The Bitcoin halving event took place on May 11, three days ago. As expected, that day was volatile to both sides, but the bottom line was that Bitcoin maintained the crucial support zone around the K mark.The latter includes the significant 200-days moving average line (marked light green on the following daily chart), together with a mid-term ascending trend-line.The day following the halving was calm… very calm. It was actually ‘the calm before the storm.’ Since yesterday, Bitcoin fired its engines, and despite a 5% drop of the S&P 500 index, BTC soared to a current daily high of 45 (Bitstamp).This is an increase of more than 20% over the past three days, but most importantly, it is the fact that Bitcoin is decoupling from the global equity markets (as of now).Now For The Real

Topics:

Yuval Gov considers the following as important: Bitcoin (BTC) Price, BTC Analysis, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Mandy Williams writes Why the Bitcoin Market Is Stuck—and the Key Metric That Could Change It: CryptoQuant CEO

Wayne Jones writes Metaplanet Acquires 156 BTC, Bringing Total Holdings to 2,391

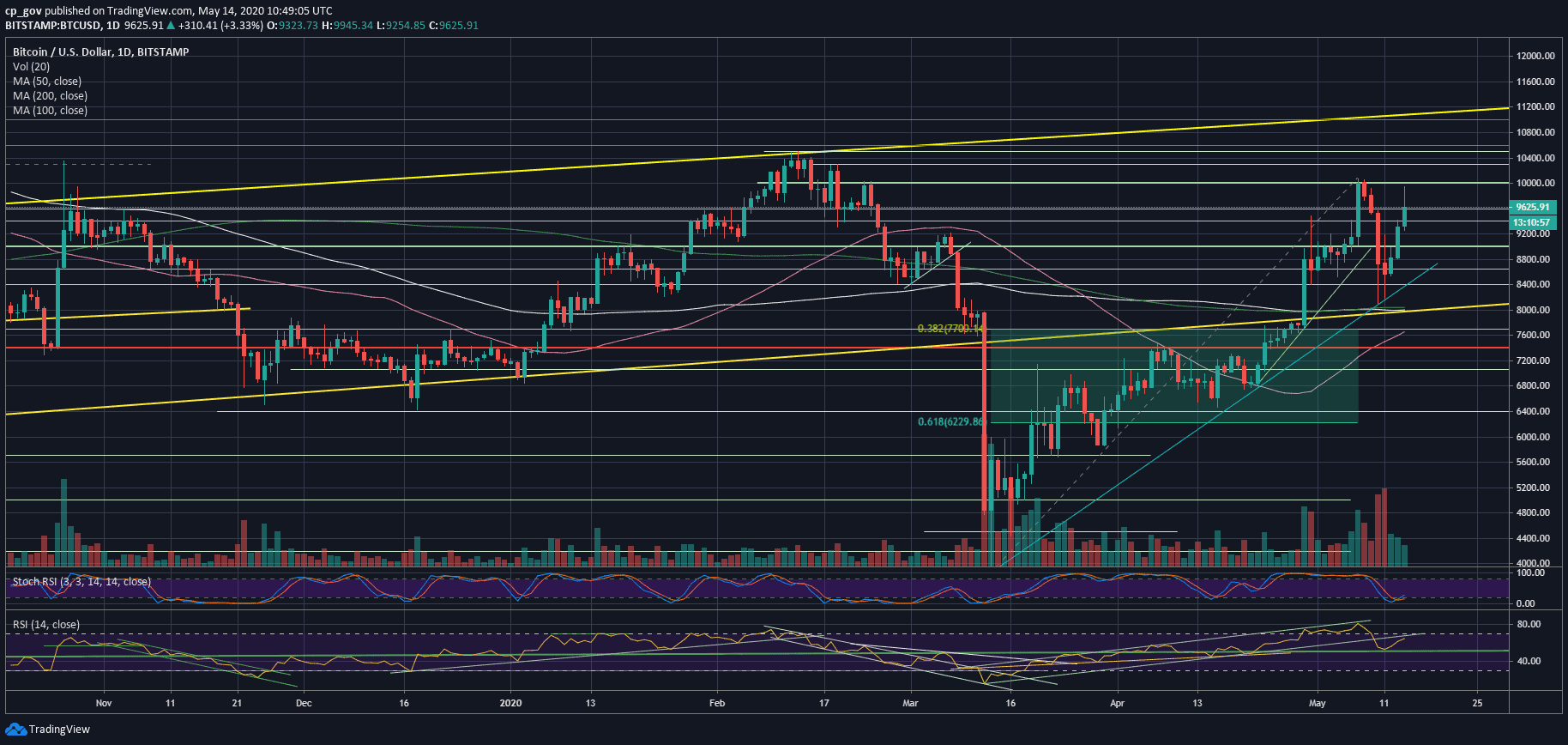

The Bitcoin halving event took place on May 11, three days ago. As expected, that day was volatile to both sides, but the bottom line was that Bitcoin maintained the crucial support zone around the $8K mark.

The latter includes the significant 200-days moving average line (marked light green on the following daily chart), together with a mid-term ascending trend-line.

The day following the halving was calm… very calm. It was actually ‘the calm before the storm.’ Since yesterday, Bitcoin fired its engines, and despite a 5% drop of the S&P 500 index, BTC soared to a current daily high of $9945 (Bitstamp).

This is an increase of more than 20% over the past three days, but most importantly, it is the fact that Bitcoin is decoupling from the global equity markets (as of now).

Now For The Real Test

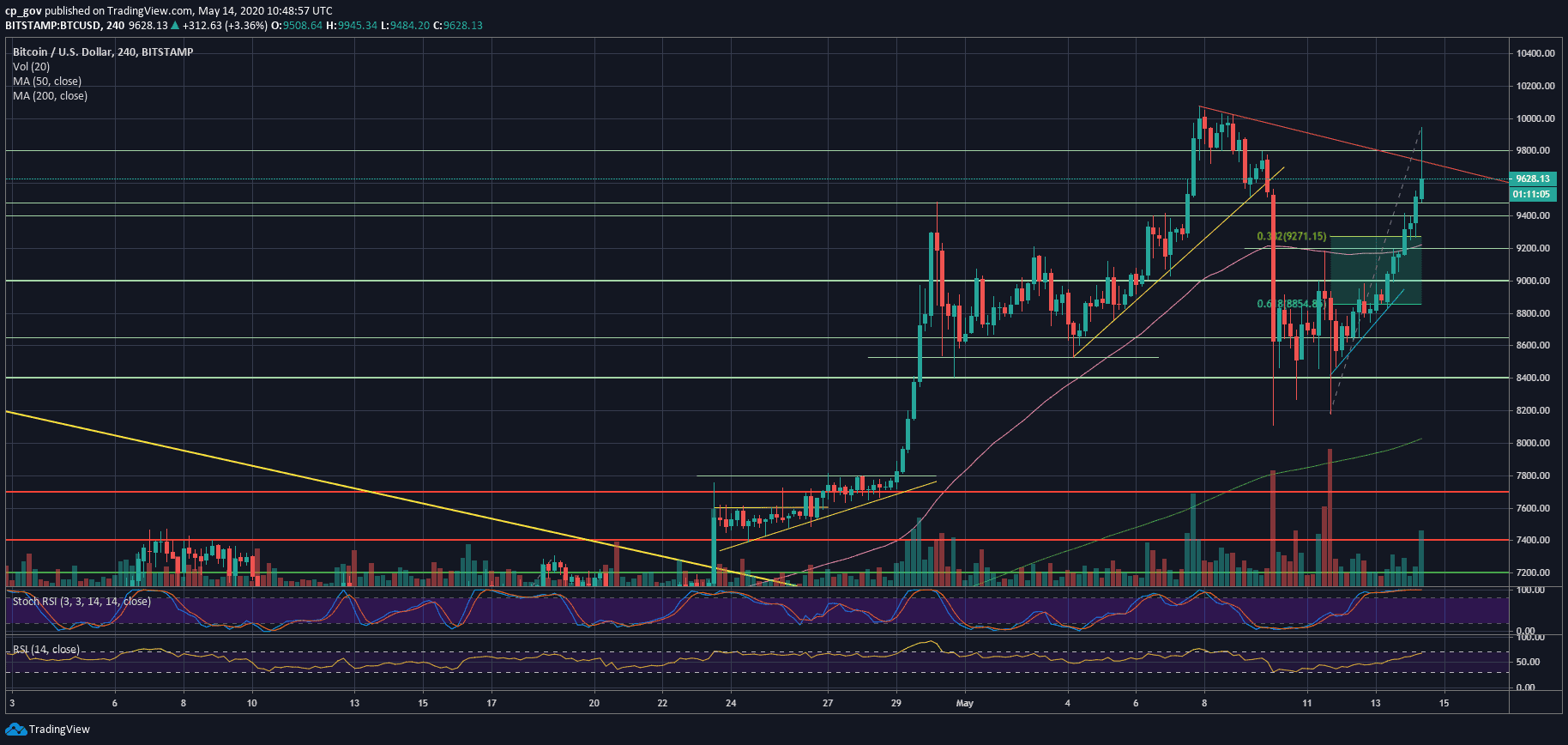

As can be seen on the following 4-hour chart, Bitcoin encounters a short-term resistance descending trend-line at $9750. This, together with the critical supply zone of $9800 – $10,000 was the area Bitcoin failed to breach just a week ago, before the fatal drop to $8K (a 20% rapid drop).

In case Bitcoin does break above the $10K area, the next major resistance will be $10,500, although $10,300 might provide some resistance as well. The $10,500 is the 2020 high from mid-February.

Correction Can Be Actually Healthy

As we already know, the primary cryptocurrency likes to be volatile. The recent surge from $8K was parabolic and had only minor corrections.

A healthy rise is not parabolic. We all remember the most famous parabolic move of Bitcoin at the end of 2017 and how it ended.

Looking at the support areas, the first significant support zone now lies between $9400 – $9500 (prior resistance). However, even forming a higher low at $9200 – $9300 will be considered healthy and bullish – Fibonacci retracement level 38.2% falls around $9270.

Looking at the daily RSI indicator, we can identify some weaknesses here. The RSI found support around the critical 50 levels, but there is a bit of bearish divergence. The last time Bitcoin was hovering around the $10K mark a week ago, the RSI was touching 80. Now, the RSI is as low as 65 and facing critical ascending trend-line as resistance.

One thing is for sure: the altcoin holders have hard times watching their big brother smashing Ethereum, Ripple, Tezos, Chainlink, and all the rest.

Total Market Cap: $262 billion

Bitcoin Market Cap: $177 billion

BTC Dominance Index: 67.5%

*Data by CoinGecko