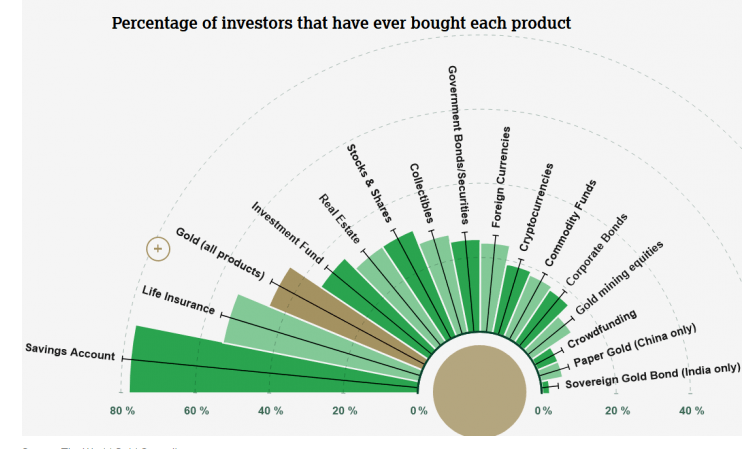

A research report published by cryptocurrency firm Coinshares shows millennials’ increasing lack of trust in fiat currencies.A number of countries witnessed massive inflation in 2018, further hurting confidence in fiat.Google search for terms “bitcoin” and “cryptocurrency” increased at the same time and coincided with a surge in market cap cryptocurrencies.Last week, British cryptocurrency research firm Coinshares published its ‘Crypto Trends Report’. Their research, coupled with the report from World Gold Council, revealed that millennials and even Gen Z are gradually losing confidence in fiat currencies.Cryptocurrency buying overtakes bonds and funds. |Source: CoinsharesThis comes at a time when multiple countries around the world printed double- or even triple-digit inflation numbers.

Topics:

Ayush Singh considers the following as important: cryptocurrency, Cryptocurrency News

This could be interesting, too:

Fintechnews Switzerland writes How DeepSeek Could Propel the AI Agent Crypto Market Beyond Meme Coins to Sustainable Business Models

Emily John writes Over 1200 Crypto ATMs Shutdown in US Amid Crash

Christian Mäder writes These Are the 5 Bitcoin Initiatives in the US at the Federal Level

Emily John writes Avalanche Foundation and Rain Launch Crypto Payment Card

- A research report published by cryptocurrency firm Coinshares shows millennials’ increasing lack of trust in fiat currencies.

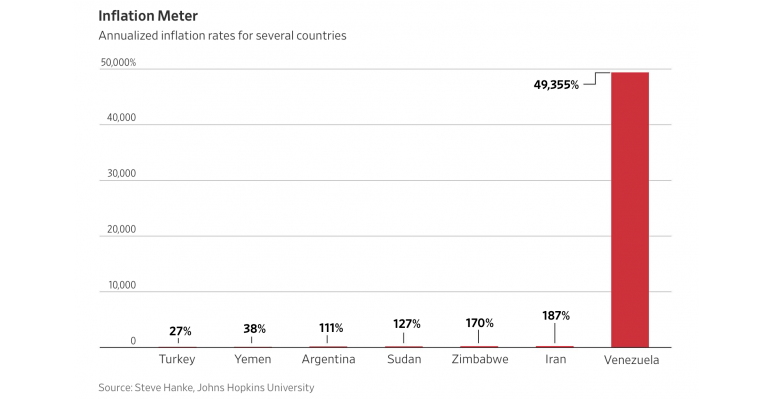

- A number of countries witnessed massive inflation in 2018, further hurting confidence in fiat.

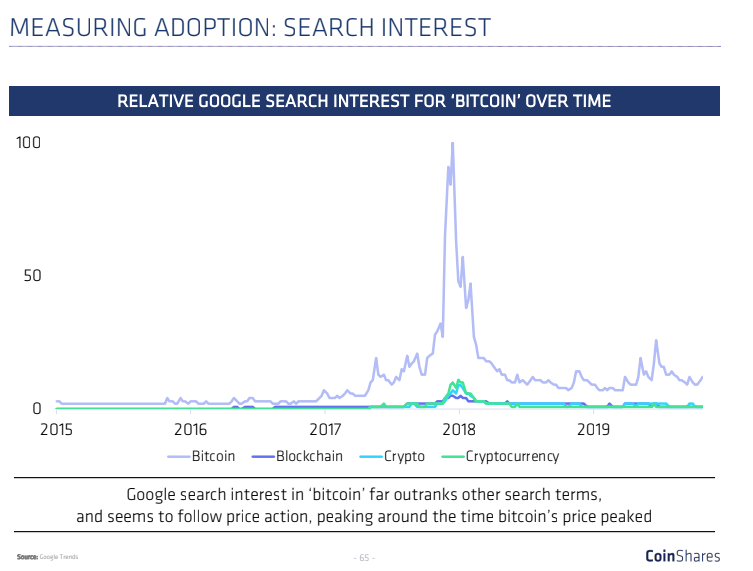

- Google search for terms “bitcoin” and “cryptocurrency” increased at the same time and coincided with a surge in market cap cryptocurrencies.

Last week, British cryptocurrency research firm Coinshares published its ‘Crypto Trends Report’. Their research, coupled with the report from World Gold Council, revealed that millennials and even Gen Z are gradually losing confidence in fiat currencies.

Source: Coinshares

This comes at a time when multiple countries around the world printed double- or even triple-digit inflation numbers. In 2018, Argentina, Iran, Turkey, Sudan, Yemen and Zimbabwe reported huge annualized inflation rates. Of course, the obliteration of Bolivar deserves no special mention. Zimbabwe’s long-standing battle with hyperinflation is no stranger as well.

Source: Gold Telegraph

When the news of the collapse of several country currencies hit the world, many took to the internet to search for alternative investments to fiat currencies. The Google search rank of the term “bitcoin” spiked sharply followed by other terms such as “cryptocurrency” and “blockchain”.

Source: Coinshares

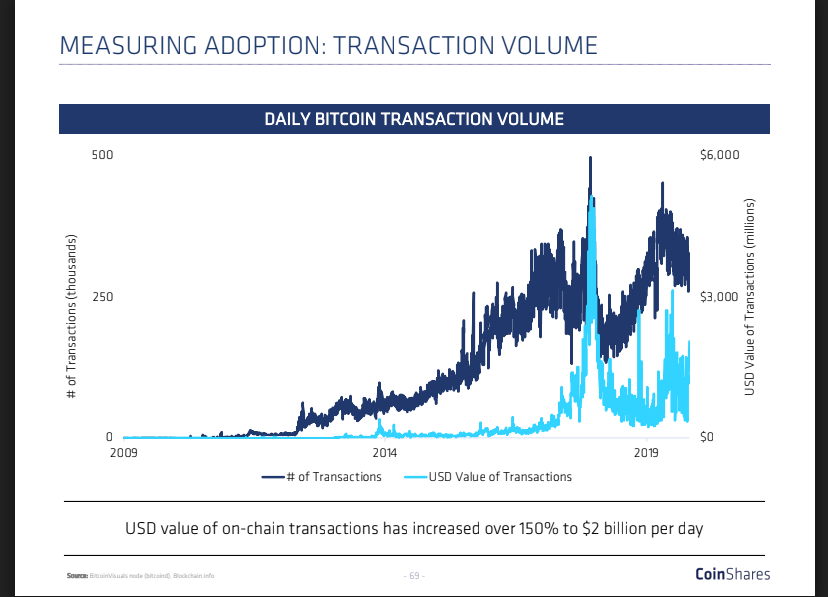

However, these search trends weren’t just to satisfy the curiosity for blockchain and crypto. Many were converted into transactions of some value. This was reflected in the surge in market cap of on-chain transactions. The market cap rose 150% to almost $2 billion a day and as evident in the chart below.

Source: Coinshares

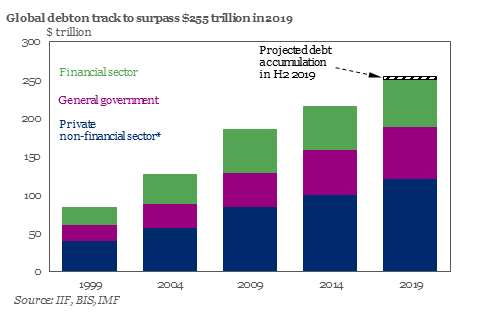

Milennials’ trust in their countries’ currencies seems to be evaporating fast. The lack of confidence doesn’t come as a surprise as the total global debt towering continues to climb. To put into perspective, the world’s debt as a per cent of GDP is estimated to hit 330% by the end of 2019.

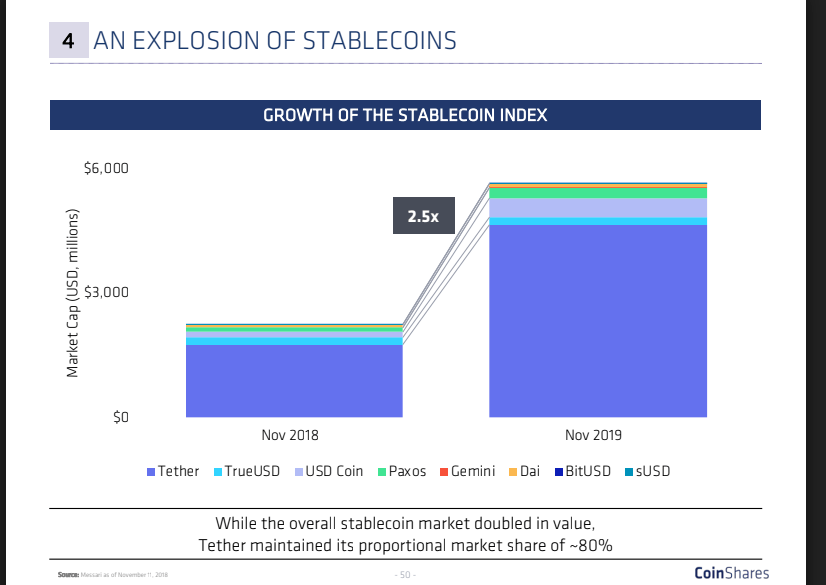

Need for Stable Cryptocurrency also Rising

The search for a decentralized digital currency has not stopped at bitcoin. The growing interest in stablecoins—a digital asset pegged to a cryptocurrency, fiat money or commodity—has seen a major move higher as well. Although the overall interest in cryptocurrency is increasing, the rising level of stablecoin index indicates that crypto volatility has pushed conservative crypto buyers towards more stable assets like Tether.

Source: Coinshares

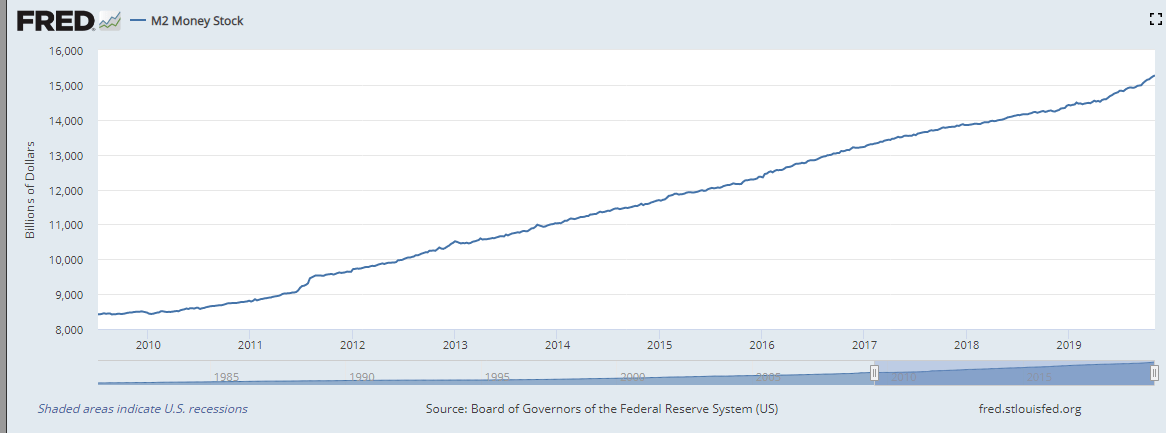

As central banks’ plan to inflate away the debt (by printing more money) is killing the purchasing power of fiat money, many investors are turning to cryptocurrency.

Source: Fred

Growing interest in cryptocurrency says a lot about how modern investors are becoming wary of the printed piece of paper that loses value every second and has a history of pushing countries into anarchy.