Many top traders on Twitter do not expect a Santa Claus rally this year.A quant analyst with a small following is ignoring bearish calls.The trader boldly claims that the top cryptocurrency offers a rare and superb buying opportunity.The top analysts on Crypto Twitter (CT) are seeing a bloody Christmas for bitcoin. Many widely-followed accounts are predicting a price drop to between ,000 and ,000. If they’re right, then bitcoin is headed for another 30% plunge after already retracing by nearly 50% from this year’s high of ,880. Analyst predicts bitcoin puking big time this month. | Source: TwitterThese traders have amassed huge followings because they present scenarios that are likely to play out. But they don’t always get it right. It’s worthwhile to find gems or exceptional

Topics:

Kiril Nikolaev considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- Many top traders on Twitter do not expect a Santa Claus rally this year.

- A quant analyst with a small following is ignoring bearish calls.

- The trader boldly claims that the top cryptocurrency offers a rare and superb buying opportunity.

The top analysts on Crypto Twitter (CT) are seeing a bloody Christmas for bitcoin. Many widely-followed accounts are predicting a price drop to between $6,000 and $5,000. If they’re right, then bitcoin is headed for another 30% plunge after already retracing by nearly 50% from this year’s high of $13,880.

These traders have amassed huge followings because they present scenarios that are likely to play out. But they don’t always get it right. It’s worthwhile to find gems or exceptional analysts who have a few hundred followers. They don’t get a lot of attention because some of them present contrarian ideas. One of them is Riggs; the quant analyst boldly claims that the recent bitcoin dip is a gift to bitcoin holders.

Riggs: Bitcoin Is in ‘One of the Top 3 Greatest Buying Opportunities in Investment History’

“What a time,” that’s how Riggs ended his tweet about bitcoin that has garnered close to 900 likes. Those concluding words indicate the analyst’s level of confidence. According to Riggs, the number one cryptocurrency is at a price level that looks extremely attractive. The trader emphasized that there were only two other instances in bitcoin’s history that offered the same buying opportunity.

To drive his claim, the trader points to the beginning of the 2013 and 2017 bull markets. In both periods, bitcoin had just risen from a crippling bear market.

The surge in price was then followed by a significant pullback. The three arrows on the chart point to the instances when the price touched the green indicator. Those moments appear to mark the end of the retracement.

These times offered the best chances to enter the market before the top cryptocurrency went into the stratosphere. They seem to have offered minimum risks and maximum growth opportunities.

Global Turmoil to Drive Bitcoin’s Price Higher

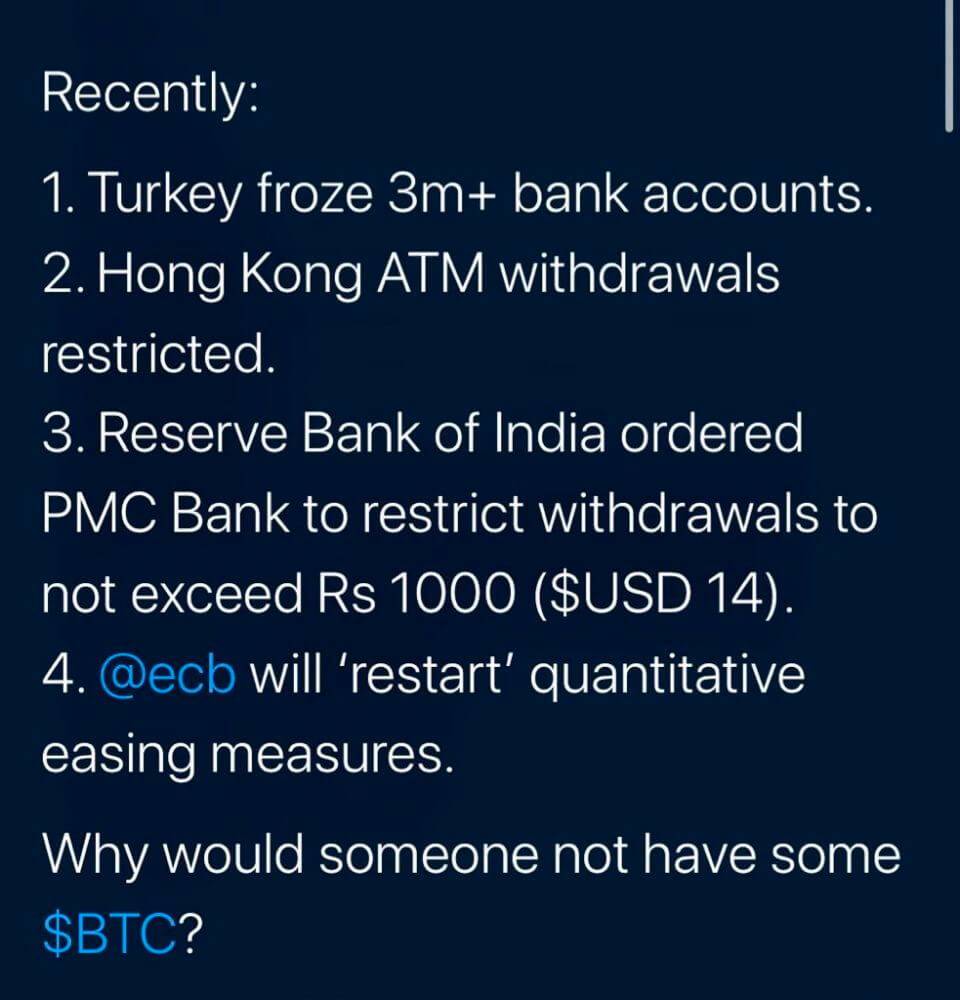

The quant analyst is not only relying on charts to argue his ultra bullish case. The trader also mentioned upheavals around the world that might spark demand for the dominant cryptocurrency. In a tweet, Riggs wrote,

Millions already need BTC to survive, to send money to their families, to preserve their wealth.

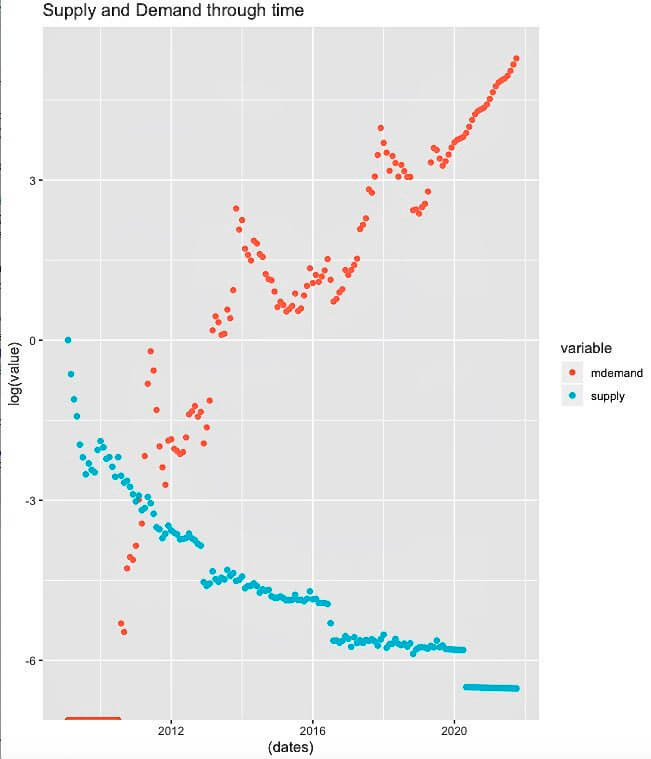

Trader Riggs bolsters his assertions by plotting a chart of bitcoin’s supply and demand over time. Based on the chart, demand for bitcoin would plummet before we enter 2020. However, it will eventually pick up and then skyrocket towards the end of 2020.

On the other hand, supply would take a nosedive next year. This is somewhat accurate because the May 2020 halving would decrease block rewards by half.

Still Best to Practice Caution

Trader Riggs presents a compelling bullish narrative but it’s still wise to practice risk management strategies to protect your capital. Think about setting stops in accordance to your risk appetite. You can also consider buying other assets.

Mati Greenspan, founder of Quantum Economics, echoes these sentiments. When asked if bitcoin’s price is a godsend to long-term holders, the trader told CCN,

No, bitcoin is a risky asset.

The analyst added,

As it seems to me at the moment it could be undervalued. But I’ve been wrong before. Any investment in emerging technology comes with a great deal of risk, which is why we continuously research and always diversify.

After a 50% bitcoin retracement, Riggs tells us that it’s time to buy despite the warnings of many big CT accounts. Only time will tell who’s right.

Disclaimer: The above should not be considered trading advice from CCN. The writer owns bitcoin and other cryptocurrencies. He holds investment positions in the coins but does not engage in short-term or day-trading.

This article was edited by Sam Bourgi.