According to recent reports, the Ministry of Finance in India has proposed to ban digital assets. The move comes only three months after the nation’s Supreme Court revoked a two-year-old ban.India Changes Its Mind On Crypto (Again)?A local report from today informed that India’s Ministry of Finance had moved a note for inter-ministerial consultations. After the consultations, it will reach the cabinet and subsequently, the Parliament.Should it be successfully implemented, it could effectively ban dealing with cryptocurrencies in any form in the country. People familiar with the matter have connected the note with a law draft issued in July 2019, which was especially harsh on digital currency traders and investors.It had suggested “a fine of up to Rs 25 crore (.3 million) and imprisonment

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitfinex, bitstamp, btcusd, btcusdt, crypto ban, india, kraken, okex

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

According to recent reports, the Ministry of Finance in India has proposed to ban digital assets. The move comes only three months after the nation’s Supreme Court revoked a two-year-old ban.

India Changes Its Mind On Crypto (Again)?

A local report from today informed that India’s Ministry of Finance had moved a note for inter-ministerial consultations. After the consultations, it will reach the cabinet and subsequently, the Parliament.

Should it be successfully implemented, it could effectively ban dealing with cryptocurrencies in any form in the country. People familiar with the matter have connected the note with a law draft issued in July 2019, which was especially harsh on digital currency traders and investors.

It had suggested “a fine of up to Rs 25 crore ($3.3 million) and imprisonment of up to 10 years for anyone dealing in them.”

According to Amit Maheshwari, partner at AKM Global, such legislation should not be passed. He argued that it would make it “illegal to hold, sell, issue, transfer, mine, or use cryptocurrencies and, if passed in the current form, would completely decimate the crypto-industry in India.”

India’s Ban Lift And Local Reaction

As CryptoPotato reported in March 2020, India’s Supreme Court lifted a two-year-old ban on digital assets instituted by the Reserve Bank of India (RBI). Shortly after, cryptocurrency businesses in the second most populated country in the world started feeling the positive effects.

While some large companies decided to increase their investments and presence in the region, other local firms and exchanges thrived in the first few months. Somewhat unsurprisingly, the demand and trading volume for cryptocurrencies surged almost immediately after.

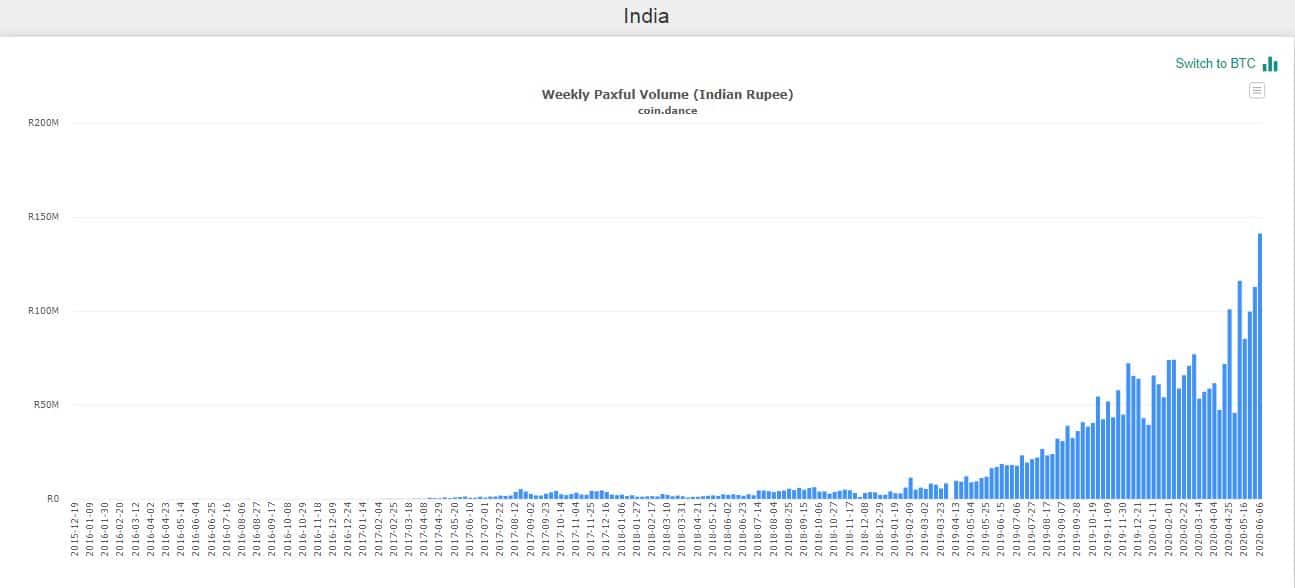

According to the popular monitoring resource Coin Dance, the peer-to-peer (P2P) exchange Paxful saw an ATH of its trading volume last week.

Research compiled by OKEx and Coinpaprika concluded that upon the ban reversal, “India’s overall cryptocurrency market has become prosperous again, especially reflected in the exchanges’ trading volume.”

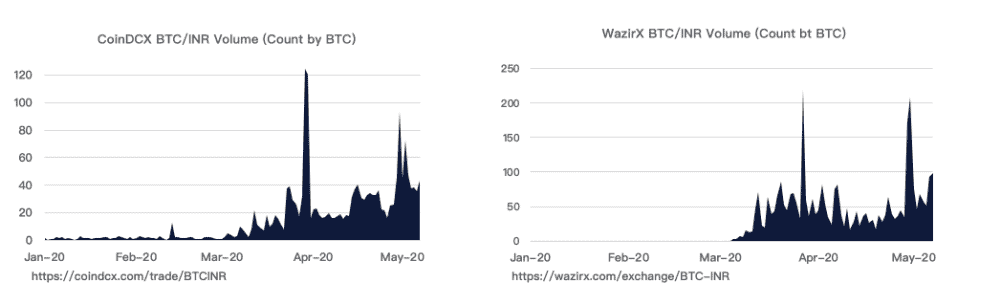

Local digital asset platforms such as WazirX and CoinDCX saw significant volume spikes since March.

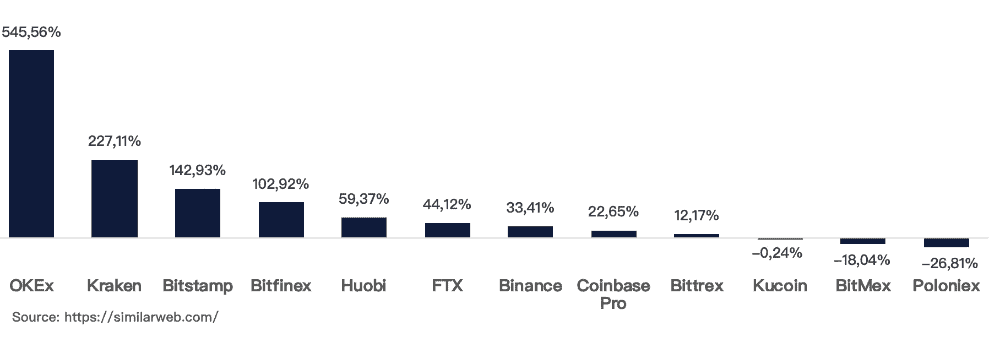

The same is true for website traffic from India on other major exchanges. OKEx’s visits surged by nearly 550%. Kraken, Bitstamp, and Bitfinex also recorded triple-digit increases.

As such, if the country indeed proceeds with administering an effective ban on dealing with digital assets, the consequences on local traders, investors, and businesses could be considerably damaging.