Over the past day, we saw the Bitcoin price trading inside the tight range between 00 and 00. A few hours ago, Bitcoin finally seemed to break successfully to the upside touching 00; however, the primary cryptocurrency got rejected very quickly, plunging 0 immediately back inside the described trading range.Over the past weeks, we had mentioned the correlation between Bitcoin and the global markets. This correlation disappeared at some point, but as of writing these lines and over the past day, we saw Bitcoin following the Wall Street futures.It will be interesting to see how today’s trading day develops in Wall Street, and see if Bitcoin acts accordingly or not.As mentioned in yesterday’s analysis, the 00 – 00 range is a tough resistance for Bitcoin. As of now, it will

Topics:

Yuval Gov considers the following as important: Bitcoin (BTC) Price, BTC Analysis, btcusd

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Wayne Jones writes Metaplanet Acquires 156 BTC, Bringing Total Holdings to 2,391

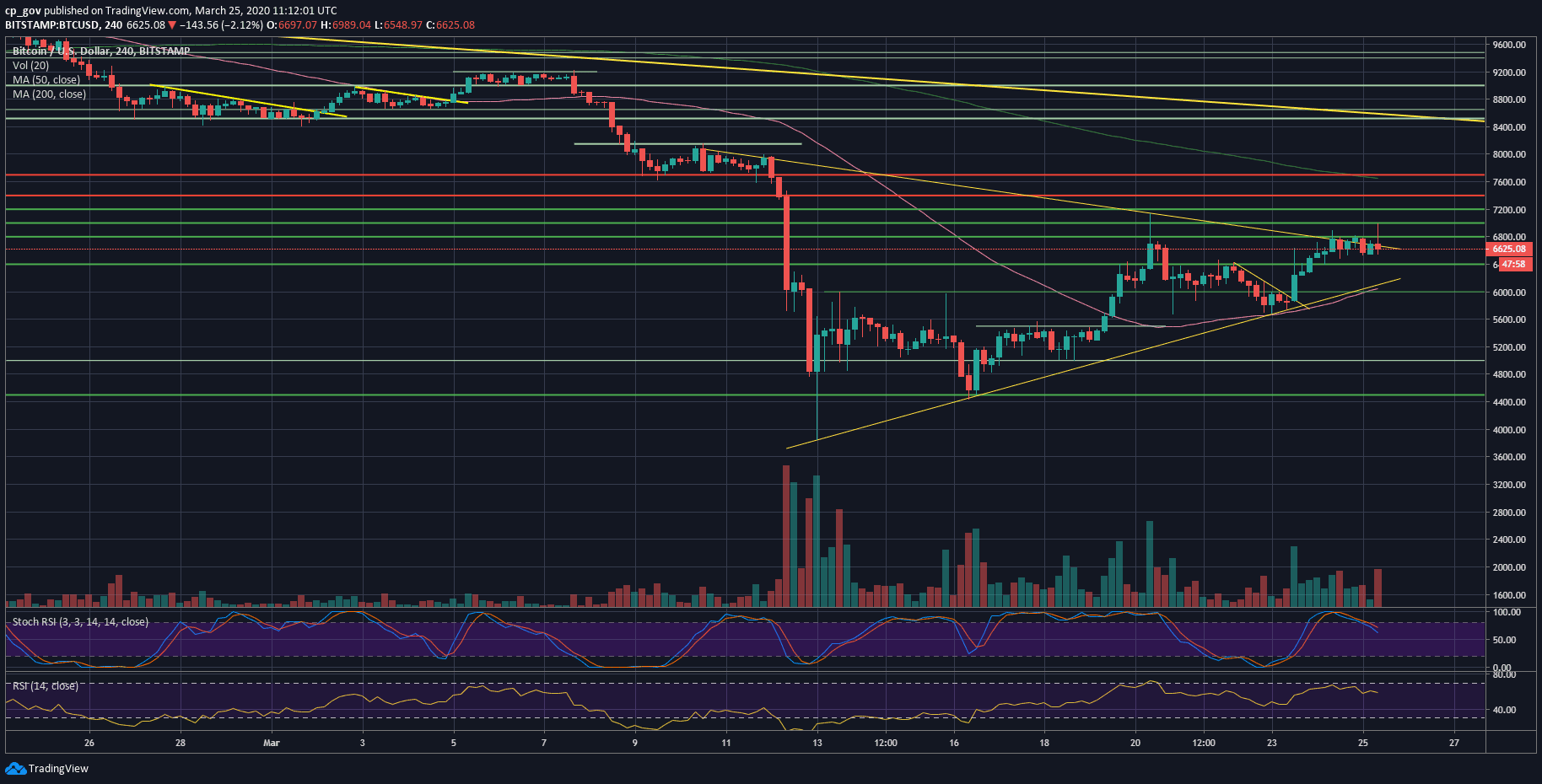

Over the past day, we saw the Bitcoin price trading inside the tight range between $6600 and $6800. A few hours ago, Bitcoin finally seemed to break successfully to the upside touching $7000; however, the primary cryptocurrency got rejected very quickly, plunging $400 immediately back inside the described trading range.

Over the past weeks, we had mentioned the correlation between Bitcoin and the global markets. This correlation disappeared at some point, but as of writing these lines and over the past day, we saw Bitcoin following the Wall Street futures.

It will be interesting to see how today’s trading day develops in Wall Street, and see if Bitcoin acts accordingly or not.

As mentioned in yesterday’s analysis, the $6800 – $6900 range is a tough resistance for Bitcoin. As of now, it will be interesting to see if Bitcoin can maintain the trading range (between $6600 and $6800).

If Bitcoin can’t break above the mentioned resistance, it might confirm a double-top formation in the short-term, which is a bearish pattern. This top around $7,000 was reached five days ago as well.

Besides, looking at the 4-hour chart’s symmetrical triangle, we notice that Bitcoin couldn’t break out of the triangle (candle open above), and as of now, it follows the path of the upper descending trend-line.

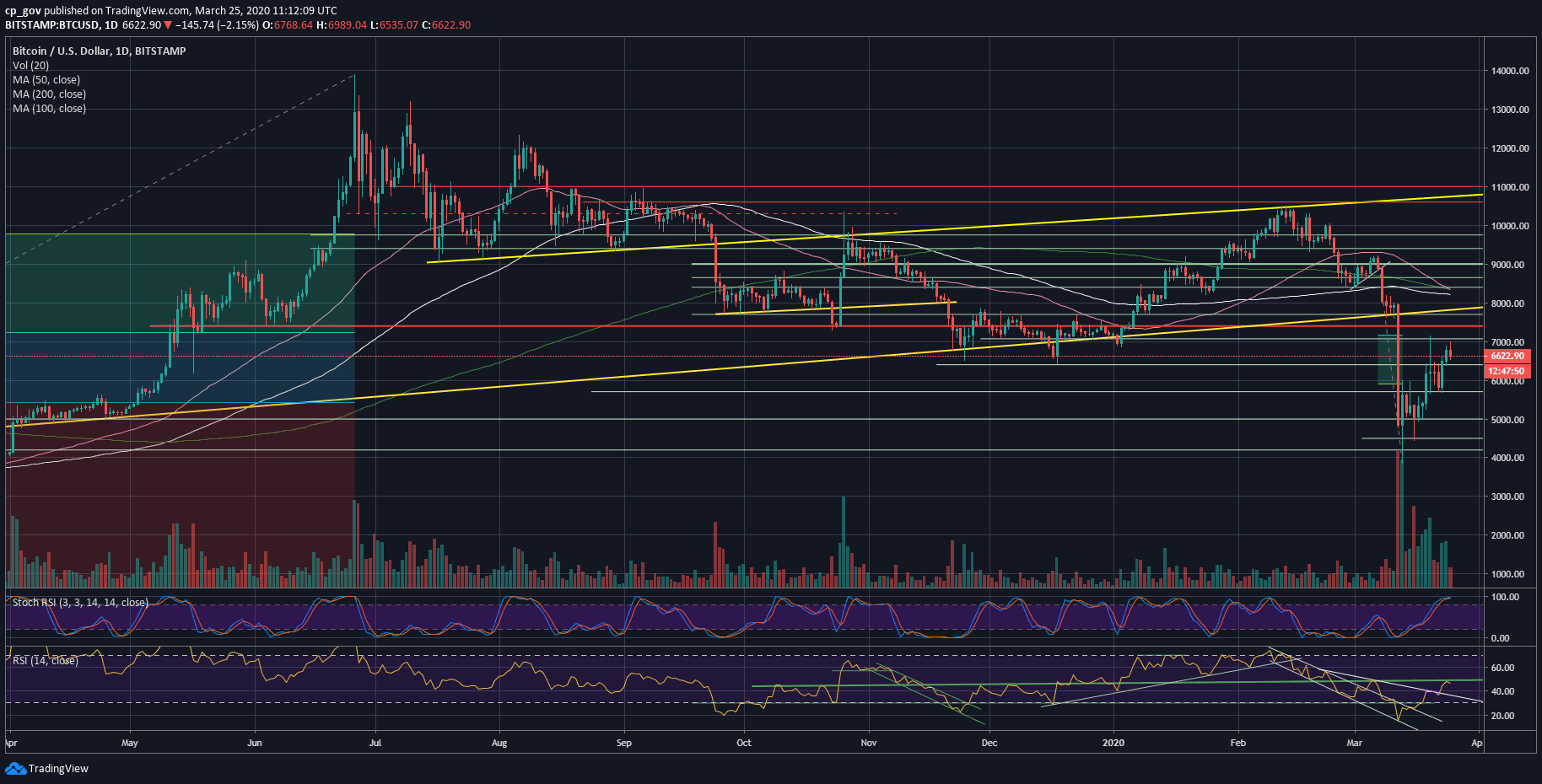

Another bearish sign is coming on behalf of the daily RSI indicator. The RSI, or the momentum indicator, had encountered critical resistance around the 50 mark. As can be seen on the following chart, it failed to break through and now facing down.

Besides, the Stochastic RSI oscillator, both on the daily and the 4-hour is at the overbought territory, about to make a bearish crossover.

As you might have noticed, for the short-term, there are more bearish signs that a correction in Bitcoin is needed. However, as long as the correlation to the markets continues, then there are “external noises” that might change everything.

Total Market Cap: $185 billion

Bitcoin Market Cap: $121 billion

BTC Dominance Index: 65.4%

*Data by CoinGecko

Key Levels To Watch & Next Possible Targets

– Support/Resistance levels: As mentioned above, Bitcoin is now struggling to maintain the described trading range, along with the $6600 support area.

If the above support breaks down, then we can expect the $6400 price area as the next possible support. Further below is the 4-hour’s triangle lower ascending trend-line (~$6150 now), the $6000 benchmark, along with the 4-hour MA-50 line (marked pink).

From above, the first resistance area lies at the $6800 – $6900 level. In case of a breakout, then the next resistance level is likely to be the $6800, followed by the $7000 benchmark, which is today’s high (Bitstamp). Further above lies $7200, which is the Golden Fib level, $7400 and $7700.

– The RSI Indicator: discussed above.

– Trading volume: The volume of the last days is not significant, and the amount is declining over the past ten days (since the March 12 plunge).