Bitcoin’s price action has been bearish as of late.Nevertheless, the biggest bull in Crypto Twitter sees a reversal in the horizon.Other traders do not share an optimistic outlook and bet on a bitcoin plummet to ,000 levels.To say that crypto enthusiasts have turned bearish on bitcoin would be an understatement. The number one cryptocurrency is now trading below ,000. The chart looks ugly and it gives very little reason to be bullish.A full-time trader illustrating why it bitcoin is bearish right now. | Source: TwitterThe cryptocurrency has been in a slow bleed ever since it climbed as high as ,350 on Oct. 26. At that point, many thought that bitcoin would restart its bullish trend. Unfortunately, long positions got liquidated as the digital asset dumped.Nevertheless, Crypto

Topics:

Kiril Nikolaev considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- Bitcoin’s price action has been bearish as of late.

- Nevertheless, the biggest bull in Crypto Twitter sees a reversal in the horizon.

- Other traders do not share an optimistic outlook and bet on a bitcoin plummet to $6,000 levels.

To say that crypto enthusiasts have turned bearish on bitcoin would be an understatement. The number one cryptocurrency is now trading below $8,000. The chart looks ugly and it gives very little reason to be bullish.

The cryptocurrency has been in a slow bleed ever since it climbed as high as $10,350 on Oct. 26. At that point, many thought that bitcoin would restart its bullish trend. Unfortunately, long positions got liquidated as the digital asset dumped.

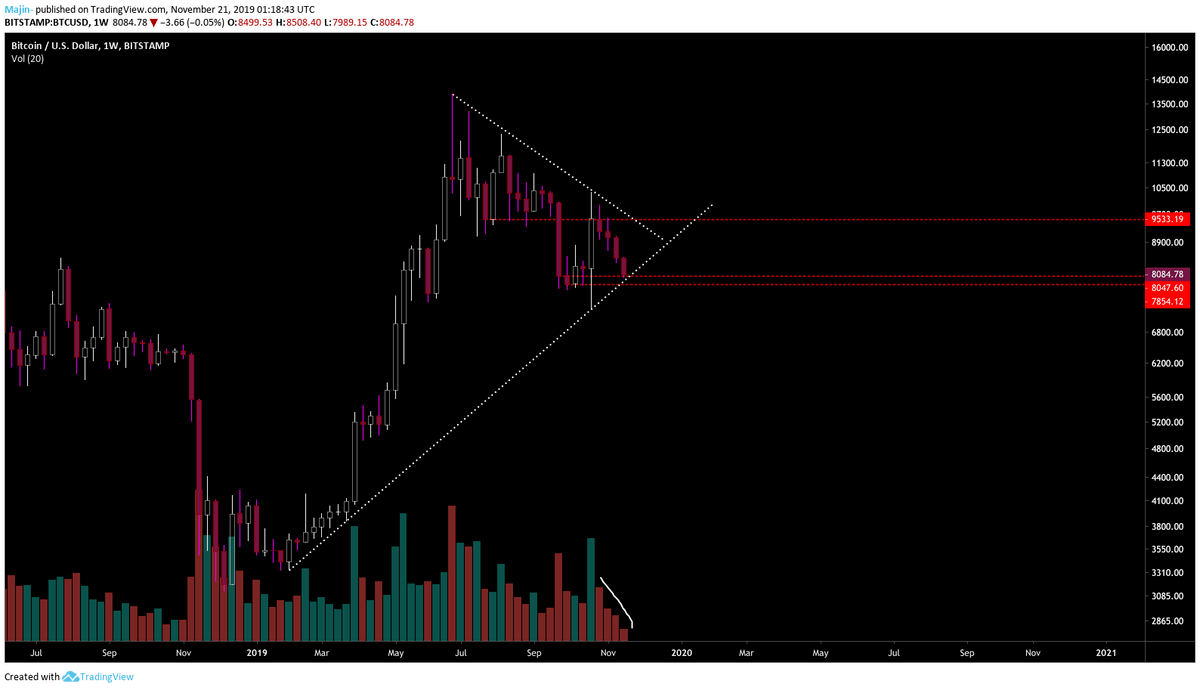

Nevertheless, Crypto Twitter’s biggest bull Majin strongly believes that the dominant cryptocurrency is primed for a reversal. The liquidity game theorist claims that bitcoin is bottoming out.

Bitcoin in the Process of Reaccumulation

Bitcoin has been painful to watch over the last few weeks. The cryptocurrency lost all bullish steam while volatility was being slowly sucked out of the window. This is often a sign of distribution where the smart money investors gradually take profits.

Majin, however, sees the exact opposite. The trader believes that the smart money investors are accumulating BTC in preparation for the next leg up. The analyst told CCN,

I interpret the entire $7,400 and $10,00 range as reaccumulation. So the short-squeeze went to the top of the range.

The short squeeze that the trader’s referring to is the move above $10,000 on Oct. 26. Majin added,

The slow-bleed since has been reaccumulation, absorption of supply, and preparation of a new rally. I expect [bitcoin] to start drifting up from here.

Majin’s analysis came with bitcoin’s weekly chart. The chart shows that the cryptocurrency is still respecting the uptrend line with declining volume. The analyst added,

Especially note the receding weekly volume as price is moving down the range on the last four candles.

When asked what level would invalidate the analysis, Majin replied,

[Bitcoin] price below $7,800 but I expect it to have already bottomed.

Other Prominent Traders Do Not Share Majin’s Optimism

I scoured Crypto Twitter (CT) and it appears that Majin is the only one to have a rosy outlook on bitcoin. Many are expecting a substantial drop to $6,000 levels. For instance, popular Elliottician Benjamin Blunts predicts a bitcoin dump to $6,500. At that point, it might muster the strength to reverse its trend.

Trader Escobar sees a similar scenario playing out. The trader forecasts a plunge to $6,800 before the top cryptocurrency can show signs of recovery.

It’s not surprising that many traders are expecting a drop to $6,000. After all, $6,000 is a psychological level for bitcoin.

A dump to $6,500 would mean that bitcoin lost over 53% of its value from the 2019 top of $13,880. Even for the number one cryptocurrency, that would be an extreme retracement.

Trader Rekt conducted an in-depth study of the bitcoin halvings. He discovered that the cryptocurrency would go on a pre-halving retracement that wipes out between 38% and 50% of its value.

Thus, the 47% drop to the Oct. 23 low of $7,293 is very likely the bottom of this pullback. I am one with Majin, and I believe that a bullish reversal is incoming.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.