The Federal Reserve made an unexpected announcement at 5 PM U.S. Time Sunday afternoon. Along with another 0 billion immediate injections – 0 billion in treasuries and 0 billion in mortgage-back securities, the Fed is cutting the rate to zero.Donald Trump fires all the guns he has at an early stage of the coronavirus battle: Following the past week’s cut of 0.5% just a week ago, the Fed had announced shortly before the Futures on Wall Street open, on an another aggressive rate cut to zero, valid from March 26, 2020.According to the announcement, “Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook. In light

Topics:

Yuval Gov considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, coronavirus, federal reserve

This could be interesting, too:

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Bitcoin Schweiz News writes USA-Goldreserven bald als Krypto-Token? Die Blockchain-Revolution für Staatsgold

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

The Federal Reserve made an unexpected announcement at 5 PM U.S. Time Sunday afternoon. Along with another $700 billion immediate injections – $500 billion in treasuries and $200 billion in mortgage-back securities, the Fed is cutting the rate to zero.

Donald Trump fires all the guns he has at an early stage of the coronavirus battle: Following the past week’s cut of 0.5% just a week ago, the Fed had announced shortly before the Futures on Wall Street open, on an another aggressive rate cut to zero, valid from March 26, 2020.

According to the announcement, “Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook. In light of these developments, the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent.”

If the U.S. Government didn’t want to expose their QE plans, now they say it out loud. This is the first time such actions are taking place since the financial crisis of 2008.

Bitcoin – The First To Respond

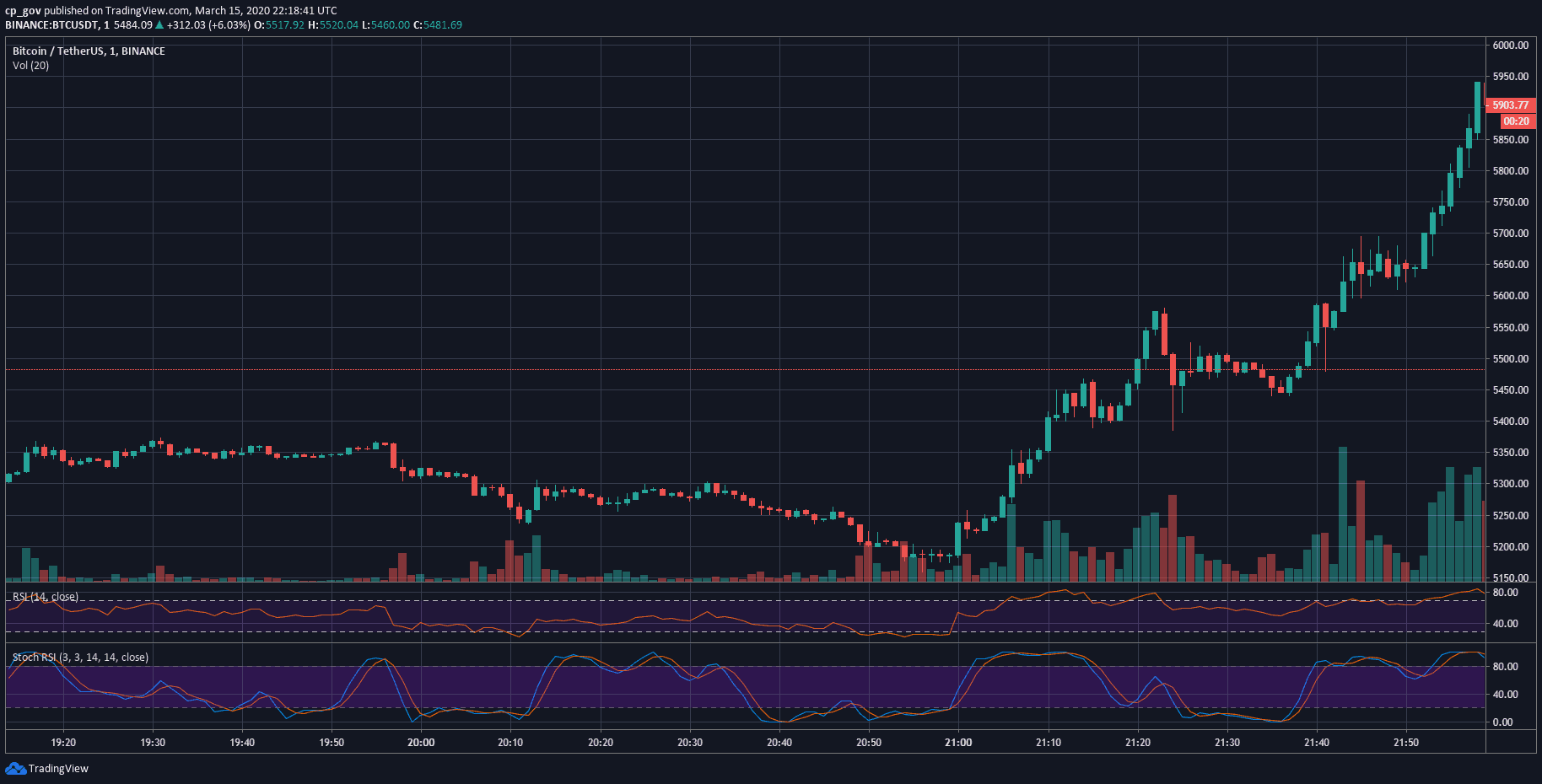

Following the announcement, Bitcoin, as the only traded asset on Sundays, quickly responded and soared from a daily low of nearly $5170 to $5960. This is a price increase of almost 14% in less than an hour.

Besides the fact that Bitcoin is positively correlated with the global markets, the primary cryptocurrency’s main idea is being a deflated store of value. Just two months before the Bitcoin halving event, Bitcoin might be receiving a boost to its existence after the wild money printings by all major banks around the world.

Those printings will create inflation and decrease the value of the FIAT the taxpayers are holding. Will people turn to Bitcoin? Only time will tell.

Technically, as CryptoPotato reported earlier today, Bitcoin broke out of the 4-hour chart’s triangle. The breakout took place precisely as described:

“A decision on the next short-term direction is expected in the coming 12-24 hours. Assuming the correlation between Bitcoin and the global markets as mentioned above, this is the timeframe that Wall Street futures will open ahead of Monday’s trading session, and Bitcoin is likely to act accordingly.”

The breakout took place roughly around the $5,300 mark, and since then, Bitcoin price saw massive increases of almost $700 directly to the tough resistance of the $6000 mark.

While it seems to be a start of a bullish move for Bitcoin, Wall Street futures opened in deep red – minus 4% as of writing these lines – showing that the market didn’t like this panic-step, at this early stage.

Following the recent correlation, Bitcoin quickly corrected and as now trades again, roughly above the breaking zone at $5400.