Just a few days after the US election is over, world pharmaceutics giant Pfizer announces that it’s COVID-19 vaccine is 90% effective. The news spread rapidly through the media and sparked a surge of the US indices.Thus, Dow Jones gained 4,56% reaching an all-time high at 29,616, S&P 500 is up 3.20% traded at 3,620.60 reaching an all-time high, and Nasdaq is up only 1.02% with its own all-time record at 12,005. This significant update from Pfizer gave hope for the sooner renewal of travels as New-Year and Christmas holidays approach, hence stock prices of major airline companies soared as well crude oil prices, as both WTI and Brent are up almost 10%.Bitcoin is in a danger zone as it is currently traded below the MA100 on an hourly chart and is about to touch important dynamic and static

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Just a few days after the US election is over, world pharmaceutics giant Pfizer announces that it’s COVID-19 vaccine is 90% effective. The news spread rapidly through the media and sparked a surge of the US indices.

Thus, Dow Jones gained 4,56% reaching an all-time high at 29,616, S&P 500 is up 3.20% traded at 3,620.60 reaching an all-time high, and Nasdaq is up only 1.02% with its own all-time record at 12,005. This significant update from Pfizer gave hope for the sooner renewal of travels as New-Year and Christmas holidays approach, hence stock prices of major airline companies soared as well crude oil prices, as both WTI and Brent are up almost 10%.

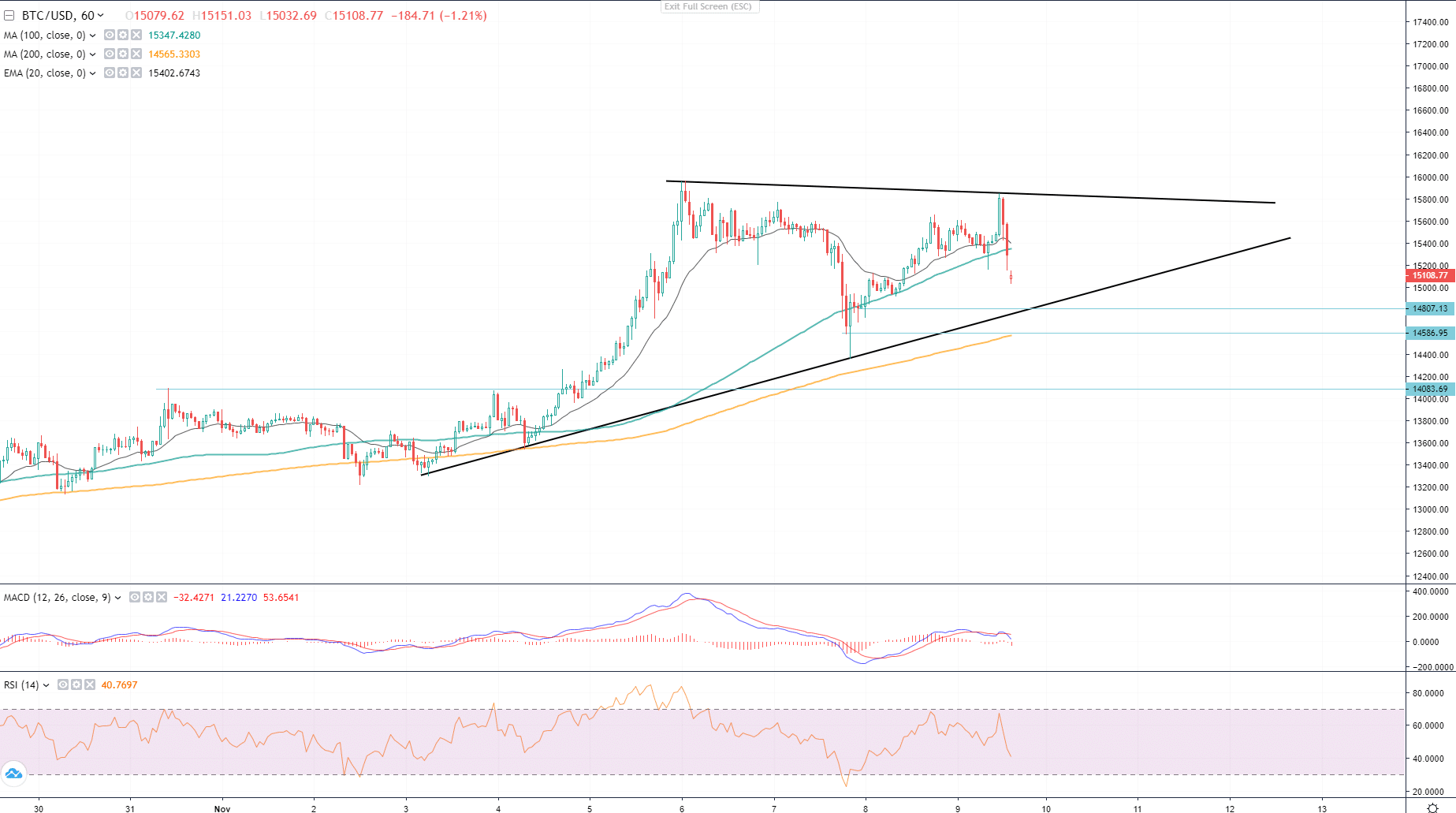

Bitcoin is in a danger zone as it is currently traded below the MA100 on an hourly chart and is about to touch important dynamic and static support levels at $14,807.

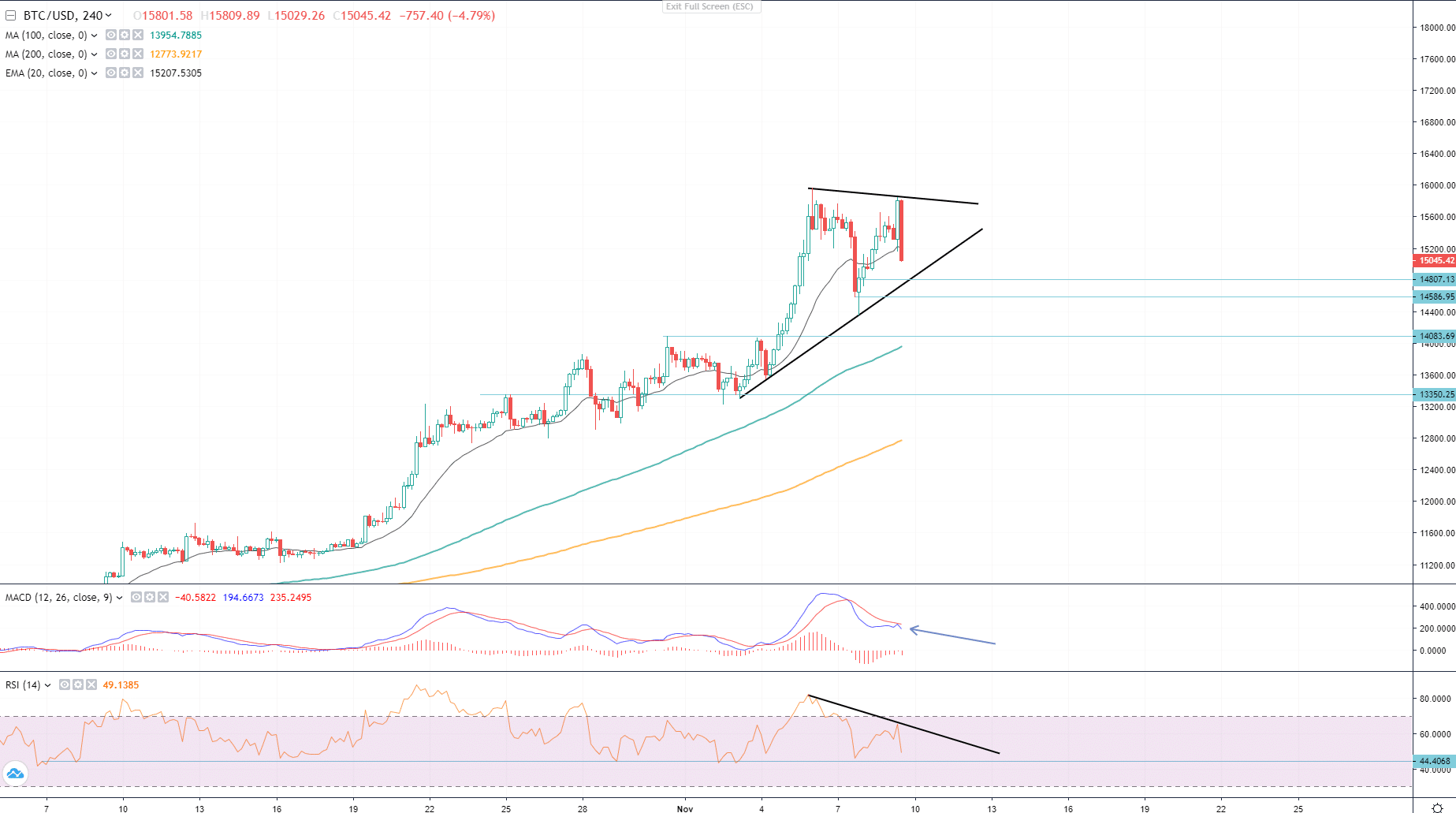

If the $14,807 support withholds, Bitcoin has all chances to retrace and test the resistance near $15,700 – $15,750, although a 4-hour chart demonstrates that BTC could plummet further.

MACD indicator already signalled the divergence of the digital Gold traded against the US Dollar, RSI indicator also shows a heavy divergence, however for the past month BTC never was oversold and created its own mid-chart support level on RSI. As seen on the chart above BTC/USD will drop to $14,083 if it closes below the dynamic resistance, where it will also touch the MA100.

For safe-haven assets, such as Gold, Silver and the digital-Gold – Bitcoin (BTC) the news does not sound positive and all three dropped by near 5%. The plummet of Gold and Bitcoin can be explained by other major events that will take place this and next month. As the Sale seasons, Christmas and New Year approach there will be a huge demand for cash, though it might not be as high as during the previous year due to lockdowns, many will consider converting their assets to cash to purchase belongings and gifts.

Senior Vice President at Overbit. Technical analyst, crypto-enthusiast, ex-VP at TradingView, medium and long-term trader, trades and analyses FX, Crypto and Commodities markets.