any moment. The initial signal of the reversal will be a Gold Cross on the indicator, and then the growth of the price and the oscillator lines will fix and confirm it. A breakout of the local resistance near $8370.00 will open a pathway to the resistance line of the mid-term channel.

Photo: Roboforex / TradingView

The decline of the hashrate indicates that there are becoming fewer miners in the Bitcoin network; they stop mining the leading cryptocurrency. In the future, this may provoke a serious slump of the exchange rate: Cole Garner, an independent analyst, reminds of the same situation leading to a slide-like decline of the BTC.

As long as the exchange rate keeps declining, mining the BTC becomes less and less profitable and efficient. Earlier, it was said that if the BTC fell below $8000.00, its mining might become a losing enterprise. We may not neglect the probability that a new declining wave will provoke the users to sell more coins.

According to the head of Silvergate Alan Lane, the BTC will not manage to replace the US dollar even in the remote future. However, it has room for development: the BTC may become the roval of gold as the reserve asset. However, for the Bitcoin to be used this way all over the world, its reputation should be enhanced. It has suffered a lot since the times when digital money was used for fraud and other criminal affairs. Later, with the security improvements, the risk decreased but the reputation remained imperfect.

During this year, the capitalization of the crypto market has grown by 32% to $237 billion. The BTC and XRP volatility turned out impressing.

Disclaimer: Any predictions contained herein are based on the authors' particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.