Bitcoin failed to breach the ,000 mark and is now seemingly entering a consolidation stage again. However, a new wave of volatility may be on the way as CME futures contracts and 0 million worth of options will expire on August 28, which might trigger mass liquidation.Bitcoin has been rejected at the ,900 level twice, and what came after were large sell-offs, which further pushed down the price of Bitcoin. If bitcoin continues to fall, a bigger correction to as low as ,600 seems possible. But some analysts remain confident of the near-term price movement and consider the recent drops minor corrections before bitcoin retest the ,000 level. “The pullback in bitcoin appears healthy,” Katie Stockton, analyst at Fairlead Strategies shared. “There is room for further near-term

Topics:

Guest considers the following as important: Sponsored

This could be interesting, too:

Guest User writes The Power of Smart Contracts in the World of DeFi

Guest User writes Explore a Universe of Opportunities in Digital Asset Trading at KoinBay

Guest User writes Strategies for Success: Effective Strategies for Affiliate Marketing Beginners and Benefits for XERAPRO Users

Guest User writes The Benefits of WEWE Global’s Referral Marketing in the Crypto World

Bitcoin failed to breach the $12,000 mark and is now seemingly entering a consolidation stage again. However, a new wave of volatility may be on the way as CME futures contracts and $700 million worth of options will expire on August 28, which might trigger mass liquidation.

Bitcoin has been rejected at the $11,900 level twice, and what came after were large sell-offs, which further pushed down the price of Bitcoin. If bitcoin continues to fall, a bigger correction to as low as $9,600 seems possible.

But some analysts remain confident of the near-term price movement and consider the recent drops minor corrections before bitcoin retest the $12,000 level. “The pullback in bitcoin appears healthy,” Katie Stockton, analyst at Fairlead Strategies shared. “There is room for further near-term downside with support in the $10,000-$10,055 area, where there was once resistance, and room to short-term oversold territory.”

How BTC Futures Generates Profits?

Bitcoin failing to reach a higher level is certainly bad for some holders, but we can make the best of the situation by trading futures.

BTC futures trading enables traders to long or short BTC, so traders can earn money as long as their predictions are right. While spot traders only earn profits when the price of bitcoin goes up. Furthermore, traders can borrow leverage from exchanges to increase their buying power, thus multiplying their profits.

Let’s see how:

Step 1: the current price of BTC is $11,000. If you believe the price is going to drop, you can open a short position with 0.01 BTC. Now, 0.01 BTC may not seem much, but with 100x leverage, you can open a contract worth 1 BTC.

Step 2: When the price of BTC declines to $10,000, you close the position.

Profit: ($11,000 – $10,000) * 1 BTC/$10,000=0.1 BTC.

ROI: 0.1/0.01*100%=1000%

Bexplus is a leading crypto derivatives platform offering 100x leverage in BTC, ETH, EOS, LTC, and XRP futures contracts. No KYC, no deposit fee, traders can receive the most attentive services, including 24/7 customer support.

- Demo account with 10 BTC

Bexplus is one of the few exchanges that offer a free demo account, which puts you through its rules and trading widgets. Inside the demo account is 10 BTC for traders to practice and try out strategies as much as they like.

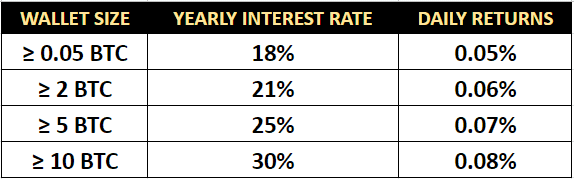

- BTC Wallet: up to 30% Annualized Interest Without Any Risks

Bexplus users can gain profits not only from trading. Join the Bexplus wallet to earn up to 30% annualized interest without taking risks. With up to 30% annualized interests, it is no doubt one of the most profitable rates in the industry.

While most lending platforms require traders to deposit at least 1 BTC, traders can make a deposit starting from 0.05 BTC on Bexplus.

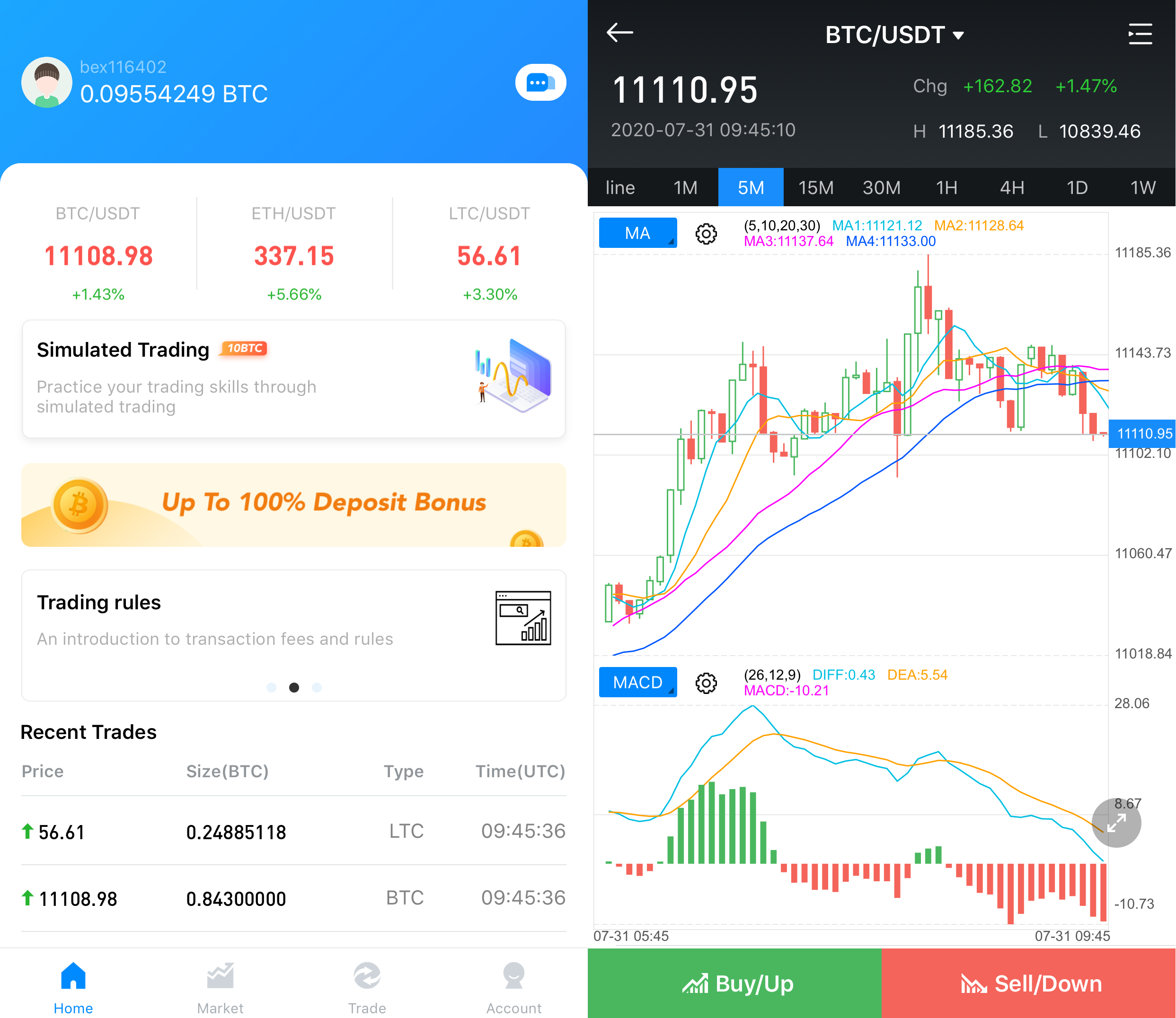

- Trade Freely on Android & iOS

The top-ranking Bexplus app integrates all the necessary functions and tools (real-time charts, a variety of indicators, news alerts and etc.) while keeping a minimalist and intuitive interface. With the Bexplus app, you can manage your account anywhere and anytime you want. Furthermore, the 24/7 notification could keep you updated with big price movements, making it easier to secure your positions.

- Deposit Activity to Earn 100% BTC Cashback

Deposit BTC in the Bexplus account and you can earn a 100% BTC bonus, which can also be used to trade futures contracts. Plus, more margins reduce the likelihood of forced liquidation. The more deposit, the more bonus you will get. Up to 10 BTC is available for each deposit.

A successful trader always diversifies his/her strategies and adapts to the market changes. Bexplus offers you infinite opportunities to earn profits. Don’t hesitate to join Bexplus and claim your bonuses!

Follow Bexplus on:

Website: https://www.bexplus.com/

Telegram: https://t.me/bexplusexchange

Apple App Store: https://itunes.apple.com/app/id1442189260?mt=8

Google Play: https://play.google.com/store/apps/details?id=com.lingxi.bexplus