XRP has seen a slight increase of 3.15% against the USD over the past 24 hours and it’s back up at %excerpt%.2477. The cryptocurrency has lost a total of 16% over the last week. Despite the recent bloodbath, however, XRP is holding up well against BTC.After losing a steep 40% over the past 3 months, XRP remains the third-largest cryptocurrency with a market cap of .67 billion.Looking at the XRP/USD 1-Day Chart:Since our previous XRP/USD analysis, XRP met resistance at %excerpt%.3262 and started to roll over. During the recent declines, XRP dropped significantly, freefalling until finding support at %excerpt%.20. XRP recovered that day as it managed to close above the %excerpt%.2345 support level.From above: The nearest level of resistance lies at %excerpt%.25. Above this, resistance is located at %excerpt%.2584, %excerpt%.27, %excerpt%.2811,

Topics:

Yaz Sheikh considers the following as important: XRP Analysis

This could be interesting, too:

CryptoVizArt writes XRP Breakout Imminent? Ripple Price Analysis Suggests a Decisive Move

CryptoVizArt writes Ripple Price Analysis: Where Is XRP Headed Following Massive Crash and Swift Rebound?

CryptoVizArt writes Ripple Price Analysis: Can XRP Reach in the Following Months?

CryptoVizArt writes Ripple Price Analysis: Can XRP Soar to Soon?

XRP has seen a slight increase of 3.15% against the USD over the past 24 hours and it’s back up at $0.2477. The cryptocurrency has lost a total of 16% over the last week. Despite the recent bloodbath, however, XRP is holding up well against BTC.

After losing a steep 40% over the past 3 months, XRP remains the third-largest cryptocurrency with a market cap of $10.67 billion.

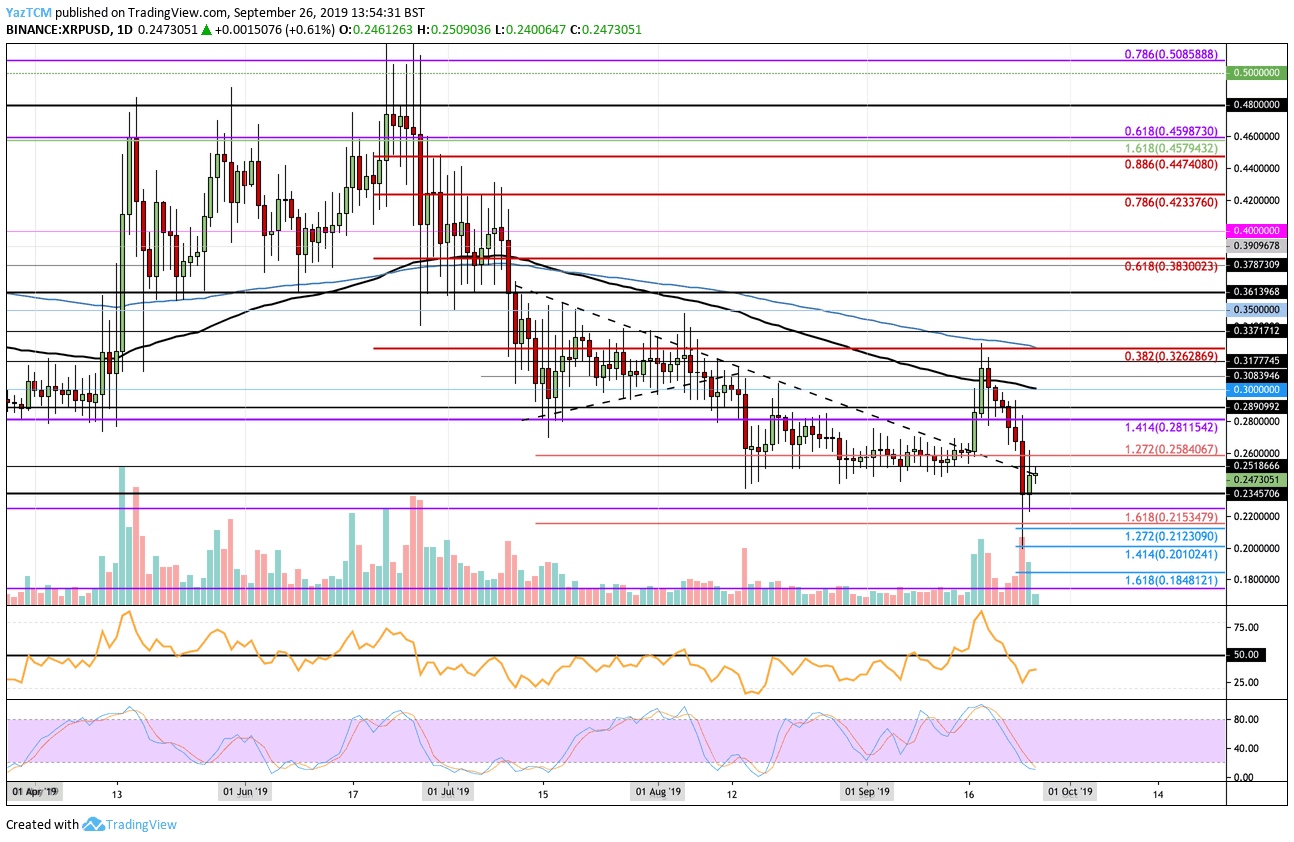

Looking at the XRP/USD 1-Day Chart:

- Since our previous XRP/USD analysis, XRP met resistance at $0.3262 and started to roll over. During the recent declines, XRP dropped significantly, freefalling until finding support at $0.20. XRP recovered that day as it managed to close above the $0.2345 support level.

- From above: The nearest level of resistance lies at $0.25. Above this, resistance is located at $0.2584, $0.27, $0.2811, $0.2890, and $0.30. The resistance at $0.30 is strengthened by the 100-days EMA. Higher resistance is expected at $0.31, $0.3177, and $0.3262 (bearish.382 Fib Retracement and 200-days EMA).

- From below: The nearest level of support lies at $0.2345. Beneath this, support lies at $0.2250, $0.2150, and $0.2123 (downside 1.272 Fib Extension). Beneath this, support is found at $0.20 and $0.1848 (downside 1.414 and 1.618 Fib Extensions).

- The trading volume has increased substantially during the latter half of September.

- The Stocahstic RSI is prepping itself for a bullish crossover signal which should send the market higher.

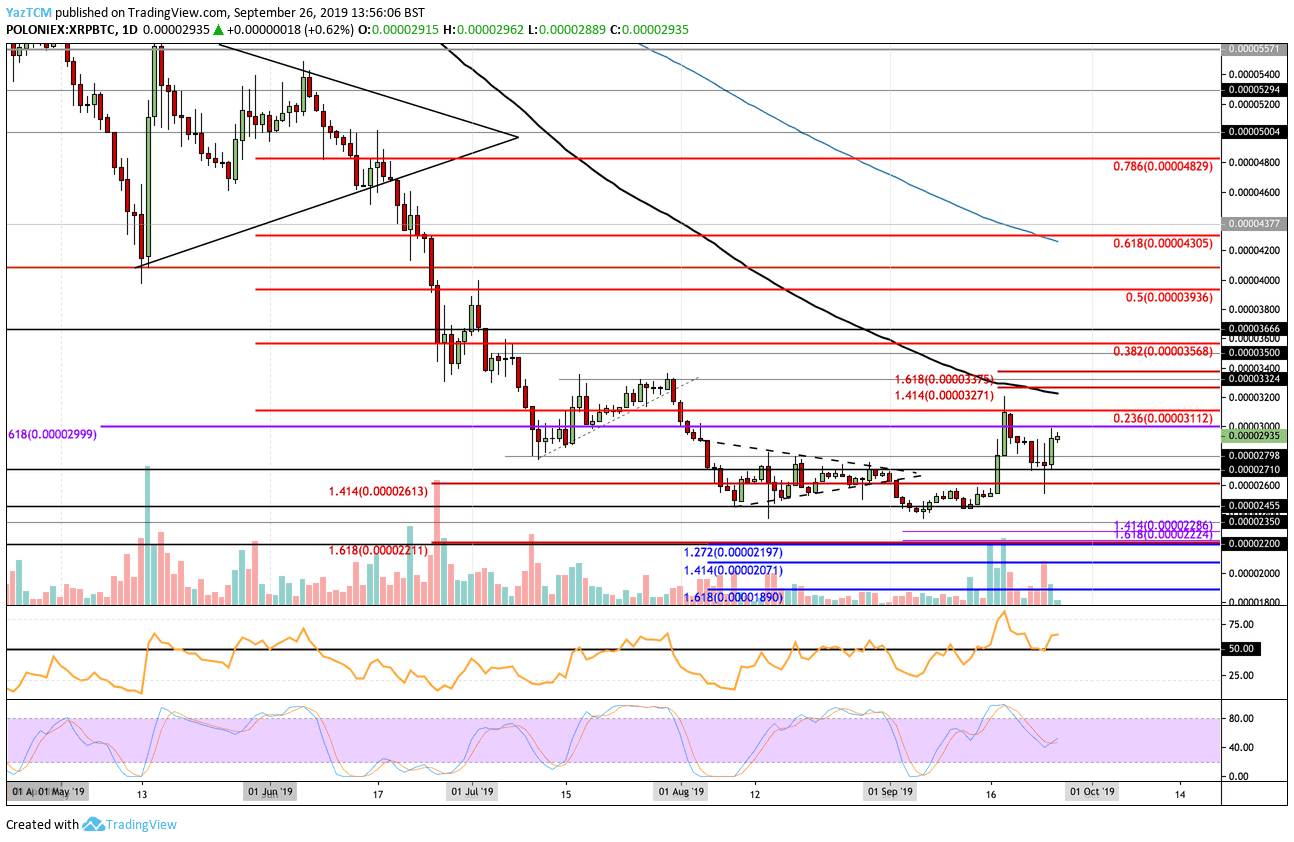

Looking at the XRP/BTC 1-Day Chart:

- Against Bitcoin, XRP performed comparatively well. The cryptocurrency rebounded higher from the 2710 SAT support level and is now attempting to break back above 3000 SAT.

- From above: If the bulls break 3000 SAT, higher resistance lies at 3112 SAT, 3200 SAT (100-days EMA), and 3375 SAT. If the buyers break 3400 SAT, resistance lies at 3568 SAT (bearish .382 Fib Retracement), 3666 SAT, and 4000 SAT.

- From below: The nearest level of support lies at 2798 SAT. Beneath this, support is at 2710 SAT, 2700 SAT, 2600 SAT, and 2455 SAT.

- The trading volume has also increased during the second half of September.

- The RSI has managed to rebound at the 50 level which shows that the bulls remain in complete control over the market momentum. If it can continue to climb, we could expect to see XRP reaching 3200 SAT fairly soon.