One of the most awaited events in the cryptocurrency space, the Bitcoin Halving, is estimated to take place about 100 days from today.On this day, the reward that miners get from adding blocks to the network will be slashed in half: from 12.5 BTC per block, as of today and the recent four years, to 6.25 BTC per block. It will also reduce Bitcoin’s pre-set inflation rate from the current 3.68% to about 1.8%.Even though the date of the Bitcoin Halving could range depending on the network’s hash rate and will take place on block number 630,000 (around 14,400 blocks to go). As of now, it is estimated to be in precisely 100 days.How The Halving Will Affect The Bitcoin Network?The largest cryptocurrency will go through serious network changes, which will surely have an impact on miners. Those

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin-Halving

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

One of the most awaited events in the cryptocurrency space, the Bitcoin Halving, is estimated to take place about 100 days from today.

On this day, the reward that miners get from adding blocks to the network will be slashed in half: from 12.5 BTC per block, as of today and the recent four years, to 6.25 BTC per block. It will also reduce Bitcoin’s pre-set inflation rate from the current 3.68% to about 1.8%.

Even though the date of the Bitcoin Halving could range depending on the network’s hash rate and will take place on block number 630,000 (around 14,400 blocks to go). As of now, it is estimated to be in precisely 100 days.

How The Halving Will Affect The Bitcoin Network?

The largest cryptocurrency will go through serious network changes, which will surely have an impact on miners. Those are the backbone of the Bitcoin blockchain.

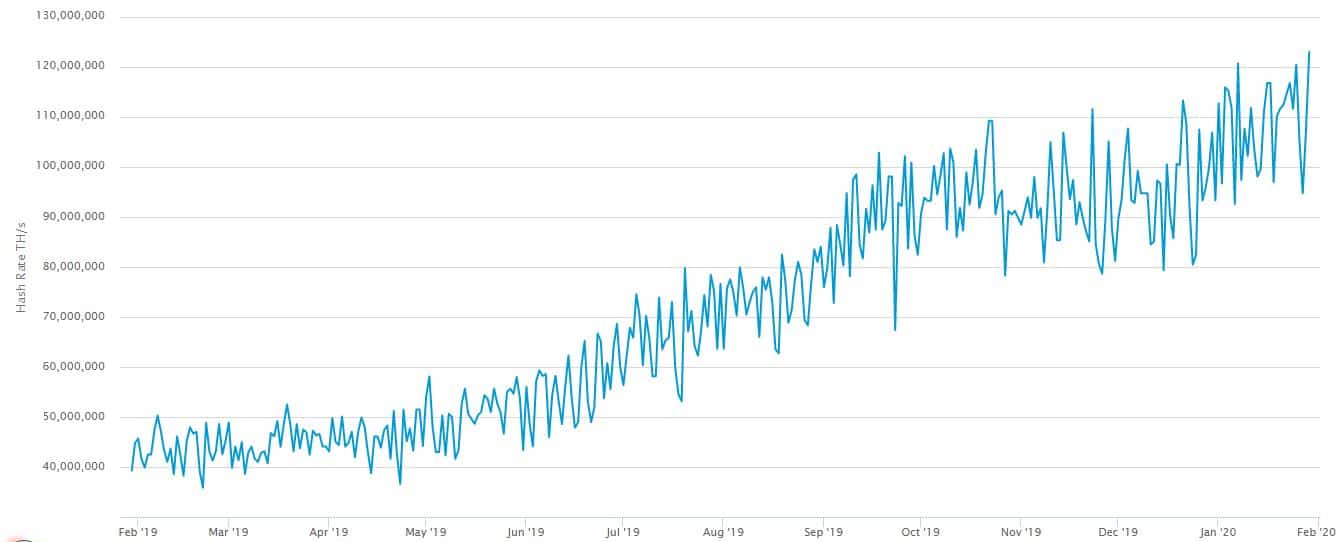

The work miners do is essential for the network’s state of security. In theory, the more computational power they put in, the harder it would be to take over the consensus and impact it negatively. The hash rate recently recorded a new all-time high of over 120,000,000 TH/s. This suggests that the network’s security is getting more and more robust.

Bitcoin miners get paid in two ways. They receive mining fees for the work they do to validate transactions and guarantee that all of them are authentic, and there’s no double-spending. Additionally, for the fact that they add transactions into a block and broadcast that block to the public blockchain, they receive the so-called block reward. This is what the Halving reduces.

The first-ever Bitcoin Halving event took place in 2012 and reduced the block reward from 50 BTC to 25 BTC per Block. The next one, four years later, took that number down to 12.5 BTC. The upcoming one will bring it to 6.25 BTC.

As of now, 1,800 new bitcoins are produced daily, and the amount will drop to 900. Naturally, this could affect the total supply, and it also controls the inflation rate.

The Possible Halving Effect On The Bitcoin Price

This is the big question that the community speculates on. On one side of the argument, there are those who are taking historical data to debate that the price of Bitcoin will surge in the months following the event.

Apart from history, basic economic principles back it up as well. The only Bitcoins that could enter the market are those that miners receive for their work. Hence, when this amount is slashed in half, this could reduce the overall supply of bitcoins substantially (or the inflation rate). If the supply of an asset decreases, while the demand for it remains the same or increases, its price should, in theory, increase.

On the other hand, a few analysts and experts believe that the Halving has already been priced in, and there won’t be any significant impact. This means that traders are already factoring in the Halving and trade accordingly. In this regard, when everyone expects something to happen, then usually the complete opposite takes place. This is because most traders will lose over time.

Unlike the idea above, others would say that the halving event just can’t be priced until we will officially reach the event itself. Other opinions include Meltem Demirors, who supports the view that the Halving won’t impact the price, but she comes from a different standpoint. She believes that Bitcoin is not going up because the derivatives market is growing, and users are speculating with it rather than actually owning it.

Of course, we have yet to see whether the Halving will influence the price. Still, it’s an important event that changes the entire network dynamics and has a definitive impact on it.