Fidelity Digital Assets, the subsidiary of the large American investment company Fidelity Investments, has published a report on Bitcoin highlighting that its benefits have helped BTC to become an “aspirational store of value” for investors.Bitcoin’s Store Of Value FunctionsLaunched in October 2018, Fidelity Digital Assets has become a significant player offering cryptocurrency services for large institutions. While initially operating only in the US, the company announced expanding to Europe as well last year because of the growing demand for digital assets.In its latest report on Bitcoin, Fidelity Digital Assets described the leading cryptocurrency as an “aspirational store of value.” The company also noted that BTC is still relatively early in its mass adoption stages, which could grant

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Adoption, btcusd, btcusdt, fidelity

This could be interesting, too:

Christian Mäder writes Die Bitcoin-Weltkarte: Holdings im Fokus

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Christian Mäder writes Das Bitcoin-Rennen der US-Bundesstaaten: South Carolina plant millionenschweren Krypto-Reservefonds!

Fidelity Digital Assets, the subsidiary of the large American investment company Fidelity Investments, has published a report on Bitcoin highlighting that its benefits have helped BTC to become an “aspirational store of value” for investors.

Bitcoin’s Store Of Value Functions

Launched in October 2018, Fidelity Digital Assets has become a significant player offering cryptocurrency services for large institutions. While initially operating only in the US, the company announced expanding to Europe as well last year because of the growing demand for digital assets.

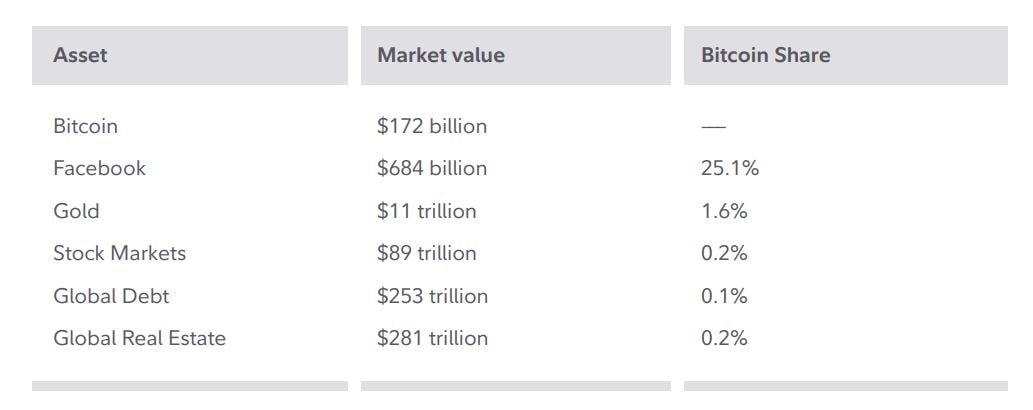

In its latest report on Bitcoin, Fidelity Digital Assets described the leading cryptocurrency as an “aspirational store of value.” The company also noted that BTC is still relatively early in its mass adoption stages, which could grant substantial opportunities for profits to investors. Fidelity illustrated Bitcoin’s room for growth in the graph below.

“An analogy is that investing in Bitcoin today is akin to investing in Facebook when it had 50 million users with the potential to grow to the more than two billion users it has today. This is driven by the idea that Bitcoin offers asymmetric upside. If Bitcoin is widely adopted by retail and institutional investors as a store of value, the upside may be substantial relative to the initial upfront investment.”

The paper also compared BTC’s store of value market share against gold, saying that the precious metal is still the undisputed favorite amongst traditional investors. However, Bitcoin’s position could increase rapidly once the masses become more aware of its features. This could have a dramatic effect on BTC’s price, according to John Pfeffer, from Pfeffer Capital LP:

“Most people in the world don’t yet see Bitcoin as digital gold. As soon as people see it in a different way, the price will adjust.”

Digital Scarcity Attracts

According to Fidelity, digital scarcity is what investors find most appealing about Bitcoin. After all, the primary cryptocurrency has a pre-determined limited supply of only 21 million coins.

“The key characteristics that are cited in reference to good stores of value are scarcity, portability, durability, and divisibility. The most important of these attributes is arguably scarcity, which is essential for protecting against the depreciation of real value in the long run. Scarcity means that there’s a limited quantity of the asset in question, more cannot be easily created, and it is impossible to counterfeit.”

As such, BTC’s “unforgeable digital scarcity” fits perfectly within the perception of a store of value. John Vincent from Wakem Capital Management noted that the latest actions from world governments to print excessive amounts of fiat currencies had exemplified Bitcoin’s qualities.

By referring to the 2020 halving, he said, “you don’t have to be a Ph.D. to understand that the number of dollars just doubled, whereas the BTC supply just halved.”

Is Volatility Indeed Bad?

Bitcoin’s infamous volatility has often been brought up by naysayers as an inherently adverse feature that repels traditional investors. However, while Fidelity’s report indeed acknowledged the high fluctuations, it provided a contrasting approach:

“A different perspective is that many participants initially learn about Bitcoin because of its volatility. As new participants conduct further study, perceptions often shift to focus less on short-term performance and more on the long-term value proposition.”

The investment firm also asserted that high fluctuations could “attract investment, development, and innovation.”