Binance Futures traders held more open positions in June compared to May, even though trading volumes declined month-on-month. Open interest on Binance Futures rose 180% in June compared to May, from 220 million USDT to 580 million USDT. Binance concluded that this might anticipate an increase in Bitcoin volatility.Traders Held More Open Positions in BTC Contracts Than in MayBinance released its monthly report discussing the activity on its futures trading platform. While trading volume declined compared to May, open interest almost tripled.Last month, trading volume on Binance Futures dropped 36% from May to .6 billion traded in perpetual contracts. The daily average volume was .9 billion, down 34% from May. Bitcoin’s low volatility might explain the decline in trading volume. The

Topics:

Anatol Antonovici considers the following as important: AA News, Altcoin Season, Binance, Binance Futures, btcusd, btcusdt

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes Mit Binance kann jetzt jeder einfach 2’000 USDC verdienen: EARN TOGETHER

Bitcoin Schweiz News writes Bitpanda vs. Binance: Welche Bitcoin-App ist die beste für die Schweiz?

Bitcoin Schweiz News writes Binance: Warum diese Bitcoin-Börse die Konkurrenz abhängt!

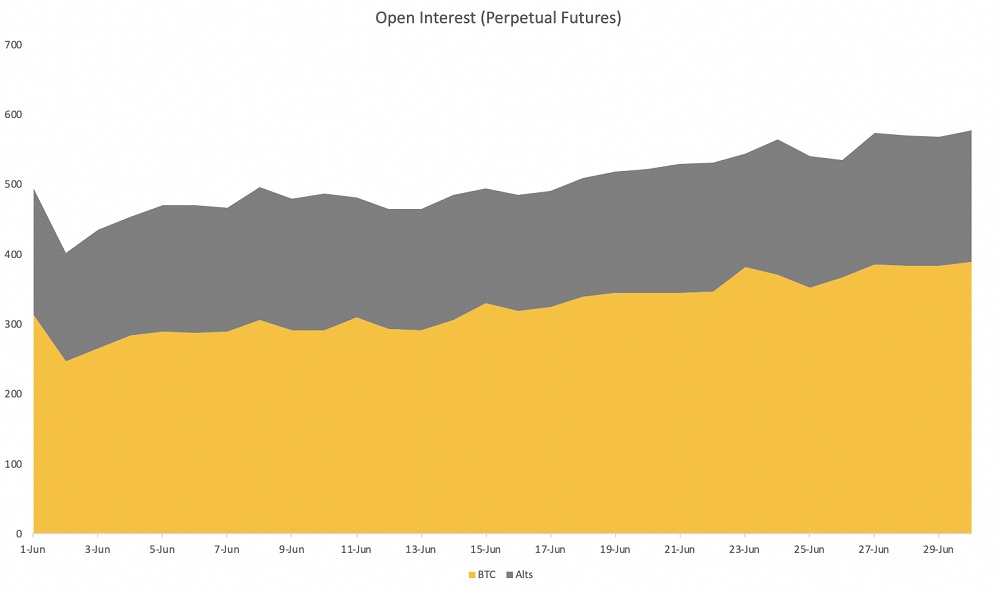

Binance Futures traders held more open positions in June compared to May, even though trading volumes declined month-on-month.

Open interest on Binance Futures rose 180% in June compared to May, from 220 million USDT to 580 million USDT. Binance concluded that this might anticipate an increase in Bitcoin volatility.

Traders Held More Open Positions in BTC Contracts Than in May

Binance released its monthly report discussing the activity on its futures trading platform. While trading volume declined compared to May, open interest almost tripled.

Last month, trading volume on Binance Futures dropped 36% from May to $87.6 billion traded in perpetual contracts. The daily average volume was $2.9 billion, down 34% from May. Bitcoin’s low volatility might explain the decline in trading volume. The oldest cryptocurrency hasn’t been such dormant since October 2019, according to the crypto exchange.

Despite the decline in volumes, open interest surged 180%. This might point to increased demand for more exposure-driven activity on Binance Futures, i.e., traders are interested in holding the positions rather than profit from the short-term fluctuations.

For those unfamiliar, the open interest gauge reflects the number of futures contracts or positions than haven’t been settled yet at a given time. Elsewhere, the volume figure touches upon the number of futures being exchanged between buyers and sellers. Thus, while volume decreased, there are even more open positions, suggesting that traders might expect an increase in volatility.

BTC/USDT Still Dominates Perpetual Contracts on Binance Futures

BTC perpetual contracts were the most traded even though Binance introduced six new altcoin contracts, bringing the total number to 31. Binance Futures added ALGO, ZIL, KNC, ZRX, COMP, and OMG – all traded against USDT. Besides this, the platform added a new contract type – quarterly futures.

Open interest in Bitcoin contracts increased despite the BTC’s low volatility. This happened even if the king of crypto delivered negative returns in June, dropping over 3%. Major altcoins like ETH, BCH, and EOS followed with similar losses. Still, those who invested in mid-cap tokens, including ADA, VET, LINK, and BAT, could secure decent gains. For example, VET surged 40% over the month.

Binance’s futures platform noted an increased demand for altcoins, as the volume percentage across altcoin perpetual contracts, rose to over a quarter, from 17.9% in May. On the other side, BTC contracts accounted for 73.3% versus 82.1% in May.

Indeed, everyone is talking about the revived altcoin season, as VeChain, Chainlink, Dogecoin, and other tokens have experienced impressive gains over the last few weeks. More importantly, they moved independently from Bitcoin, which suggests that altcoins have matured.

It’s worth mentioning that the altcoins rally is mainly driven by decentralized finance (DeFi) tokens.