Bitcoin’s price might reach 0,000 in the years to come, according to a recent report compiled by the popular U.S. cryptocurrency exchange, Kraken. It indicated that Millennials will soon inherit trillions of dollars, which the younger generation could invest in Bitcoin, as they are more tech-oriented.The Great Wealth TransferThe paper estimated that more than T of U.S. wealth will change hands in the upcoming years. Generation X will inherit T, while the remaining T will go to Millennials.There are considerable differences between the two generations, especially when it comes down to investing perceptions, the report explained.Generation X (born between the early 60s and late 70s) prefer more old-school forms of investments. However, they have witnessed significant economic

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Long-Term Prediction, kraken

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin’s price might reach $350,000 in the years to come, according to a recent report compiled by the popular U.S. cryptocurrency exchange, Kraken. It indicated that Millennials will soon inherit trillions of dollars, which the younger generation could invest in Bitcoin, as they are more tech-oriented.

The Great Wealth Transfer

The paper estimated that more than $68T of U.S. wealth will change hands in the upcoming years. Generation X will inherit $38T, while the remaining $30T will go to Millennials.

There are considerable differences between the two generations, especially when it comes down to investing perceptions, the report explained.

Generation X (born between the early 60s and late 70s) prefer more old-school forms of investments. However, they have witnessed significant economic turmoils in the 80s, the dotcom bubble burst, and lastly, the 2008 financial crisis. As a result, they have “developed a casual disdain for authority.”

Millennials (the 1980s-1990s), on the other hand, are the first digitally native generation. The report outlined that they prefer rapid, transparent, and convenient solutions due to their constant internet access. Therefore, they might be most keen to invest in less-traditional, more technical, and digital assets, such as Bitcoin.

In fact, a Charles Schwab study on the matter revealed that the Grayscale Bitcoin Trust (GBTC) is the fifth most favorable investment choice amongst Millennials.

Bitcoin At $350,000 In 2044?

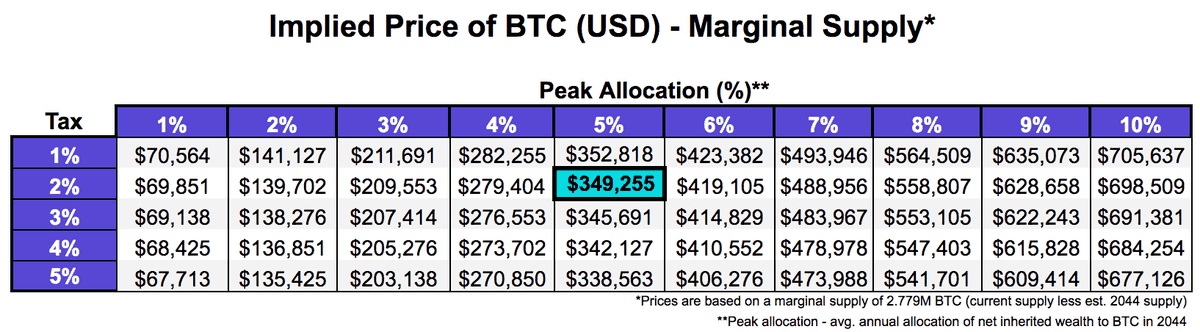

The veteran exchange’s document quantified the potential flow of wealth into Bitcoin. To do so, they considered the adoption rate of innovative technology, the rate of wealth inheritance, and the expected allocation of wealth to Bitcoin in 2044, or “peak allocation.”

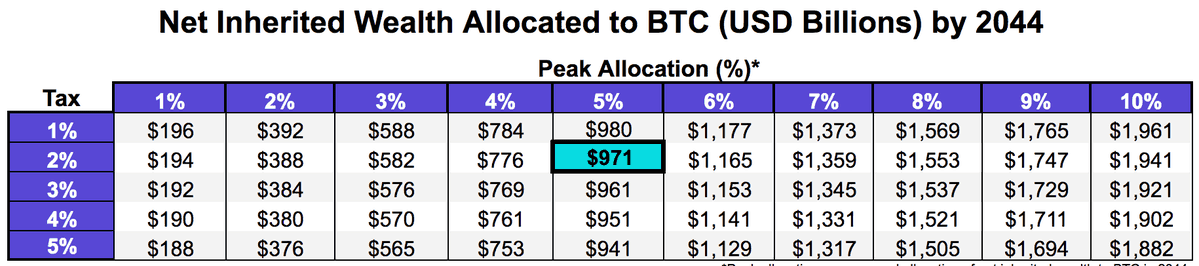

They also made assumptions on the future investment rates based on preferences and inheritance tax. If the mentioned above requirements are met, and Millennials allocate 5% of their wealth after a 2% tax in Bitcoin, then by 2044, the total invested amount will be close do $1T.

By also implying the marginal supply to this scenario, the report ultimately predicted that Bitcoin will be at $350,000 in 2044. However, it also said that this is only based on U.S. inheritance wealth. Meaning that it excluded the rest of the world and projected a relatively “safe” prediction.

If that’s to occur, BTC’s total market cap will surge to over $6 trillion. Even though it seems like an unlikely outcome at the moment, Binance CEO Changpeng Zhao recently pointed out how it could happen in the following years.