The recent volatility in the global markets and the cryptocurrency markets has raised most trading volumes. Bitcoin options, for instance, reached a new all-time high yesterday. The futures market also saw a massive jump in the volume, as Binance Futures breaks its all-time high record.Bitcoin Options Volume SoarsThe past several days have been quite harmful to the cryptocurrency market in terms of price action. For example, the leading digital asset by market capitalization, Bitcoin, lost over ,400 of its value since last Friday (as of writing these lines).Despite the adverse price movements, the trading volumes are surging to new highs, showing that the heavy traders are speculating the recent Bitcoin price fluctuations.According to the following data from Skew, a new all-time high in

Topics:

Jordan Lyanchev considers the following as important: AA News, Binance Futures, bitcoin futures, Bitmex, CME, deribit

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The recent volatility in the global markets and the cryptocurrency markets has raised most trading volumes. Bitcoin options, for instance, reached a new all-time high yesterday. The futures market also saw a massive jump in the volume, as Binance Futures breaks its all-time high record.

Bitcoin Options Volume Soars

The past several days have been quite harmful to the cryptocurrency market in terms of price action. For example, the leading digital asset by market capitalization, Bitcoin, lost over $1,400 of its value since last Friday (as of writing these lines).

Despite the adverse price movements, the trading volumes are surging to new highs, showing that the heavy traders are speculating the recent Bitcoin price fluctuations.

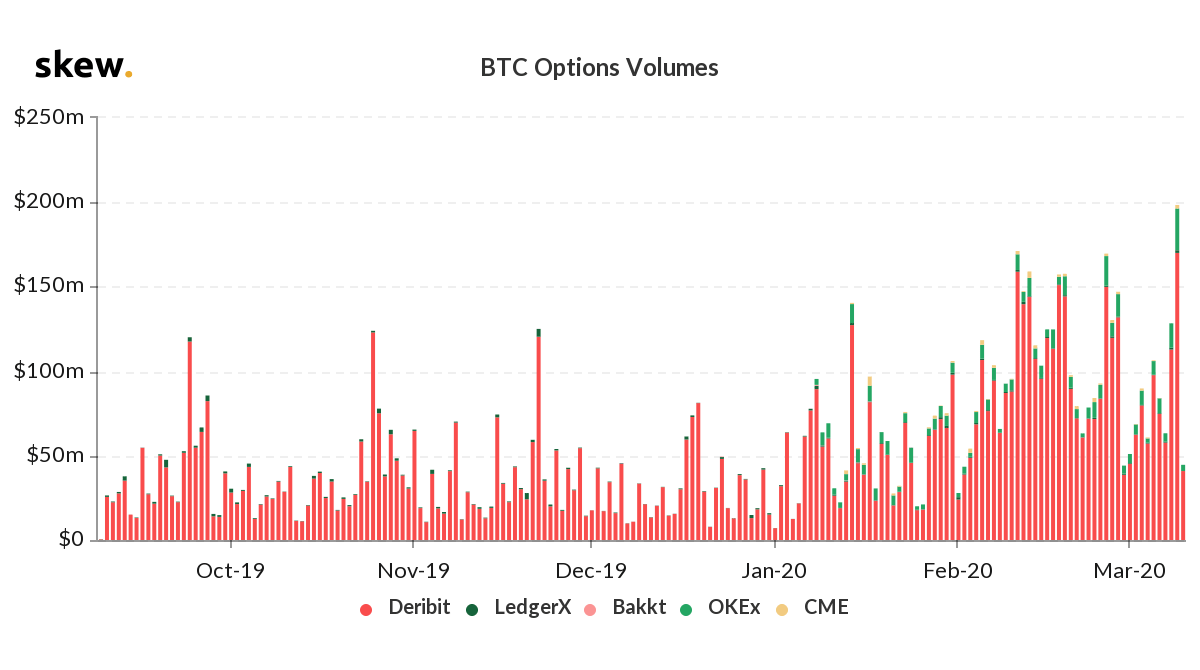

According to the following data from Skew, a new all-time high in the BTC options volume was reached yesterday, following a trading volume of approximately $200 million.

Deribit exchange is responsible for the most significant portion of the trading volume. LedgerX is next, but the difference between the two is quite substantial.

Contrary, Bakkt, the Bitcoin Futures trading platform of the Intercontinental Exchange (ICE), didn’t perform that well. It launched the first CFTC-regulated option platform last year but showing slow growth since its launch date.

The Chicago Mercantile Exchange (CME) also released options on Bitcoin futures recently. Skew’s data, however, stated that its volume still lags behind other exchanges.

Futures: Binance On The Rise

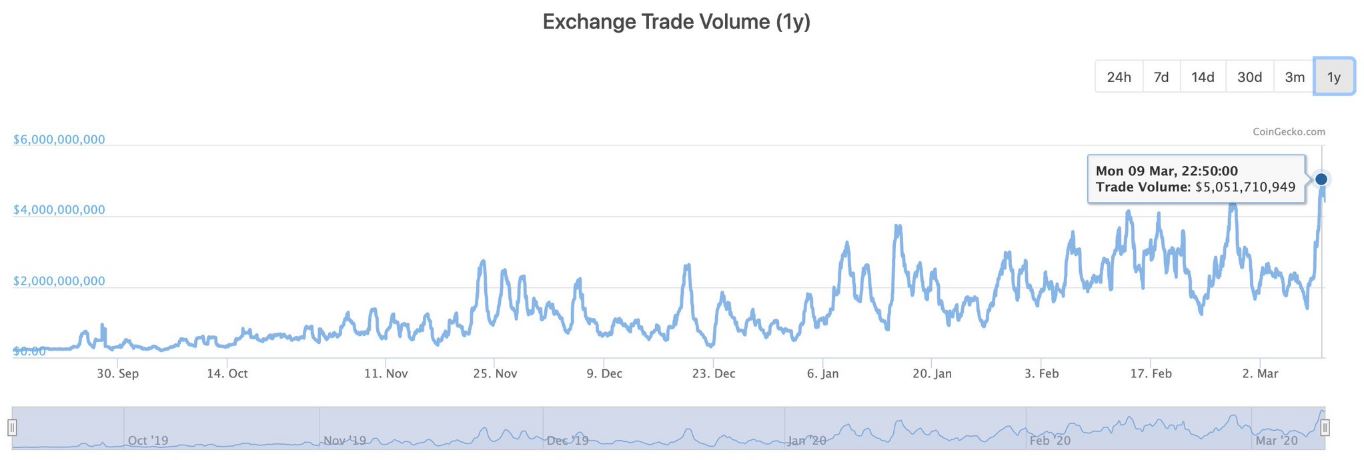

In the Bitcoin futures market, Binance seems to be taking full advantage of the increasing trading volumes. Despite being the young son of the leading spot exchange, launching only in late 2019, Binance Futures is finding its path to the leading exchanges by volume, following a new all-time high of over $5 billion yesterday.

More data on the matter reaffirmed Binance’s growth. During the past month, the Binance spot and futures’ exchange volume has skyrocketed with 345% and is now at $97 billion.

However, the leading Bitcoin margin exchange, BitMEX, still has steadily led the derivates exchanges. The veteran exchange records an impressive growth of its own with 95% and is knocking on the $100 billion trading volume mark. Most of the volume coming from the BTC/USD perpetual contract.