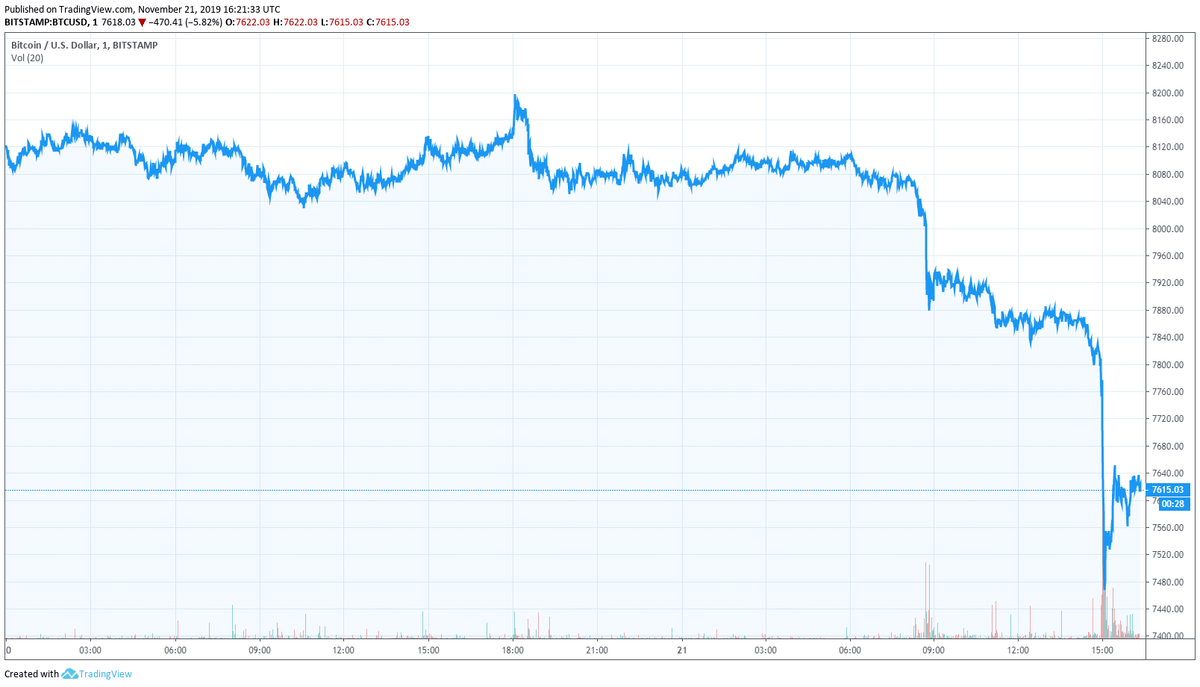

The bitcoin price crashed through another vital support level on Thursday.BTC has now plunged nearly 50% from its mid-year zenith.A legendary bitcoin trader says that this time, it’s “dying” for good.The bitcoin price crashed through another vital support level on Thursday, hastening a decline that has seen the leading cryptocurrency fall nearly 50% from its yearly high.Bitcoin has recovered from these punishing reversals before, but one legendary trader predicts that this time will be different.Bitcoin Price Dives to 4-Week LowThe bitcoin price slid to a four-week low below ,400 on Thursday. | Source: TradingViewThough just six months ago, June 2019 must seem like a distant memory to cryptocurrency investors. Riding the wave of Libra fever, the bitcoin price spiked as high as ,880,

Topics:

Josiah Wilmoth considers the following as important: Cryptocurrency News, Mark Dow

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- The bitcoin price crashed through another vital support level on Thursday.

- BTC has now plunged nearly 50% from its mid-year zenith.

- A legendary bitcoin trader says that this time, it’s “dying” for good.

The bitcoin price crashed through another vital support level on Thursday, hastening a decline that has seen the leading cryptocurrency fall nearly 50% from its yearly high.

Bitcoin has recovered from these punishing reversals before, but one legendary trader predicts that this time will be different.

Bitcoin Price Dives to 4-Week Low

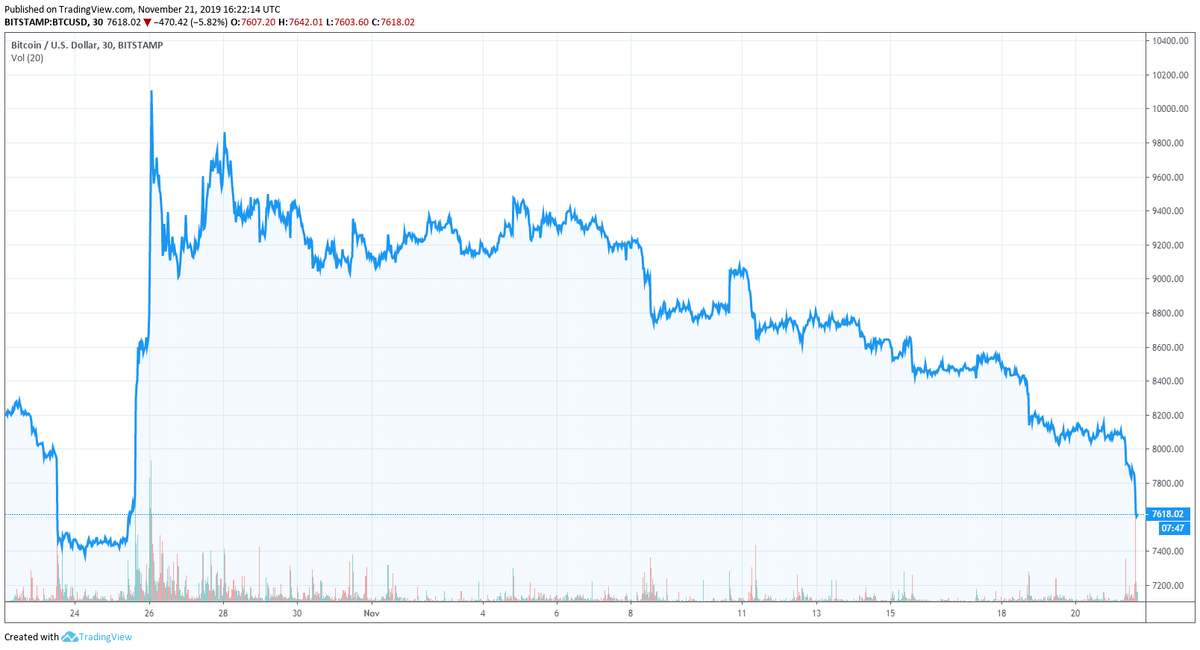

Though just six months ago, June 2019 must seem like a distant memory to cryptocurrency investors. Riding the wave of Libra fever, the bitcoin price spiked as high as $13,880, and some bulls thought BTC could end the year at a new all-time high.

That rally has all but evaporated in the months that followed. While bitcoin’s year-to-date gains remain fantastic, they’ve rapidly unraveled since BTC briefly reclaimed the $10,000 handle four weeks ago.

On Thursday, the bitcoin price careened as low as $7,394 on Bitstamp, notching a 10% decline from the previous day’s high above $8,200.

Bitcoin has now completely erased the late October surge that seemed to follow China’s sudden embrace of blockchain technology. But whether the product of a misguided belief among retail investors that Beijing would soften its stance on public cryptocurrencies or just another orchestrated pump, that rally has entirely disappeared.

Bitcoin now sits at a four-week low.

Even more concerning is that the tumble forced the bitcoin price below its 200-day moving average (DMA), a closely-monitored technical indicator that almost always screams, “Sell!” Unless assets quickly regain that level, the 200-DMA will transform from support into a new resistance line.

‘Big BTC Short’ Trader Sounds the Death Knell

Mark Dow, a former US Treasury and International Monetary Fund economist, says that there’s no recovery coming. “Bitcoin is dying,” he boasted on Twitter.

It’s not unusual for the bitcoin bears to come out of the woodwork during dramatic market pullbacks to boast about their prescience. Crypto investors have grown accustomed to the death knells. After all, skeptics have been predicting its demise for a decade – one curated list includes nearly 400 separate “bitcoin obituaries.”

However, Dow is no garden-variety crypto skeptic. He famously began shorting bitcoin in late 2017 when the price ballooned to just under $20,000. He rode the crypto market’s brutal decline all the way down to about $3,500, where he finally closed his short position.

Dow believes the flagship cryptocurrency is locked in an “echo bubble unwind,” which will feature “occasional upside spasms” like the ones investors enjoyed earlier in 2019. However, he expects to observe “progressively weaker FOMO” as BTC’s Dec. 2017 highs grow smaller and smaller in the rearview mirror.

As he tweeted earlier this week:

We’ll see if 200dma matters to #bitcoin. But truly strong assets don’t give back moves like the one up thru 10k, esp when they start from so far below ATHs

Thesis of echo bubble unwind, w occasional upside spasms & progressively weaker FOMO, just got a lot stronger. $XBT $BTC