Just four days ago, one Bitcoin was trading for over ,000. However, the cryptocurrency markets followed the global markets, and as of writing these lines Bitcoin fights to close the daily candle above ,000.If the bad blood coming from the equity markets was not enough, then came the SUSHI sell-off by its creator. This led the defi tokens, mainly Ethereum, to severe drops, which did not skip Bitcoin as the primary cryptocurrency.As of now, Bitcoin marks 50 as of today’s low, which is an intraday loss of 0. 50 is also the lowest BTC price recorded since July 26, 2020.Key Support and Resistance For Bitcoin’s Short-termThe critical level here is ,000. There is not much time left for the daily close, and Bitcoin will look to finish today and tomorrow’s candle (the weekly)

Topics:

Yuval Gov considers the following as important: Bitcoin (BTC) Price, BTC Analysis, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Wayne Jones writes Metaplanet Acquires 156 BTC, Bringing Total Holdings to 2,391

Just four days ago, one Bitcoin was trading for over $12,000. However, the cryptocurrency markets followed the global markets, and as of writing these lines Bitcoin fights to close the daily candle above $10,000.

If the bad blood coming from the equity markets was not enough, then came the SUSHI sell-off by its creator. This led the defi tokens, mainly Ethereum, to severe drops, which did not skip Bitcoin as the primary cryptocurrency.

As of now, Bitcoin marks $9850 as of today’s low, which is an intraday loss of $600. $9850 is also the lowest BTC price recorded since July 26, 2020.

Key Support and Resistance For Bitcoin’s Short-term

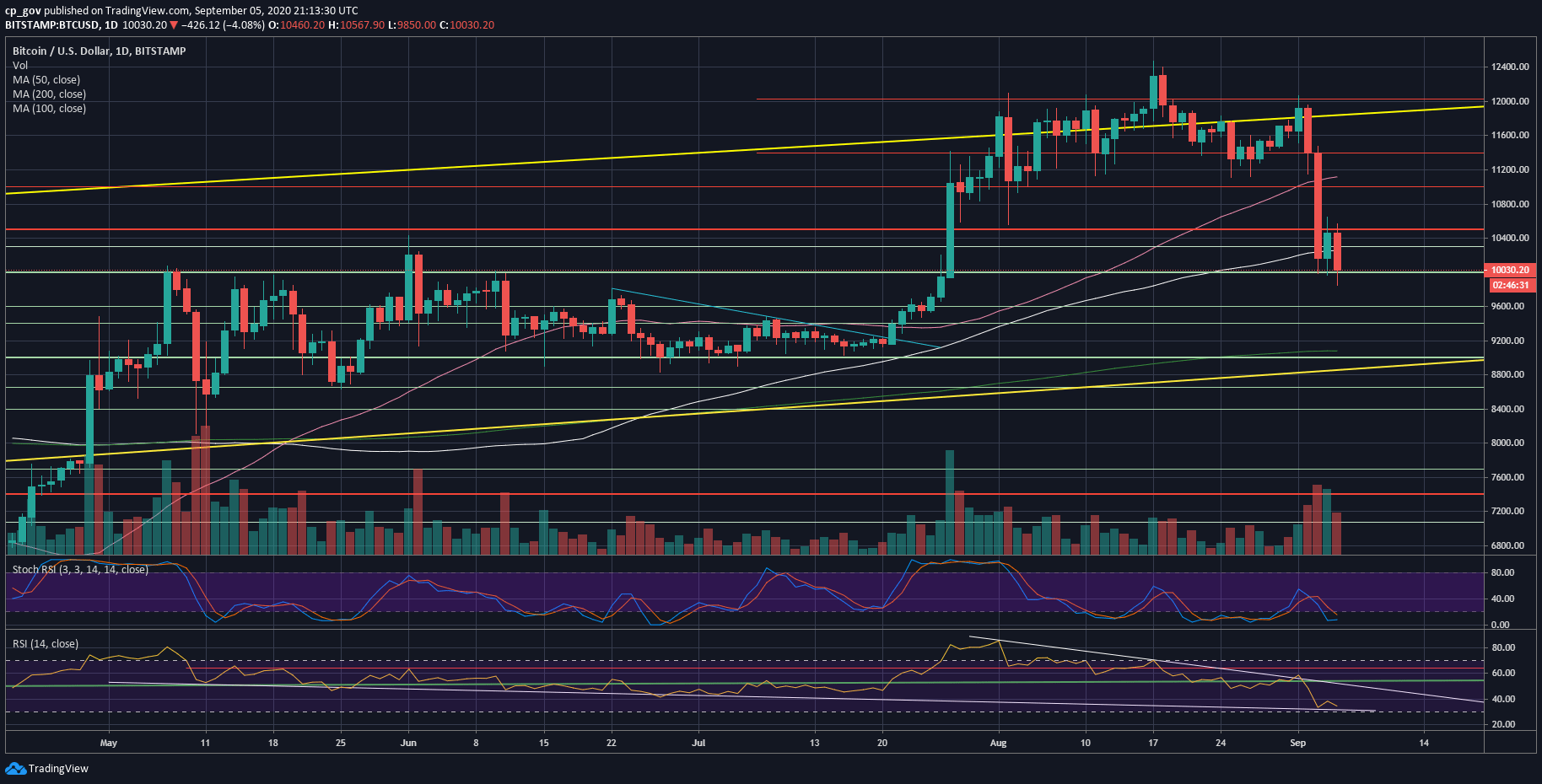

The critical level here is $10,000. There is not much time left for the daily close, and Bitcoin will look to finish today and tomorrow’s candle (the weekly) above $10,000.

In case Bitcoin losses the 5-figures number, then $9800 will be the next support. Further below lies $9600, which is also the CME gap.

If the latter does not hold, then the next support could be found at $9400, followed by the 200-days moving average line at $9100.

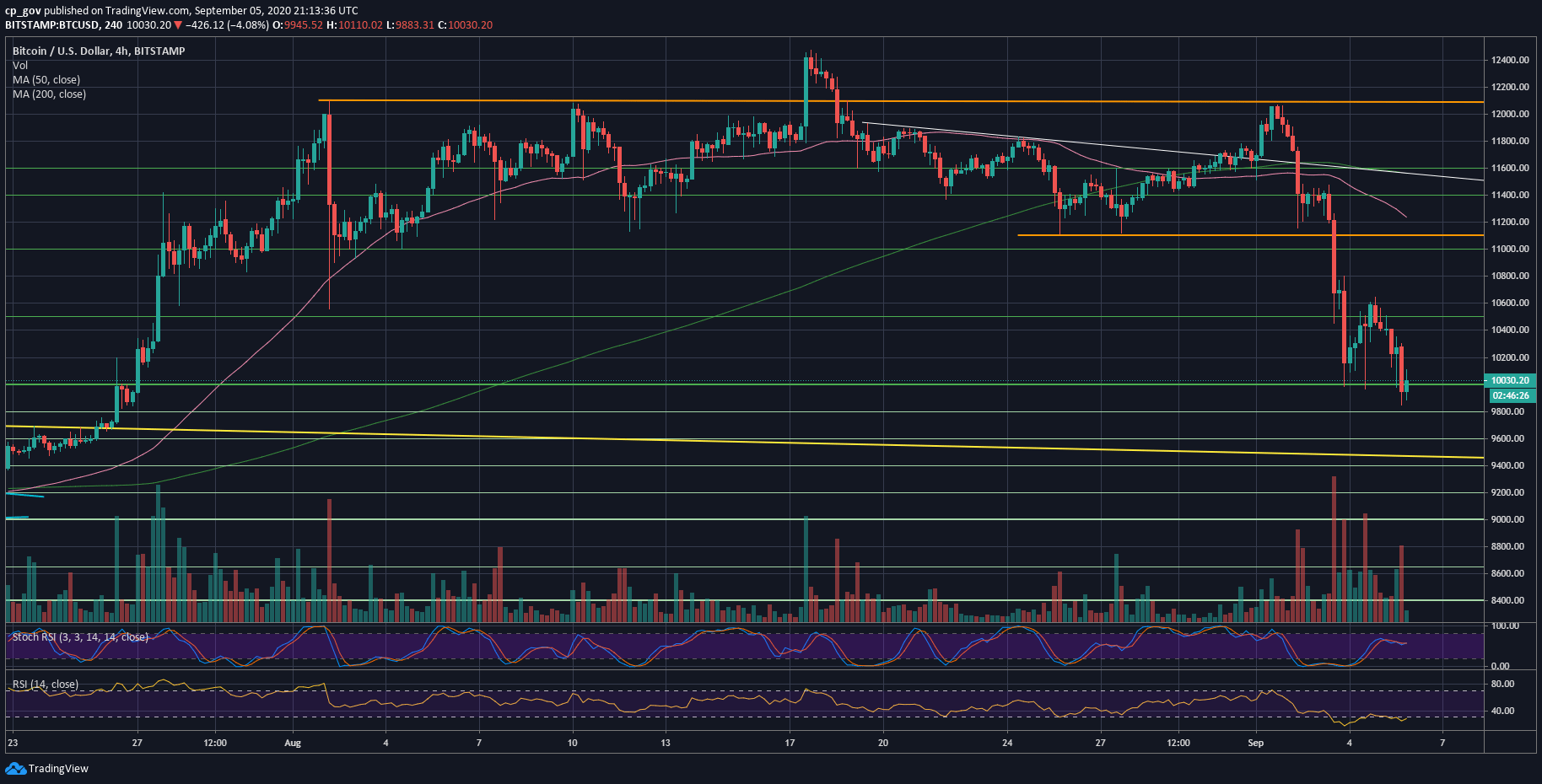

On the other hand, there is a high chance that we will see a correction after so much blood. The first level of resistance now becomes the 100-days moving average line at $10,250 (the white line on the daily chart). This is followed by $10,500 – the previous 2020 high before August.

Further above lies $10,800 and $11,000 – $11,100, along with the 50-days moving average line (marked pink on the following daily chart).

From a technical point of view, the RSI is nearing an oversold level. This supports the option of some bullish correction. Adding to the above, there is a little bit of bullish divergence on the 4-hour RSI.

As opposed to the above, the last drops were followed by a huge amount of volume. This is in favor of the bears. Thursday’s sell-off volume was the highest over the past 30-days. So short term, we might be a temp correction; however, mid-term is still bearish until proved otherwise (a weekly close above $11,000).

Total Market Cap: $323 billion

Bitcoin Market Cap: $185 billion

BTC Dominance Index: 57.3%

*Data by CoinGecko